A lot has been written about VectorVest’s exclusive Relative Timing, RT indicator, and deservedly so. There’s no better measure of investor sentiment.

VectorVest Founder Dr. Bart DiLiddo writes in Stocks, Strategies and Common Sense that RT, displayed on a 0-2 scale, has all the characteristics of a guided missile system. “It can see things not visible to the naked eye and automatically returns to 1.00 when a stock’s price flattens out. Once it locks in on a stock, it tracks it relentlessly. It explodes upward from bottoms and dives from tops.”

There’s no doubt RT is a fast, smart indicator on its own. Then, in December 2008, VectorVest introduced a new graph layout which included a 40-Simple Moving Average of RT and two moving averages of VectorVest’s Stop-Prices, a 10 and 65. Called the “Midas Touch”, it was created as an indicator for when to Buy and Sell gold using the Gold Bugs Index (HUI) and we still use for that purpose today. Quite simply, the Midas Touch converts volatile, erratic pricing data into smooth trends that are easy to read. It didn’t take long for the investing wizards at VectorVest to discover that the Midas Touch was fantastic for all stocks, not just gold.

The Midas Touch layout is conveniently saved for you in the Graph Layouts menu. Additionally, for your convenience, stocks that meet the criteria of all three indicators hitting new highs on a 3-month graph are placed in a WatchList called Midas Touch Stocks. These are high momentum stocks.

I find that if you do nothing else but use the 40-MA of RT as one component of your favourite graph layout, you will improve your win-rate and be miles ahead of most investors. The key is to be patient and only buy when the 40-MA of RT is rising. It’s like a rocket. It takes a large amount of thrust to get it going. Think of this as increasing buyer conviction. Once you have lift-off, its momentum tends to carry price faster, farther and higher before eventually losing steam and turning down. Just like a rocket, this usually happens slowly, so you have time to analyze your position and decide whether you want to sell or not.

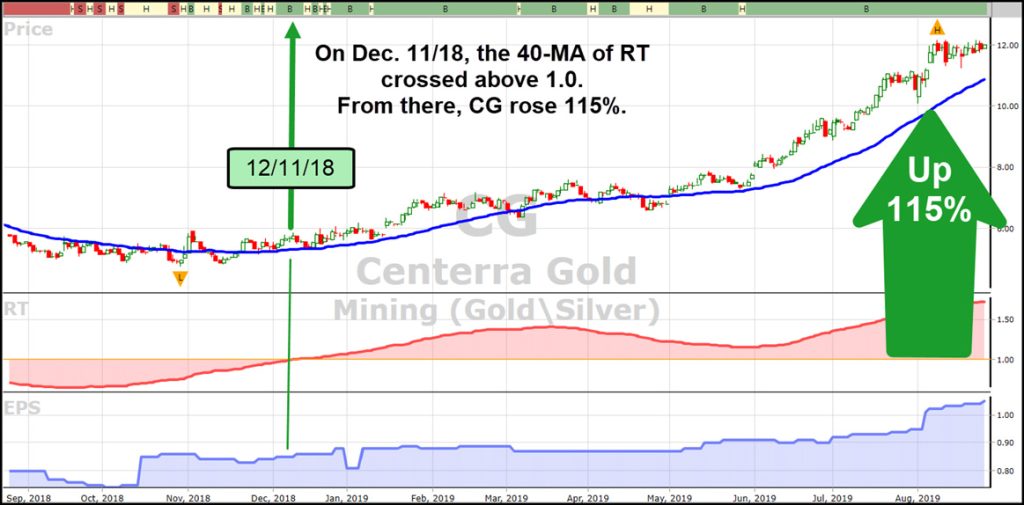

Like any moving average, the 40-MA of RT works best in a trending market. To find potential buy candidates you can use the Midas Touch WatchList, the Master Retirement WatchList or any of your favourites. I like to run the New Buy Rated Stocks search and put the best candidates in a WatchList. Sometimes it takes a while after a New Buy for the 40-MA of RT to lift off and provide confirmation. Take Centerra Gold (CG) for example, a top VST stock that is often in the Master Retirement WatchList. It got a New Buy on November 1st, 2018. The 40-MA of RT was rising but still well below 1.0. If you bought there, it turned out alright, but if you waited until the 40-MA of RT crossed above 1.0 on December 11th, you would have avoided some whipsaws and sideways price action.

Same story with Canada’s favourite gold stock, Kirkland Lake (KL). An ideal entry was at a New Buy November 22nd, 2018. From there, one could have held KL through a pullback that started around March 15th when the 40-MA of RT had crested and started falling. It never fell below 1.0, but you sold, you could have bought it back around May 31st when KL received another New Buy. The 40-MA of RT had stopped falling and was rising again.

For more insights into trading the Midas Touch, please read the Special Report in the Views titled, “The Amazing Midas Touch”. Study several graphs this weekend. You’ll soon know how to TRADE THE MIDAS TOUCH RT LIKE A ROCKET.

HOT STOCKS IN OUR Q&A

As a regular new feature, our weekly Tuesday Q&A attendees will help me pick a basket of Hot Stocks for submission to our Educational Services Team. From there, the Team will select five stocks for presentation in our Friday night Canada Market Timing Report. Check out the first Hot Stock Picks in tonight’s Report. It’s going to be fun and educational.

Leave A Comment