By Don Fanstone, Member Kitchener/Waterloo User Group

Earnings Season, Going With the Winners:

Earnings season is in full swing with winners and losers. Buying stocks (or options) on companies that continually increase their earnings and their sales is a good way to pick winners going forward.

Two suggestions going forward.

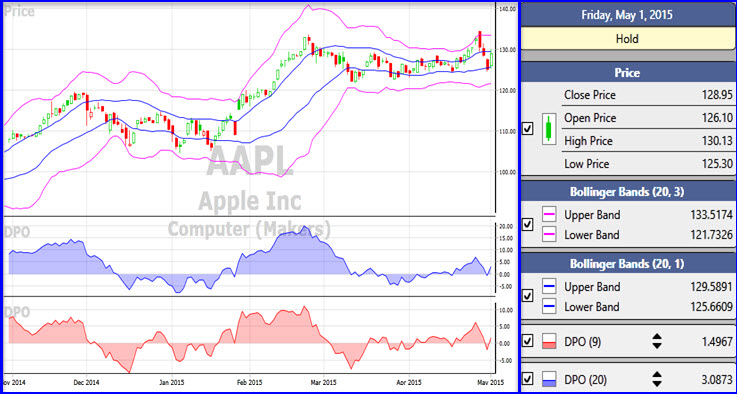

Apple: Apple had great earnings, but surprised investors by retreating in value. Were investors taking profits, or were speculators with short term option positions cutting their losses having expected good earnings and then being disappointed when the stock did not rise in value? I am personally aware of investors who rightly expected Apple to have blow-out earnings; and who were buying inexpensive at-the-money May 1st options with 4 days to expiry, expecting to earn short-term profits.

For whatever reason Apple dropped in price, it’s a fairly safe assumption that going forward, it will continue to be a dominant player in media equipment.

The ideal time to take a position is when there is a green light in the price column, the market is moving Up with an Up/Up condition, and Apple makes a new high, closing above $134.54. This eliminates all resistance, and the previous high becomes support. Buy October 120 Call Options.

Follow the stock price in “Star Search” If the price falls out of the upper quadrant, close the trade.

Alternatively:

If the stock price falls below the simple 30 day moving average and the DPO turns negative, close the trade.

Skyworks: This Company is a supplier to Apple and has reported great earnings.

Buy November $90.00 Call Options at a close above $102.87, same conditions as noted above for Apple.

Watch Friday’s Special Presentation: A good explanation of Selling Covered Calls and Buying Protective Puts in this week’s Strategy of the week. Don’t miss it.

Sells for the Week of April 27:

None:

Buys for the Week of April 27:

None.

Options Courses. The VectorVest Basic Options course is available online.

The VectorVest Intermediate Options course is being offered on May 28th in Mississauga. Check the Views or call 1-888-658-7638 for the course description and pricing. It will soon also to be offered online.

I encourage all to read Lee Lowell’s book “Get Rich with Options”, go to VV University and watch the Video on Options, and read Dr. DiLiddo’s article in the Views Manager under Special Reports, and attend the VV Options Course.

Understand Options Before you begin to trade, there is much to learn.

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

Long options bought just prior to highly anticipated earnings releases have a sporadic record.

As hordes chase the assumed “pop” (up/or down), option prices become dearer based on supply and demand. Decades ago, to complete a multitude of option pricing models, a fudge factor was incorporated. Option players refer to this fudge factor as Implied Volatility, or “IV”, and it has great use as a sentiment indicator. In the case of earnings, IV tends to collapse (often violently) after the event (earnings release) and many find that, even when correct on direction, their option trades end up losers.

One approach is to purchase sufficiently in advance of earnings.

An alternate approach is to buy options shortly in advance and sell-to-close JUST BEFORE earnings. This technique harvests IV increase.

Another technique is to trade after the earnings release based on recent past experience on how the individual stock usually behaves after a beat or miss. There are databases available for this approach and be warned, “consensus” estimates are not particularly useful metrics for beat/miss criteria. Thomson (pre-Reuters) published a free service. Today, crowd sourced data seems to lead the way for finding good estimates, but size and direction predictions for subsequent moves remains difficult.

AAPL followed its release with a couple of negative announcements. 1) The new iWatch has birthing pains: bad “thumper” modules and “tattoogate”. 2) Much more important – ECU proceedings regarding Irish tax treatment,appears to be heading toward tax recovery from Apple of truly astounding size. Judging from market reaction immediately after earnings, do you think maybe someone had advance information?

Tom I think you agree that it is extremely difficult to guess what will happen the day after earnings. I have been killed several times despite blowout earnings. Even holding one as it rose like crazy right onto the close of the market on earnings announcement night when they reported fantastic results. The next day it tanked for no apparent reason. I suffered holding it for weeks and finally dumped it.

I have also dumped a stock that I knew would have poor earrings which it did, only to see it pop 13% the next day after reporting the lousy earnings. If earnings are good, the analysts often seem to find some tidbit in the wording to cause a negative effect. On the other hand if earnings are expected to be bad and they meet the bad expectations or maybe do slightly better, the stock can soar. Look at GILD which just had fantastic blow-out earnings and APPL as well. Leading up to earning you could get a fantastic price for AAPL covered calls. Now you can only get pennies as the stock is dropping.

My point is that I think earnings are not a good time to roll the dice. I can’t back it up with hard data but a trader told me that 75% of stocks go down after reporting and 75:25 is not good odds.

I did not realize that AVO reported today. I just learned minutes ago while writing this that the stock has tanked and I have AVO both July 17 and July 21 call options that are worthless now. A very significant loss and another lesson learned about holding through earnings that applies much more to options than stocks. The latter may come back some day but options will evaporate.

HI Tom:

Thanks for your comments on earnings and the day of announcement. It is a challenging pick and your suggestion of buying after good earnings have been posted is a better strategy to follow.

Tom:

I too was blind-sided on Avigilon. The company made money, just not as much as analysts forecast. Looking at the huge volume, it’s evident that a mutual or hedge fund dumped their holdings. Due to the huge amount of stock for sale, the price tanked. The stock should be worth $21.00 so I am holding onto my July 16’s till expiry.

Don

Tom Cauley:

Interestingly, Avigilon just posted that they will be buying 10% of their shares in the market for cancellation. The stock has responded with another increase.

Don