I know many VectorVest investors consider themselves “gold bugs”. We constantly study the price of gold and gold stocks. In part it’s the allure of potentially explosive profits. We’ve seen them before. It’s also ingrained in us that gold is a hedge against inflation.

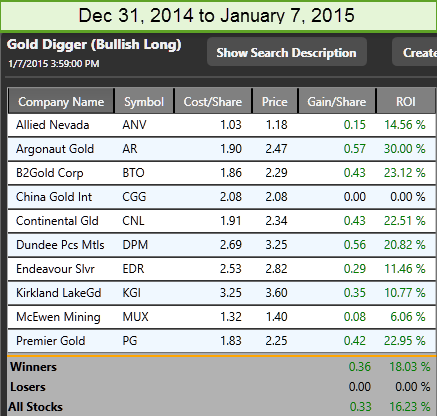

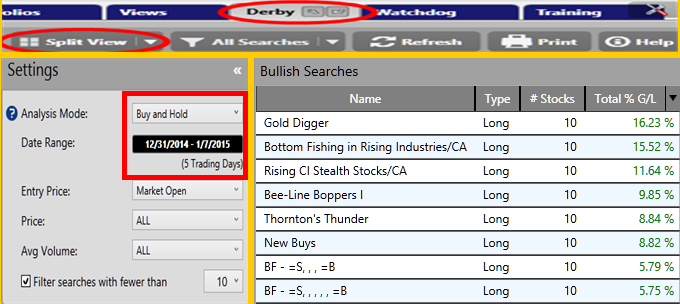

Some gold bugs buy pure gold. Others invest in the mining sector, often because it’s easier to buy and sell. Well, gold/silver stocks are once again trying to make a move. But is this the start of the big move we’ve been waiting for? No one knows for sure, but there are some encouraging signs. The top 10 stocks from the Gold Digger strategy are up 16.23% from Dec 31 to Jan 7. Eight of the 10 stocks enjoyed double digit gains led by Argonaut Gold, up 30%. See Derby results below.

Positives for the Bulls. First and most important, the average price of the industry group pulled above its 40-day MA on Dec 30. More often than not when this happens, investors have an opportunity for some quick gains, and sometimes substantial gains if the trend continues for a longer period such as we saw at the start of 2014. The Nov 18 crossover didn’t work out as well when prices rose briefly, then fell quickly. What may be different this time is the 40-MA has not only flattened, it’s also beginning to turn up along with price. Note however the two zones of resistance immediately above the current price.

Second, the Gold Digger strategy is starting to show up consistently in the 1-day and 5-day DERBY winners presented daily in the Views. Gold Digger on Dec 30 was the 1-day leader with a 5.03% gain and it was also in the 5-day list with a 4.99% gain. It was the third day of positive gains for gold/silver stocks after two fairly steep down days. When you have a match in the 1-day winners and 5-day winners, VectorVest calls this the ‘Easy Rider’ strategy. Gold Digger had matches again on Jan 2 and Jan 6. Another leading strategy, Bottom Fishing in Rising Industries, was returning mostly gold/silver stocks. We can also see this in the ‘Buy and Hold’ DERBY results for Dec 31 to Jan 7 as shown below.

At left are the ten stocks returned by the Gold Digger search at the close of trading Dec 30.

At left are the ten stocks returned by the Gold Digger search at the close of trading Dec 30.

The results shown are from the market open the next day, Dec 31.

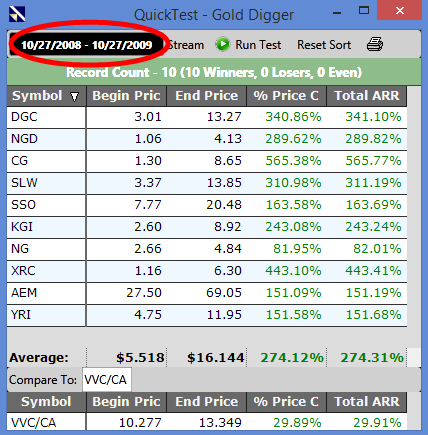

Third positive, the industry group is considerably lower today than its previous major low on Oct 27, 2008. From there, the industry group slightly more than doubled over the next 12 months. The top 10 Gold Digger stocks at that time included Detour Gold (DGC), up 340% for the year, and still one of my favourite stocks today. The best performer was Centerra Gold (CG), up 565%. Even the highest priced stock at $27.50, Agnico-Eagle (AEM) managed a 151% gain, climbing to $69.05, more than double where it is today. Keep in mind, the entire market was rallying after the collapse of 2008.

At left are the Quicktest results for the Gold Digger top 10 stocks from Oct 27, 2008 to Oct 27, 2009. An average gain of 274%. Will we ever see those kinds of returns again? Not likely. But smaller, still explosive gains have happened since then. Why not be watchful and prepared?

At left are the Quicktest results for the Gold Digger top 10 stocks from Oct 27, 2008 to Oct 27, 2009. An average gain of 274%. Will we ever see those kinds of returns again? Not likely. But smaller, still explosive gains have happened since then. Why not be watchful and prepared?

