Stock analysts and instructors often say, “the past is prologue”. An interesting catchphrase, but what really does it mean?

Wikipedia says, “What’s past is prologue” is a quotation by William Shakespeare from his play The Tempest. Antonio uses it to suggest that all that has happened before that time, the “past”, has led Sebastian and himself to this opportunity to do what he is about to do: commit murder, or another choice.

In stock trading, the meaning behind the past is prologue can help us understand how picking stocks that have performed exceptionally well during certain periods or consistently well over the long term can help us achieve better results in the future.

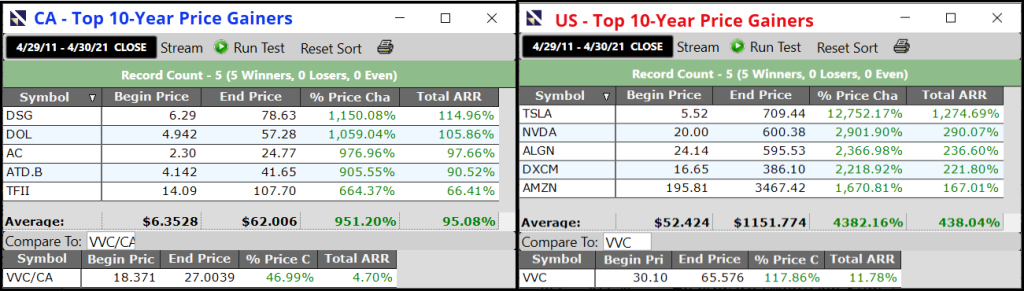

This discussion leads me to a stock-picking method championed by Bob Turnbull in his presentation to the December 2020 International Online Forum. Bob used Quicktests to find stocks from two elite WatchLists, the S&P 100 and NASDAQ 100, that met his criteria, a minimum of 40% ARR over ten years. The result is a blue-ribbon list of companies from which to choose!

I have streamlined the process using UniSearch and added a couple of additional steps to find stocks that have also achieved a 40% ARR over each of the last five years and two years.

Copied below are the steps to take, including my searches. I have also created a short video to walk you through the steps so you can create these lists yourself and see all of these great stocks. CLICK HERE TO WATCH THE VIDEO.

STEP 1 – Create a 10-year Delta Search using a WatchList filter on the S&P 100 and NASDAQ 100. In Canada, I filter on the TSX 30, TSX 60, TSX Composite, and TSX Venture 50 WatchLists, all found in the TSX folder. The Price and Average Volume criteria are necessary only for the Canadian searches. Here is the 10-year Search:

| Date/Time | Parameter | Operator | Value |

| Time of Search | Stock Price – (Split Adjusted) | Delta | 4/21/11 Sorted Desc |

| Time of Search | Stock Price – (Split Adjusted) | Delta | 4/21/11 > 400% |

| Time of Search | Stock WatchList | = | S&P100, NASDAQ100 |

| Time of Search | Price | > | 2 |

| Time of Search | Stock AvgVol – (50 day moving average volume) | > | 50,000 |

I ran my search on 4/23/21. Then I took all the stocks returned by the search and put them into a new WatchList I called Top 10 Year >40% ARR Ap 23/2021.

STEP 2 – Create a 5-year Delta Search. The criteria are the same except under Value, the date will be 4/22/16. Add those stocks to a new WatchList called Top 5 Year >40% ARR Ap 23/2021.

STEP 3 – Create a 2-Year Delta Search, same criteria again except the delta date will be 4/23/19. This time, change the WatchList filter to select only stocks from either one of your two new WatchLists created in Steps 1 and 2. That search line will now look like this:

| Time of Search | Stock WatchList | = | Top 10 Year>40% ARR Ap 23 2021, Top 5 Year>40% ARR Ap 23 2021 |

Place those stocks in a WatchList I called Top 2 Year >40% ARR Ap 23 2021.

Voila! You now have three lists of stocks that have achieved a 40% ARR or more over the past 10 years and 5 years, and you have a narrower list of stocks from those two lists that have returned 40% ARR or more in the past two years.

For recent two-year results, your top five stocks by ARR for the US should be TSLA – 643%; DXCM – 127%; MELI – 114%; ASML – 113%; and NVDA – 112%.

For Canada, the top five should be AT – 343%; SCR – 271%; BLDP – 246%; GBR – 207%; and SHOP – 179%.

Please be aware, despite the outsized average annual returns, the Canadian lists are less robust and more volatile than the US lists. It makes sense. There are more lower-priced stocks in the TSX WatchLists and many of them are in cyclical sectors such as mining and petroleum. When market conditions are good, returns on those stocks can be spectacular, and when market conditions are bad, returns can be spectacularly awful. You might consider reducing the required ARR in Canada to 30% or even 20% to include a more robust list of recognizable names.

Nonetheless, if you follow the steps and practice, you will learn how to use the power of delta searches. Keep in mind, every stock in every WatchList we created has delivered remarkable gains in the past, and they have the opportunity to do it again if THE PAST IS PROLOGUE.

Leave A Comment