If you haven’t already registered for tomorrow’s International Online Forum, please do so now.

Click Here to Register. That’s tomorrow, Saturday, March 4 at 11:00 am Eastern / 8:00 am Pacific.

Keynote speakers: Tom Mitchell, member of VectorVest Nanaimo, BC User Group will show you his process for developing a winning trading plan.

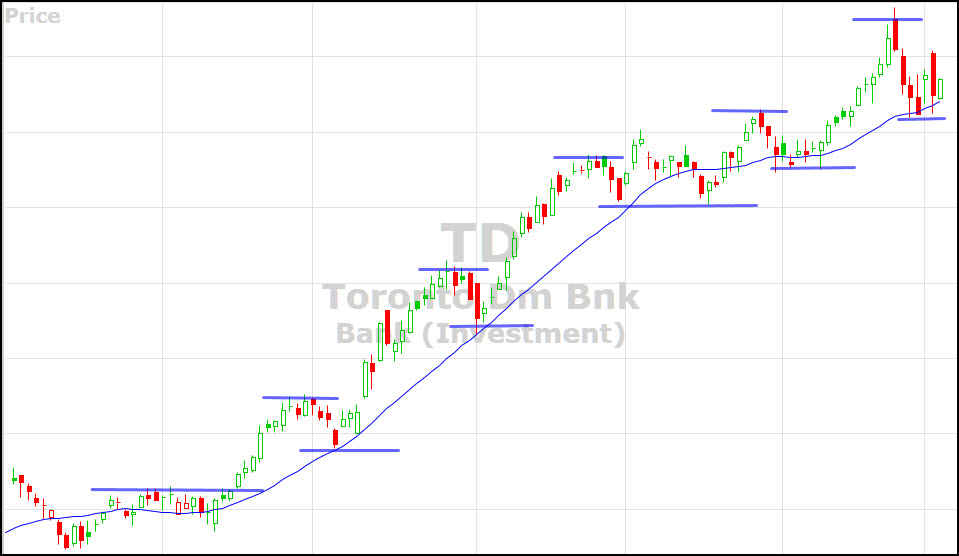

Petra Hess, Burlington, ON User Group Leader will explain Value Zone Investing. What is Value Zone Investing? How can it help you find more consistently profitable trades? Pictured below is one example Petra will use tomorrow to explain her Value Zone Investing method:

As always, we’ll do a quick review of all VectorVest’s global markets and try to determine direction for next week.

Hope to see you there.

Hi Stan, Would appreciate you directing me to the appropriate source dealing with strategies for protecting portfolios against drops in the Dow, nasdaq and s&p 500. If contra etfs are suitable to do this what percentage of one’s portfolio would be sufficient to provide the necessary downside protection? At some point there could be a ten % drop and I’d like to be prepared now. Thanks for any advice you can give me.

Good morning Andrew. Thanks for your question. Lesson 2 of our Successful Investing Quickstart videos for new investors will help you avoid a major collapse on any individual stock. In our live workshops we also give Dr. DiLiddo’s guidance on portfolio management. This includes diversifying and his cardinal rule of setting your stop to never lose more than 1% of your total portfolio value on any one stock. Finally, we give guidance from our historical benchmarks of when the market is nearing a top and investors should be defensive, and when the market is nearing a bottom and investors should be more aggressive. If you would like to email me, I can send you those benchmarks for Canada and US in a graph of VectorVest’s Emotional Market Cycle. [email protected] Thanks again Andrew.