by Stan Heller, Consultant, VectorVest Canada

Do you have a plan for dealing with this growingly volatile, up and down market? Let’s talk about it during our Q&A webinar tomorrow at 12:30 p.m. EDT. We’ll discuss the defensive options trades presented in Friday’s video and study a few of your stocks using VectorVest’s 4 Tips for Knowing When to Sell.

Do you have a plan for dealing with this growingly volatile, up and down market? Let’s talk about it during our Q&A webinar tomorrow at 12:30 p.m. EDT. We’ll discuss the defensive options trades presented in Friday’s video and study a few of your stocks using VectorVest’s 4 Tips for Knowing When to Sell.

Here is the link to register if you haven’t already done so: http://news.vectorvest.com/CA_SOTW_QA_050415_registration.html

Despite the Canadian market closing higher three of five trading sessions last week, including a 115 point gain Friday, the market ended the week lower overall. The TSX Composite fell 68 points to close the week at 15,339. It’s been a vexing market the last two weeks with wide-ranging candles especially on down days. We’ve had 3 PW/Dn signals and 2 PW/Up signals in the last 10 days although the overall trend has been sideways to lower.

So, with almost as much red as yellow in the Color Guard this week, it’s a good idea to heed VectorVest guidance in the Market Timing Gauge: “VectorVest does not advocate buying any stocks at this time.” On a potentially positive note, the 65-day MA hasn’t yet rolled over. The market has bounced off this level before, so let’s see if Friday’s bounce can continue with some upward momentum.

Friday’s Special Presentation was all about using options to protect your portfolio, essentially buying insurance in case the market continues to move lower. Once again, please join me tomorrow (Monday) at 12:30 p.m. EDT for our week SOTW Q&A. We’ll review the option strategies explained in the presentation and answer your questions. Time permitting, we’ll also re-visit VectorVest’s 4 Tips for Knowing When to Sell using graphs of stocks you own and might be wondering about.

Here again is the link to register: http://news.vectorvest.com/CA_SOTW_QA_050415_registration.html

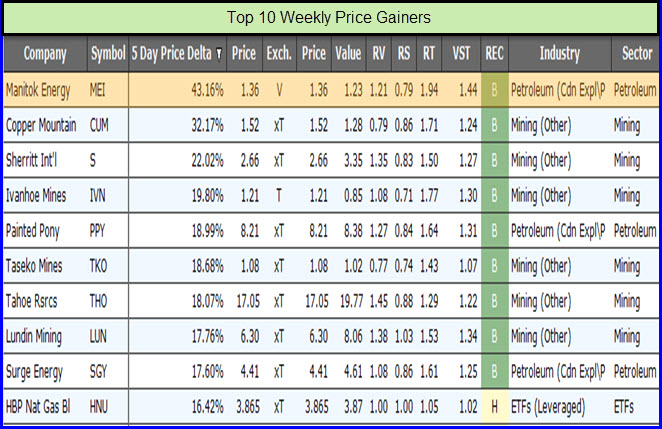

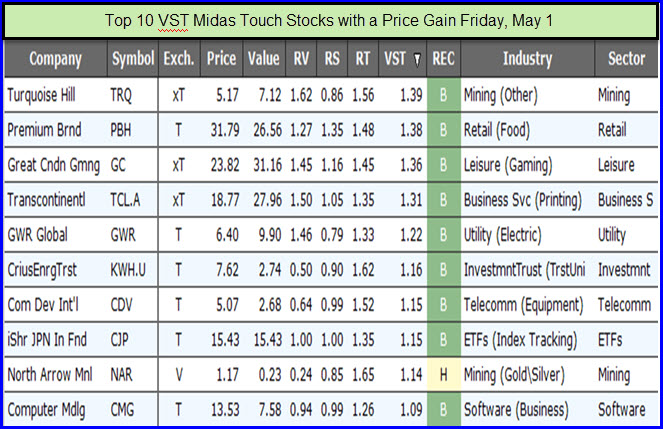

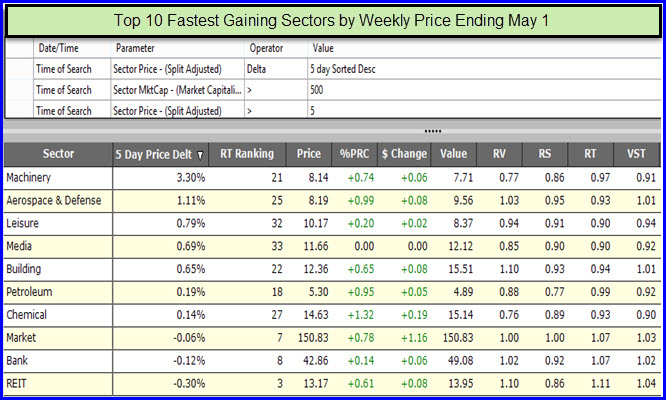

Top 10 Lists. Below are a few lists of stocks and industries as of end of trading May 1, 2015. Examining these lists can often help us identify market trends.

Leave A Comment