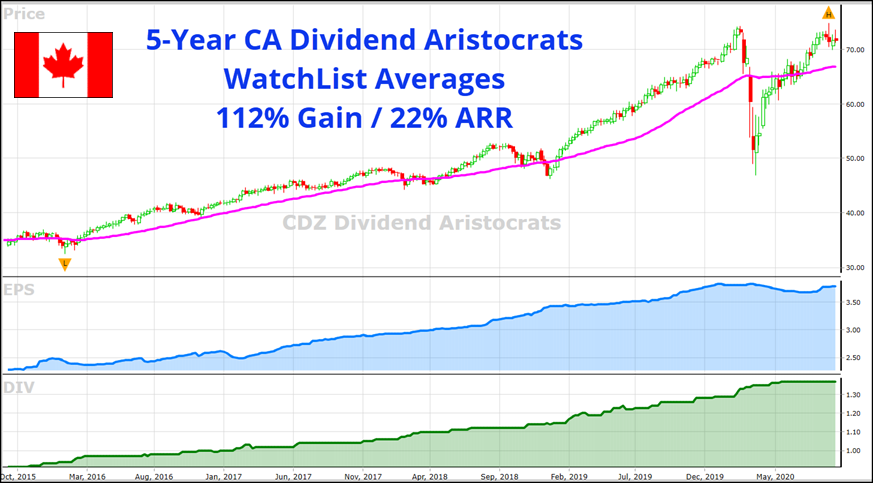

If you want to be a successful dividend growth investor, it pays to look at the Canadian Dividend Aristocrats. These are companies that have increased their dividends each year for at least five consecutive years. They must also have a minimum market cap of $300 million to qualify. For example, the 81 Dividend Aristocrats in Canada as a basket have averaged more than 22% annualized return over the last five years, not including the dividend payments. That is just buying on September 18, 2015 and holding through all the ups and downs.

The point is, these are great businesses with consistent and predictable earnings and a competitive advantage within their industries and sectors. Of course, some are better than others.

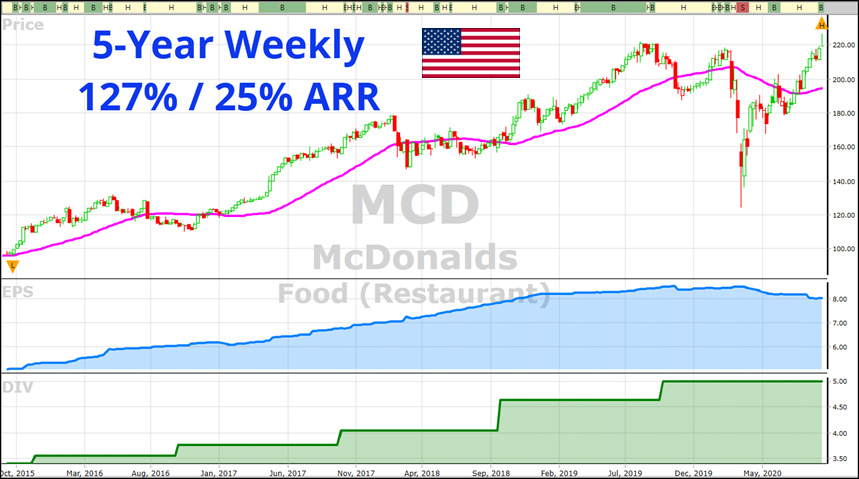

In the US, a company doesn’t get Dividend Aristocrat status unless they have raised their dividend every year for at least the last 25 years. In our US software, we have a WatchList of Dividend Aristocrats located in the Dividend Payers folder. The WatchList is called DRIP 25+ Years. There are currently 136 stocks on the list, including well-known names such as Johnson & Johnson, Walmart, Coca Cola, Lowes, McDonalds, and Canada’s own Canadian National Railway.

In VectorVest Canada, we do not have a pre-built WatchList of Canadian Dividend Aristocrats, but it is easy to create one and keep it up-to-date. I will explain how in this essay.

But first, why should you invest in Dividend Aristocrats anyway? The answer, being a Dividend Aristocrat shows a commitment by the company to consistent and growing shareholder returns. As long-term dividend growth investors, that is precisely what we want to see.

The ability to raise their dividend every year shows resilience and the ability to grow in both good and bad economic conditions. Dividend growth stocks, in particular the Aristocrats, generally hold up better than other stocks in down markets and recover faster and stronger after pullbacks.

With the economic damage from COVID-19, more than 100 companies have cut or eliminated their dividends, but not the Dividend Aristocrats I am going to tell you about. Of course, there is no such thing as a 100 percent safe dividend. Occasionally an Aristocrat fails to increase its dividend or worse, they have been forced to cut their payout altogether. It is rare, but when it happens, you should be protected by having your Stop-loss in place. Consider CAE Inc. After reliable dividend increases each of the last 10 years, it removed its dividend this year due to the COVID crisis, losing its Dividend Aristocrat status.

Alright, so where can you find these Canadian Dividend Aristocrats and what is the best way to add them to a WatchList? The easiest and quickest way is to check out CDZ, an ETF managed by iShares. Fittingly, it is called the S&P TSX Canadian Aristocrats index. Just type “iShares CDZ” into your web browser, and it shows up at the top. Once you have opened it, click on the “Holdings” tab and select “All Holdings.” From there, click on “Download Holdings” near the bottom of the page.

An excel file opens with all the symbols and other columns you do not need. You can type them individually into a new WatchList, or do this. Highlight and copy the symbols, then paste them into a new spreadsheet. Remove CAD and USD, (cash not stocks), and replace any income trusts with the abbreviation .U instead of the traditional .UN. Save as a .csv file. You can now import the stocks into a new WatchList with just a couple of clicks. You should have 81 names.

From there, study the 5-Year WEEKLY graphs with Price and the 40-SMA up top, and EPS and DIV in the sub-graph. Create a new WatchList of stocks with only the smoothest and steadiest Price, EPS and DIV patterns. I wound up with a list of 30 stocks, including such names as Quebecor, Goeasy, Alimentation Couche-Tard, Enghouse Systems, FirstService, Algonquin Power, Canadian National Railway, and Metro. These stocks have an average yield of 1.89%, a Dividend Safety or DS of 57 on our 0-99 scale, and Dividend Growth or DG of 12%. The Weekly WatchList Average graph looks smooth and steady except during the COVID collapse.

A QuickTest of all 30 stocks from 9/15/15 to 9/15/20 shows an average gain of 114.8% or 23.0% annualized, not including the dividends. The top 10 sorted by DG gained 130.4% or 26.07% ARR. During the same period, TSX gained 22.0% or 4.4% ARR. Please CLICK HERE to view a short YouTube video where I explain step-by-step my process for finding and analyzing THE BEST DIVIDEND ARISTOCRATS.

Leave A Comment