Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

It seems that when I’m working 7 days a week and don’t have time to watch the markets or trade, the market goes straight up and life is rosy, but as soon as I shut it down the market tops out. Stupid comes out of the woodwork and a crash happens, so this week it’s on me.

Last week I highlighted some ideas to look at for buying the dip and gave some guidelines that may determine the severity of any pullback. I, unfortunately, forgot to mention 1 key indicator. Stupid, as in GME. Last year in January I wrote you can always tell a top by the level of stupid.

As I have written many times in the last 6 months, I believe this will be a K-shaped recovery, meaning some will do very well ie Construction, trades, big box stores, etc., whereas others will go by the wayside ie Movie theatres, many retailers, travel industry etc. However what I didn’t see coming was this pandemic with its many lockdowns getting many more retail traders entering the market, seeing how easy it can be to make big money and using social media to work together to take control and punish the pros (primarily the short-sellers). Result – this week the big Hedge Funds lost hundreds and even billions of dollars while the little guy (assuming they didn’t let greed take over) made insane amounts of money in a short time.

What is the potential fallout from this week:

- The Pros are way beyond mad because they lost huge amounts of money, so watch for retribution on an insane level

- Energized by their recent victory, watch for the younger generation to grow even stronger through the use of social media and continue to affect change in the market

- Already there is a class action lawsuit against Robinhood for restricting trade this week

- Already there are new trading platforms ie Stash, whose ads are targeting people in their 20’s to get into trading

For me, I don’t have the stomach for this sort of thing, so I’m going to pass thank you.

Here are 2 quotes I thought were applicable:

- “The Game Stop saga is a ludicrous stock mania born of pandemic boredom and FOMO piggybacking off a clever Redditt revenge plot which targeted hedge funds who made a reckless bet on a struggling retailer and it’s going to end with lots of people losing incredible amounts of money”

- “We’ve already seen this week what happens when just some of the Retail Investor Community collaborate to move money to reflect a cause or ambition”

How can we profit safely from this:

- BE PATIENT!!! Wait for the dust to settle

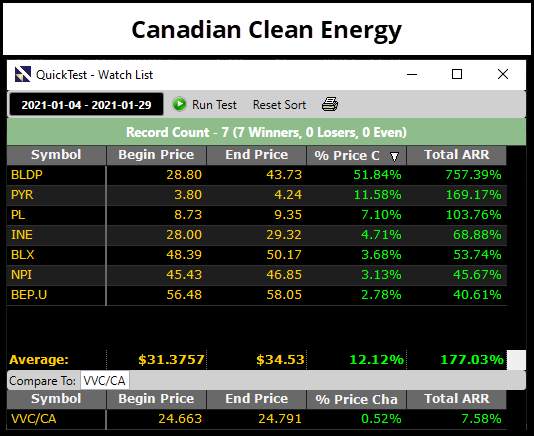

- Watch the 2 Watchlists I sent out last week re Stocks and ETFs on the USA Side3, See the attachment for Canadian Green Energy stocks

Finally, I believe that 2021 may be the start of a new era in trading and if we’re smart and trade what we see and know it can be very profitable for all of us.

As always, nothing more than my 2 cents and I hope it’s of value and interest.

Now for the markets:

USA

DOW JONES: Had a Bad week RT below 1 79 SMA is right at the Feb 2020 high See if it holds or price falls to the 200 SMA

NASDAQ: 2 support lines and 79 SMA below See if any hold or it falls to the 200 SMA

S&P 500: Support line right at 79 SMA If it doesn’t hold then long way to the 200 SMA RT is below 1

MKT TIMING: Price can fall to 1 of 3 support lines or the 65, 79 or 200 SMA Time will tell Needless to say MTI, BSR and RT all fell this week

Jan 20 BSR 10.87 Jan 29 BSR 2.68

READ Views and Strategy

CANADA

PTSE: Fell through 2 key support lines and now heading to the 79 SMA

VENTURE: Holding the 20 SMA for now

MKT TIMING: Price fell to a weak support line and held, for now, MTI, BSR and RT fell hard BSR Jan 20 3.45 Jan 29.98

READ Views, Strategy, Climate: Earnings Indicator continues to rise

EUROPE, AUSTRALIA and BRITAIN READ VIEWS

Thank you for your writeup and insight. You provide great wisdom and help settle people down to see the big picture. Based on your comments and using vectorvest helps provide confidence in trading. thank you