Finally and importantly, analysts are raising their forecasts for gold stocks in 2015, in part they say because of lower energy costs and global inflation concerns. Alec Kodatsky, Mining Analyst, also stated today that with weaker global currencies apart from the US, more people are coming back to gold to protect their assets. He picked Agnico-Eagle, Kinross and Goldcorp to outperform.

Negatives for the Bears. First, in general gold is cyclical anyway, but some analysts say Quantitative Easing has had a distorting impact on gold prices. Higher inflation generally helps gold prices and inflation is low right now and even falling according to VectorVest metrics.

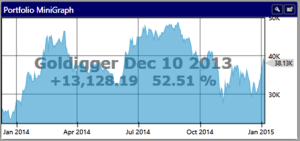

Second, gold stocks are lower priced (especially now) and volatile. A stock can be up 4% one day and down 8% the next, and vice versa. You either have to be nimble in taking profits and cutting loses early, or have the courage of your convictions that gold stocks will rise over time and take a  long term view. Keep your pepto bismol handy if you want to buy and hold through thick and thin. I started the adjacent Quick Folio of Gold Digger stocks on Dec 9, 2013 as shown in the adjacent graph. As a basket the stocks are up 52% with only one loser, but the equity curve as you can see looks like a mountain range. Lots of peaks and valleys.

long term view. Keep your pepto bismol handy if you want to buy and hold through thick and thin. I started the adjacent Quick Folio of Gold Digger stocks on Dec 9, 2013 as shown in the adjacent graph. As a basket the stocks are up 52% with only one loser, but the equity curve as you can see looks like a mountain range. Lots of peaks and valleys.

Finally, as shown on the industry graph above at the top of the article, we have two resistance zones immediately overhead. In fact, today’s price (Thursday, Jan 8) briefly climbed above the closest resistance and then fell back sharply at the end of the day. In fact, just as I’m writing, a long green candle on the industry graph has turned into a red candle showing a loss on the day. The cross above the 40-MA is one hurdle. To really feel confident about rising gold/silver stock prices, we need to see the average industry price rise above not only the next resistance level, but the one which is just above that.

So, investing in gold/silver stocks is not for the faint of heart. The potential of explosive profits is what makes many of us “gold bugs”. Personally, I don’t believe these miners have any place in your retirement portfolio. However, because explosive gains are possible, some exposure in your TFSA for capital gains exemption is not a bad idea when the timing is right. Just remember though, while you won’t pay capital gains on growth, you won’t be able to capture losses like you can in non-registered accounts for example. If you do invest in these gold/silver miners, it’s always best to tip-toe or trickle in until you see a firm trend established. Better to add to a position that’s already rising than to bail out of a full position if it turns against you.

VectorVest Advantage. The advantage we have as VectorVest subscribers is the Industry Group Ranking and the ability to track and graph the Industry Group as a whole. We have the Gold Digger Search that finds beaten down gold and silver miners that are poised to explode up from bottoms. We can also research and create a list of our favourite gold stocks, put them in a WatchList and graph the entire WatchList. Finally, we can follow and graph the Global Gold Capped Index itself as well as the stocks that comprise the index.

Are you Bullish or Bearish? With my rose coloured glasses firmly in place, I would welcome all other points of view. Either way, good luck to all you gold bugs out there!

I hope you find this article helpful, or at least interesting!

Stan Heller, Consultant VectorVest Canada

January 8, 2015

Thanks so much Stan for the great writeup on the gold industry. Very informative.

My pleasure Daphne. I’m glad you enjoyed it.

Thanks Stan. Great review of the Gold Digging World. As you mentioned, “So, investing in gold/silver stocks is not for the faint of heart.” I personally have not dabbled in this sector historically but lately because of the price of oil tanking it may be an area of interest.

Hi Warren, I think there are some opportunities here if we watch the VectorVest signals. Market cycles typically bring beaten down sectors up from the bottom eventually.

Thanks Stan I really enjoy your comments and insight and your colour guard reports

Thanks Ed. Glad you enjoyed it.

Thank you Stan I really like your comments in general.

Keep up the goog work.

Thank you Gilles. Always a pleasure.

Another great lesson Stan. I am always learning more and more ways to find opportunities in the market. Thanks!

Thanks Dave. All the best.

Excellent article Stan. Very informative.

Thanks Gerry. Always a pleasure.

Thanks Stan,

What an excellent in-depth update on gold. I always learn so much more when you talk about gold then when I just look at the HUI on Monday nights.

Much appreciated as always,

Tom

Thanks Tom. I enjoy the topic and it can be a very profitable sector.

Stan

You have energy like I have never seen before -your commitment and contributions to the Canadian VectorVest Users is unparalleled

I write this not only because of your past contributions but also to recognize and say “Thanks for the “Excellent Blog on Gold”

We are one bunch of Lucky Dudes to have you in our camp

Many Thanks Stan — Bob

Thanks Bob. I do get energy and excitement from the level of participation and comments we’re getting on this Blog at such an early stage. Wonderful to see the sharing of ideas and information. I hope we can keep it going!