VectorVest has always been on the cutting edge of investor education about Exchange Traded Funds, or ETFs as they’re commonly referred to. I’m sure our Founder, Dr. Bart DiLiddo, had a lot to do with it. He wrote his first of many essays about them in the September 8, 2000 US VIEWS. You can turn back the calendar and read every word, but below are the highlights.

Dr. DiLiddo explains, “The implications of ETFs are enormous. For one thing, they compete directly with mutual funds and have several advantages compared to mutual funds. For example, you can execute a trade on an ETF at any time during the day. Trades on regular mutual funds are executed at the end of the day. Some ETFs, such as the NASDAQ 100 Trust (QQQ), even have options. Other advantages of ETFs are that they are more tax efficient than mutual funds, i.e., you don’t get stuck with capital gains that you might not have participated in, and management fees are generally lower. A final advantage is that you have a very good idea which stocks are in the ETFs.”

He goes on further to say, “I expect that ETFs are going to give regular mutual funds a run for their money, and they have been cropping up all over the place.”

The ETF Boom

Amazing. Imagine, there were just 66 ETFs in VectorVest US when he wrote that. Today we have 450 in Canada alone. The US database covers an astonishing 1,500 ETFs. The asset growth of ETFs the last few years surpasses many times over the growth of mutual funds.

Dr. DiLiddo has written many essays on the subject since then. Just type ETFs into the search engine in the VectorVest 7 system “Views” to find them in the Overview section. There have also been several Strategy of the Week video presentations. To find them, best to go to the Strategy of the Week viewer in the Views Manager or VectorVest University itself. Scroll down and look for ETFs in the titles.

In August 2007, Dr. DiLiddo started writing about a new thing, contra or inverse ETFs. A new WatchList in VectorVest 7 had been created for them. He wrote a comprehensive essay about them on November 2, 2007, the same day in which he also wrote a special, “Word To New Subscribers”. In that special note, he stated that the Confirmed Down signal received the day before, “could be the entrée to a long Bear Market”. We all know what happened in 2008.

His essay stated, “Does a down market mean we can’t make money anymore? Not at all – in fact it could be easier than ever with the advent of Contra ETFs. Contra ETFs are Exchange Traded Funds that are designed to go up when the market goes down. Of course, they are likely to go down when the market goes up. So Contra ETFs do not eliminate risk, but they eliminate the need to have a margin account and they are allowed in most IRAs (registered accounts) that I know of. So you can trade them just like regular stocks.”

ETFs are Flexible

There’s never a bad time to learn about contra ETFs. We might need them sooner than later. The bull markets in Canada and especially the US are long in the tooth. If we enter in a Confirmed Down signal, or if a commodity you like to trade starts going south, contra ETFs can be a valuable hedge, or just another way to make money. As a starting point, check out the recent SOTW special video presentations of May 18, 2017, Cherry Picking Contra ETFs, and May 25, 2017, To Leverage Or Not To Leverage: ETFs. Both are excellent.

