As I wrote in last week’s essay, we had some interesting and valuable discussion during the prior Tuesday Q&A Webcast. At one point, the chat turned to questions about why two stocks with better than average fundamentals, Chorus Aviation (CHR) and Premium Brands (PBH), each had experienced sharp drops in price after their earnings reports.

Both stocks hit a floor early in the day and reversed. In the case of CHR, it was down 9% at the open, but by the close it had recovered almost all of it, leaving behind any investor who might have been ‘stopped out’ if they had a stop loss order anywhere inside the 9% range. Inevitably that led to comments about the pros and cons of placing stop loss orders with your broker. A couple of members stated what happened was a good example of why stop-prices don’t work and why they don’t use them. But what if the stocks had not reversed?

It’s times like these I like to draw on VectorVest’s teachings. The philosophy and guidance on stop losses can be found in Dr. Bart DiLiddo’s classic investment book, Stocks, Strategies & Common Sense. He devotes Chapter 10 to the subject which he titled, Stop-Prices: Are They For You? The opening paragraph sets the stage for an enjoyable and thought-provoking read.

“A Stop Price is like a pane of glass. Once it gets hit, it’s broken. The use of Stop-Prices is one of the most controversial and misunderstood methods of selling stocks. Stop-Prices are two-edged swords. They can cut losses and protect profits, or result in high turnover and lost opportunities. Are they for you?”

I encourage you to read the entire chapter; there are more than a few pearls of wisdom that you’ll want to read again and again. Below are a couple of concepts from the passage, just to whet your appetite.

“Investors should be aware that the period of highest risk is at the time of purchasing a stock. Taking commissions into account, you’re already starting with a loss. If the stock heads down in price, the loss increases. The name of the game, at this point, is to control further losses. Stops provide the discipline to do this.”

Always Know Your Exit Plan

Today, VectorVest instructors teach the concept by saying something like, ‘Just like boarding an airplane, taking a hotel room or heading to the mall on Black Friday, always know where the exits are before you place you place your trade.’ In other words, determine your stop-price before you click the order entry button.

“Many advisors suggest that Stop-Prices be set at 10% below purchase prices. I have found that the Stop-Price of a stock should be based upon its safety, fundamentals, and price trend. Safe stocks with solid fundamentals should have ‘looser’ Stop-Prices than those with weak fundamentals. These considerations allow investors to stay with stocks longer, and get out of weak stocks faster.”

The Sell Recommendation

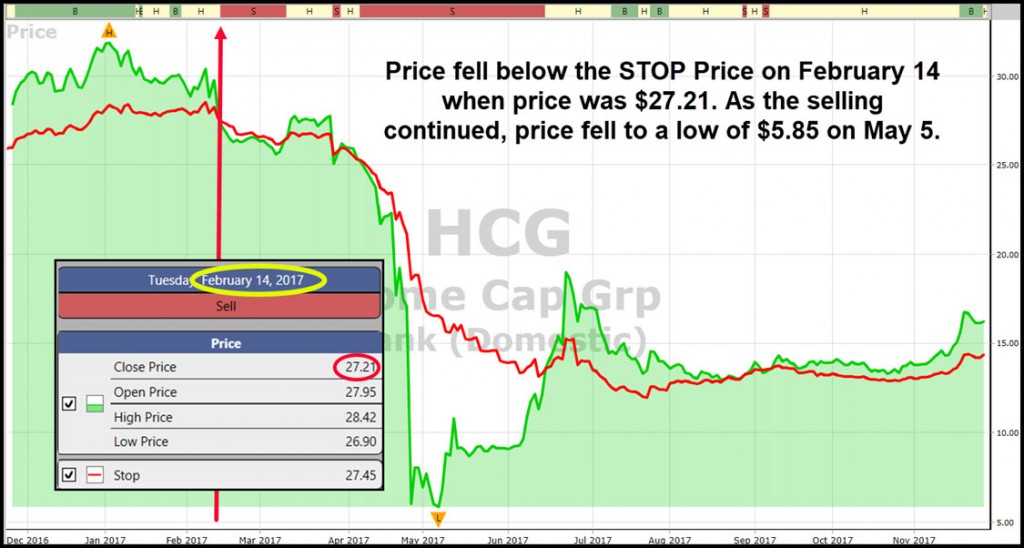

And there you have the explanation of why Dr. DiLiddo created the SELL recommendation in VectorVest, which occurs when a stock’s Price falls below its STOP. The ‘how’ is a 13-week Moving Average of Price, adjusted for the fundamentals of the stock.

As a side note, neither CHR or PBH hit VectorVest’s SELL REC during their wild rides. As Dr. DiLiddo noted in Chapter 10, “Safe, steady performers rarely hit their Stop-Prices, while risky, highly volatile stocks often break their Stops.

Dr. DiLiddo concludes this chapter by writing, “Whether you are a Prudent investor seeking an extra margin of safety, or a Speculative investor looking for trading points, Stop-Prices can help control losses and protect profits. Are they for you?”

Have the Right Strategy in Place

Successful traders have a strategy in place that works best for them. Anyone can learn to find low risk, high potential opportunities in an uncertain market if they have the right skill set. At VectorVest, you can leave emotional investing behind in 2018 and learn how exclusive, automated and rules-based investing plans can revolutionize the way you trade – no matter which way the market turns. Sign up for Two-Day Better Investing Livestream Seminar today!

INTERNATIONAL ONLINE USER GROUP FORUM

SATURDAY, DECEMBER 2 11:00 AM EASTERN / 08:00 AM PACIFIC

Join us to learn about Using Price Gaps in Trading, a Keynote Presentation by Dr. Barbara Star, author, educator and technical analysis expert.

Leave A Comment