If it’s true that misery likes company, then perhaps we can all take solace that most global markets have been miserable for at least a few weeks now.

Last Saturday I showed the Color Guard Reports from around the VectorVest world to our International Online User Group Forum. Red lights were the dominant colour. Canada has been in a Confirmed Down Call since May 13th so we know the market was falling week over week for at least two weeks prior to that. In fact, six of our seven VectorVest countries Saturday were in a Confirmed Down. On Monday, Australia joined the club.

So, let’s face it, it hasn’t been a great time to buy new long positions. VectorVest has been advocating either buy with caution when lights were yellow, or don’t buy stocks at all on Primary Wave Down signals, especially on those red lights. That said, when you have powerful indicators and a search engine like VectorVest, you can paddle your boat against the current occasionally and still have success. When you do, you need to be extremely selective, buying only high quality, rising stocks.

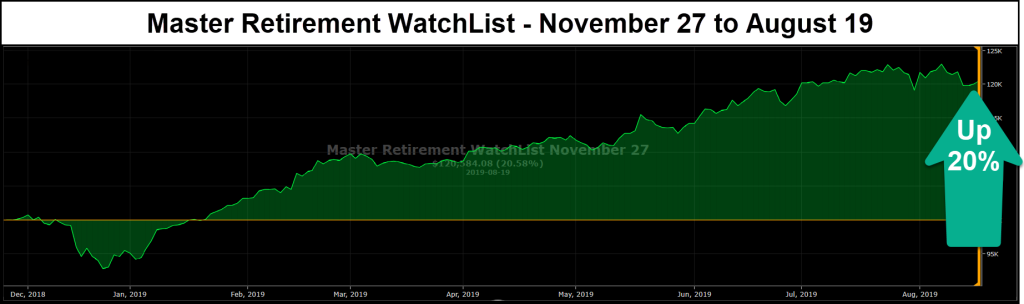

Our CA Master Retirement WatchList (MRWL) holds such stocks. Tuesday morning for example, I received an email from Wayne D. to share with our Q&A community. He said he has been paper trading a portfolio of 10 MRWL stocks since November 01st, 2018 that shows outstanding results. He said he is “basically cherry-picking stocks using Midas Touch graphs, exiting positions with the Ratchet Stop and using DEW timing”. Bottom line, the paper portfolio is up 32.5% AAR without dividends compared to 21.3% AAR with dividends in his actual portfolio using the same process but not the MRWL. Now listen, 21.3% ARR with real money is terrific, but Dick closed by saying, “Needless to say, as positions close in my personal portfolio, I will be focusing on MRWL stocks.”

Immediately a question came from Ken A., one of our regulars. “Can you Quicktest all MRWL stocks from the Confirmed Down ‘til now?” From the Viewers tab I went to the Special WatchLists folder and opened the MRWL. I changed the date to the May 13th Confirmed Call. There were 23 stocks listed that day with Shopify, (SHOP) at the top, sorted by VST. Quicktest All and we had a gain of 8.33% or 33.0% ARR, led by SHOP at 41.8% or 166.2% ARR. Seventeen winners, six losers. The TSX was up just 0.60%. Quicktest the Top 10 and we were up 12.3% or 49.2% ARR. Eight winners, two losers. In a 3-month long C/Dn market. Ken’s next chat was a single word, “WOW”.

Another example. My VectorVest friend Tom C. in Ontario sent me an email Monday with the subject line, “How I Found a Little Gem In 2 Minutes or Less With VectorVest”. Here’s what he wrote:

“On Thursday I noticed I had a few grand in cash in a US account. I thought I would look for something under $9 that I could buy a thousand shares of. It couldn’t have taken any more than 2 minutes to put the simplest search together for a stock under 9 bucks with a high RT and VST. I already had the first two in the list but on the Canadian side. So, I looked at all the charts and fundamentals and bought the third one, APPS (Digital Turbine) which I had never heard of. I’m up 13.12% already on a lousy day in a lousy market with a new C/Dn. I’m sure APPS can come down just as fast so I don’t know how long I will be able to hold it. But this is just one small thing I love about VV.”

Pretty cool. By the way, APPS made VectorVest’s Hot Stocks list in Monday night’s Enhanced Color Guard Report, and it was up another 4.8% on Tuesday. A little more cushion for Tom.

There are so many ways to use VectorVest to find what you’re looking for. This just happens to be HOW TOM FOUND A LITTLE GEM IN 2 MINUTES WITH VECTORVEST.

Leave A Comment