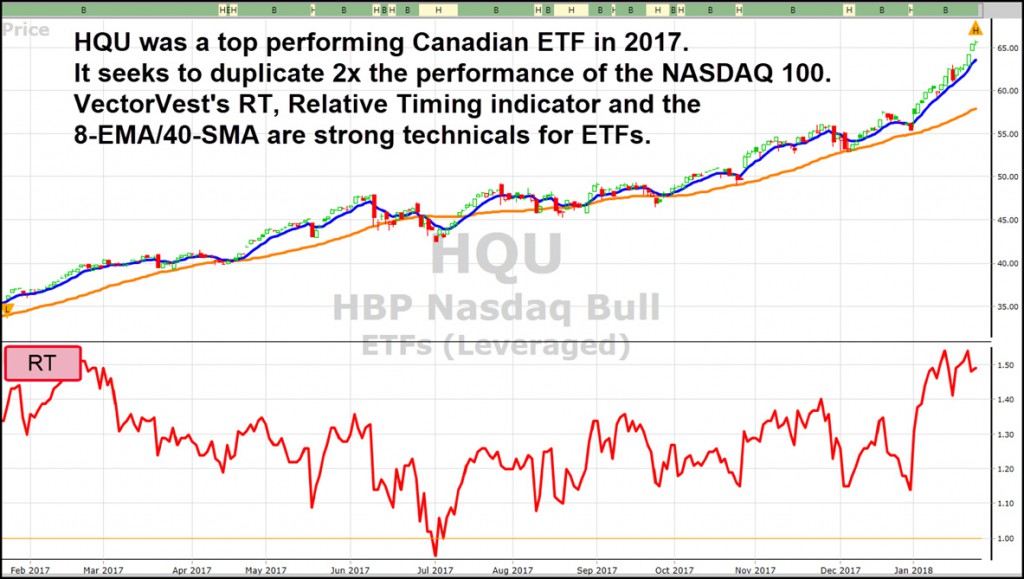

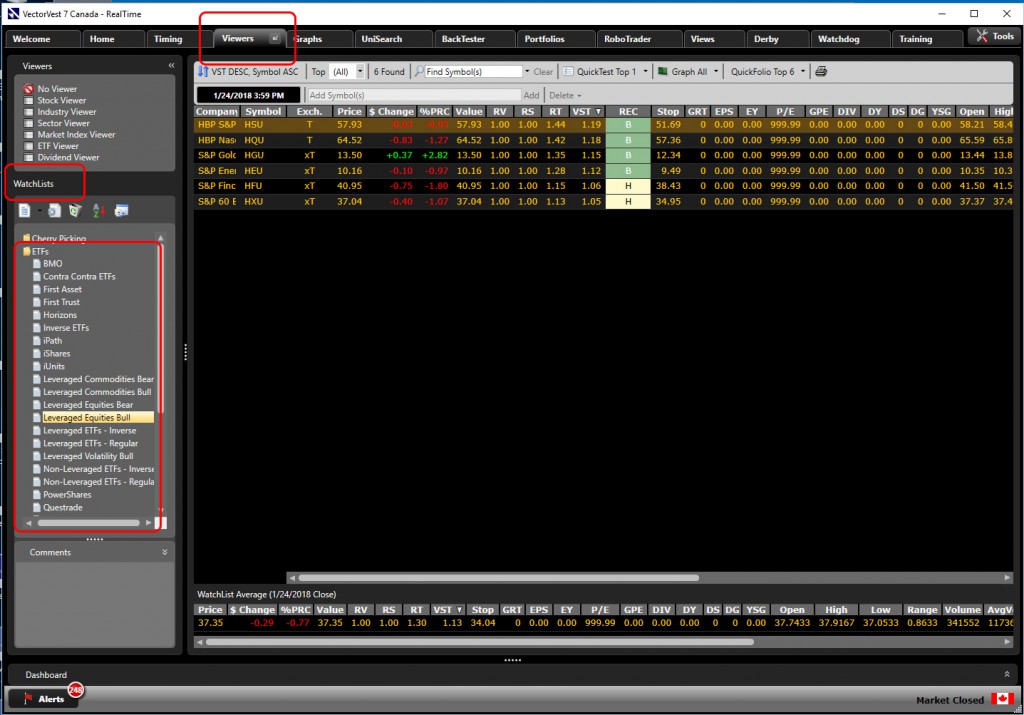

You might have noticed a few improvements recently to our CA Leveraged WatchLists. In the Folder titled ETFs, we have segmented a few categories to help you find what your looking for faster, and avoid confusion between bull and bear ETFs (regular and contra). For example, you’ll now see listings for Leveraged Commodities Bear and Leveraged Commodities Bull; Leveraged Equites Bear and Leveraged Equites Bull. You still have complete lists under Leveraged ETFs – Inverse; and Leveraged ETFs – Regular. With ETFs, like any stock, take care to know what you’re getting into before you buy. View the Full Stock Analysis Report or check the management company’s website for all the details.

Breaking Down ETFs

Just about every month in 2017 during our International Online User Group Forums, I showed 40 US ETFs that track the performance of world markets. Several investors in our VectorVest community let me know they have done well with them, finding them the easiest way to achieve global diversification. Other bullish ETFs both in CA and US, in commodities, equities and index tracking, leveraged and non-leveraged, have made consistent, sometimes spectacular gains in our rising markets. Soon, it might be time for contra ETFs to shine. After all, THERE’S AN ETF FOR ALL SEASONS AND ALL MARKETS.

—Stan

Want to find the next great ETF? Try VectorVest today!

Exceptional article. Large sums of money have been flowing into ETFs and they can be a more stable way to invest. vector Vest helps us sort through the noise and makes it easy to find the ETFs that cover what we are looking for and profit if the mkt is up or down. Thx Stan for another exceptional and timely article!!