When you depend on dividend income for a secure retirement, the most important thing in your portfolio is, dependability.

You count on those dividend stocks to provide needed income every quarter or every month. The question is, can you get adequate returns along with the comfort of knowing the companies you own are well positioned to keep paying those dividends and even increasing payments on a regular basis? When you have VectorVest, the answer is a resounding YES!

By creating a safe, well-balanced portfolio from the hundreds of established dividend payers on the TSX, you can enjoy collecting current income from your investments while watching the value of your portfolio consistently rise. All you need are the right tools and indicators that are both accurate and reliable.

For the task at hand, let’s focus on three exclusive VectorVest indicators, Relative Safety, Dividend Safety, and Dividend Growth. First, the definitions. We turn to the Full Stock Analysis Report which we can easily get by highlighting any stock in Stock Viewer or WatchList Viewer, and then right-clicking on it.

RELATIVE SAFETY

RS is an indicator of risk calculated on a 0-2 scale, the higher the number the better. RS is computed from an analysis of the consistency and predictability of the company’s financial performance including debt to equity ratio, sales volume, business longevity, price volatility and other factors.

DIVIDEND SAFETY

DS is an indicator of the assurance that regular cash dividends will be declared and paid at current or higher rates for the foreseeable future. On a scale of 0-99, stocks with DS values above 75 typically have Relative Safety (RS) values well above 1.00 and EY, Earnings Yield levels that are much higher than DY, Dividend Yield. I find the DS rating is superior to the dividend payout ratio which simply compares EY to DY in a one-day snapshot in time. DS takes into account the long-term financial performance of the company as well as the historical consistency of previous dividend payments.

DIVIDEND GROWTH

DG is a forecasted annual growth rate of a company’s dividend based on historical dividend payments and dividend predictability. It is a subtle yet important indicator of a company’s financial performance. It also provides some insight into the board’s outlook and the company’s ability to increase earnings to support a growing dividend. Retirees and long-term investors know that dividend growth is more important that a company’s current dividend yield. We want to favour stocks that have a DG rate at least 2x higher than the current rate of inflation.

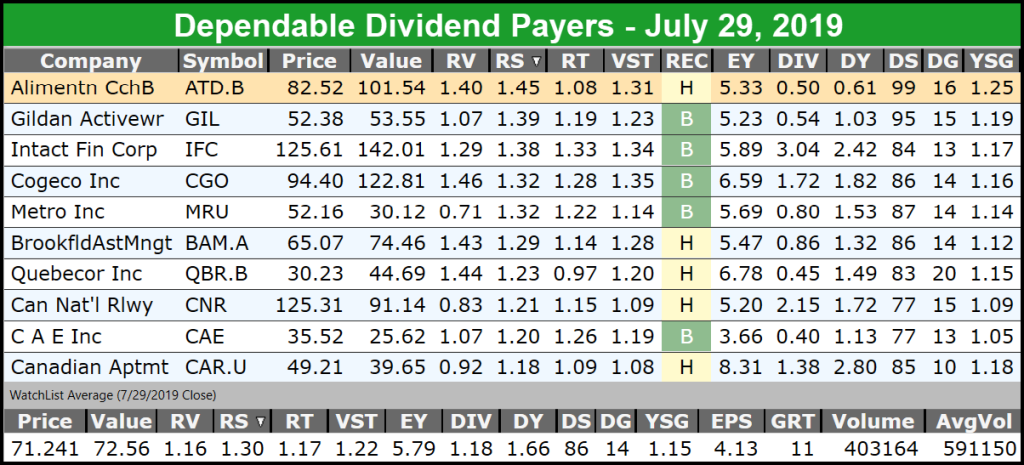

Based on the above, let’s see what a dependable 10-stock dividend portfolio might look like if we were to construct it today, Monday, July 29th. We could cherry pick from the Stock Viewer or from a WatchList such as our Master Retirement WatchList, WOW Dividends, DRIPS or Monthly Dividend Payers, but my preferred method is to use our UniSearch tool and cherry pick from the results. Remember, dependability is what we’re looking for so let’s add the following search criteria: RS > 1; DS >= 75; and DG >= 8. We’ll Sort by RS, but remember, we’re cherry picking for the combinations that are most suitable for our own risk tolerance and income needs. Below is a table of my choices.

This basket of stocks delivers on dependability in spades, not only in dividends but in price appreciation, a bonus. The basket is up 25.30% YTD, an annualized rate of return, ARR of 44%, (not including dividends) and it’s up 107.72% over the last five years, an ARR of 21.55%. From the WatchList Average row at the bottom of the table, you can see that the average Relative Safety is excellent at 1.27; Dividend Safety is high at 82; and the average Dividend Growth rate is 15%, well above the current rate of inflation. What this means is that you can reasonably expect dividends to be paid quarter over quarter with an average yield of 1.66% per year, and you can expect to receive a healthy pay raise every year going forward. You can also expect dependable capital gains over time which you can draw down on when extra income is needed for that luxury item or an unexpected expense.

VectorVest delivers what you need WHEN RETIREES DEPEND ON DEPENDABILITY.

INTERNATIONAL ONLINE USER GROUP FORUM

Please join us for this FREE webinar Saturday, August 10 from 11:00 am ET to 12:30 pm ET. In addition to our Around the VectorVest World Market Review, we will have a special presentation titled, HOW TO TRADE MULTIPLE MOVING AVERAGES FOR FUN AND PROFIT. Learn the hidden meaning behind multiple moving averages and how to trade them with confidence when using exclusive VectorVest indicators. Please click here to register.

Leave A Comment