Mike Simonato, Ontario. Presenter: “Investing for the Long Term”, presented to the Feb. 6, 2021 International Online Forum, you can watch by CLICKING HERE.

Well, this was another interesting year. Covid definitely dominated the news feeds once again and has affected everyone in one way or another. Here is what I have observed and was told that affects businesses big and small.

- COVID-19. Numbers are soaring to record highs all around the world. This has led to various restrictions and lock downs. Businesses had many restrictions throughout the year, making earnings hard to come by. They were looking forward to salvaging part of the year into the holidays but then the bottom fell out and Black Friday and the week leading into the holidays and Boxing day were disappointing including the cancellations of Xmas Parties affecting Restaurants and Grocery stores who had already ordered supplies. Then the bars all ordered supplies for New Year’s eve celebrations and then the hammer came down once again with last call at 10 and everybody had to vacate by 11pm. Many business owners are already living in their businesses after selling their houses trying to survive. I expect the numbers to continue to rise to start the New Year, which may lead to further restrictions (Big Venues already reduced to 1,000 max making season tickets of minimal value) for a reason, so I’m watching for a spike in bankruptcies. The theatre production Come From Away shut down permanently because every time they can open it costs $1.5 Million and then they have to shut down again costing them big losses so they said no more which affects not only those direct jobs but thousands of subsidiary jobs.

- People. Many front-line workers came out of retirement to help with vaccines (Including the retired doctor who gave me my booster shot yesterday). Unfortunately, re people, the news on the year was more negative than positive. Both Medical and Political people have been the subject of threats and harassment at extreme levels including their personal properties. This also involved great rudeness and disrespect at the business level ie stores, restaurants, airplanes etc. Result: The really good workers are burnt out and have had enough and have either already quit or are strongly considering it. I had an interesting conversation with a business owner yesterday who made the comment “The day of The Customer is Always Right is Over”. Many businesses have signs right on their entrance doors saying rude, disrespectful people not welcome and if they get in the staff have refused them service or to ring in their orders. This will lead to even more labour issues throughout 2022. Businesses will have to compete by offering the world to the few good workers out there.

- Inflation. Because of the Covid numbers soaring around the world, various forms of restrictions may continue to cause supply chain issues. Add to this the labour issues, these costs will be passed on to the consumer which at some point will affect spending patterns. Watch to see what businesses will be affected the most and which ones have the ability to adjust and are well enough financed to survive.

Industries that should be ok:

- Online Shopping. These include EBAY, ETSY, SHOP (Shopify) and AMZN (Amazon)

- Debit/ Credit Payments Mastercard, Visa and Paypal top 3 These had a bad year for reasons I don’t understand but look at Dec and these roared back.

- Funeral/ Long Term Care homes

NOTE See below email for results and more info re the above.

GOLD: This has proved to be the Little Heartbreaker this year despite the big names trying to promote the industry. One thing that has panned out as usual is it bottomed and started to rise Dec 15th Stan always says to watch the first week of Jan for potential. At this point it is below Stan’s 40 SMA. and it has actual failed 5 times in a row at the 79 SMA . Will it have its usual seasonal run this year? Well, a truck carrying Gold and Silver Bars flipped over on the 401 over night so that may be a bad omen Watch in the New Year to see if Little Heart Breaker continues to hurt and disappoint.

Now for the Markets

USA

DOW JONES: Weak volume, which was expected. Last 2 days a little weak. Watch next week to see if this year’s rally continues

NASDAQ: Really Choppy this week Selling 4 of last 5 days

S&P 500: Looking good. Watch next week to see if the rally can continue

MKT TIMING: Price flat this week 2 out of 3 indicators rose this week so watch to see if rally can start up again

READ VIEWS and Strategy

CANADA

PTSE: Possible Head and Shoulders setup Low Volume this week so watch next week for clearer direction

VENTURE: Looks like it’s trying for another breakout on unusually strong vol

MKT TIMING: Again possible Head and Shoulders all 3 Indicators rose so watch for clear direction in the New Year

READ Views and Strategy

AUSTRALIA Read Views and Strategy Could get a C/UP on Tuesday

BRITAIN Read Views and Strategy Got a C/UP on Thursday

MIKE’S PORTFOLIO RESULTS AND FUTURE PLANS

This post will contain my 2021 results along with my future plans and why (Reasoning) as well as things to watch.

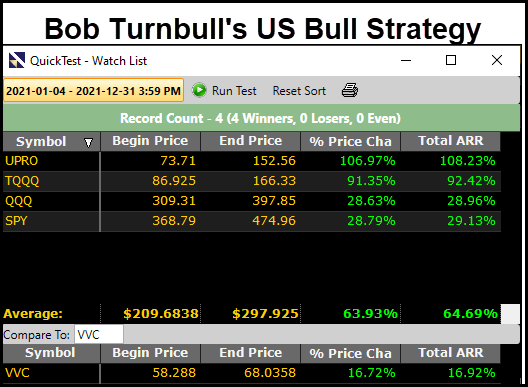

My Long Term Buy and Holds had a weaker than normal return but still more than I need. Actual Return was 22.65% MKT Return was 16.72%

If I was fully invested, I would need a 15% annual return to have a Good Retirement.

My Goal for 2022 is to put more money to work to put my full strategy to work. I may be out to lunch on my figures but my Thesis is if I can fully invest and get a 15% ARR, that gives me $50,000 per year plus my pension should give me around $65,000 which should be more than enough for a comfortable retirement.

For me, I will continue to hold Apple, Amazon and Shopify (May add to Shopify)

I will add ETSY and likely 2 of the following: Mastercard, Visa and Paypal (This will be done via CDN CDRS)

I will be doing Bob Turnbull’s Strategy (this will be done on the CDN Side)

The above will give me a 60/ 40 split between $CDN and $US (The ideal would be 50/50) currency hedge

To me, Online Shopping is here to stay and will continue to gain momentum

As a result Debit/ Credit Payment Systems will continue to do well. Can’t explain the poor result this year but look at a 5 or 10 year quick test and you’ll see overall good stocks to own.

If I put on a Crypto Position then it will be Stan’s Rec BITF ARR 168% yet last 2 months not great. Has pulled back to the 200 SMA and Bitcoin has fallen back to $47.000 so watch for another rally in 2022

Another Industry I’m watching is Long Term Care and Funeral Homes. Note If Covid ends, it may cause a pullback in Funeral Homes.

Re Long Term Care My Uncle is a very skilled trader who does extremely well. If you look at the QuickTest, CSH was the worst. My uncle however Swing Trades.

He bought 1,000 shares of CSH around $6 this year. Look at the gain and look at the nice dividend as well. Something to think about.

I really hope that things turn around in 2022 on so many levels and together we can make 2022 the best year ever for all of us.

NOTE The above is for Information only and not to be considered investment advice.

SPECIAL THANK YOU to Stan Heller and Bob Turnbull for their continued sharing and help to make us all successful traders. Can’t thank you two gentlemen enough.

As always, this post is nothing more than my 2 cents and I hope it’s of value and interest

Leave A Comment