In my May 21st essay before the long weekend, I wrote that this would be a great time to brush up on your investing knowledge by re-reading Dr. Bart DiLiddo’s classic little green investment book, Stocks, Strategies & Common Sense. Well, I took my own advice.

Below is a nugget of investing wisdom that I read again as if for the first time. This is a phenomenon many VectorVest subscribers have told me they experience when reading the little green book for a second, third or even a fourth time.

It’s right there in Chapter 1, The Five Greatest Stock Market Myths, subtitled Myth #2, You Must Assume High Risks To Make Good Money In The Stock Market.

Dr. DiLiddo writes, “…stock investing is one of the best ways the average person has of accumulating substantial wealth. It just requires a few simple techniques and some discipline. In fact, it can be a lot safer than investing in real estate, collectibles or your own business.”

He goes on to list six valuable tips for making good money in stocks with low risk:

- Buy stocks with consistent, predictable earnings growth.

- Buy stocks with earnings growth rates equal to or greater than the sum of current inflation and interest rates.

- Do not put more than 10% of your money into any single stock.

- Do not own more than two stocks in the same industry.

- Do not plunge into the market. Spread your investments over time.

- Use Stop-Sell orders to limit risk.

“Stocks with consistent, predictable earnings growth are the safest stocks you can buy,” he said. “They represent the best-managed companies in the world.”

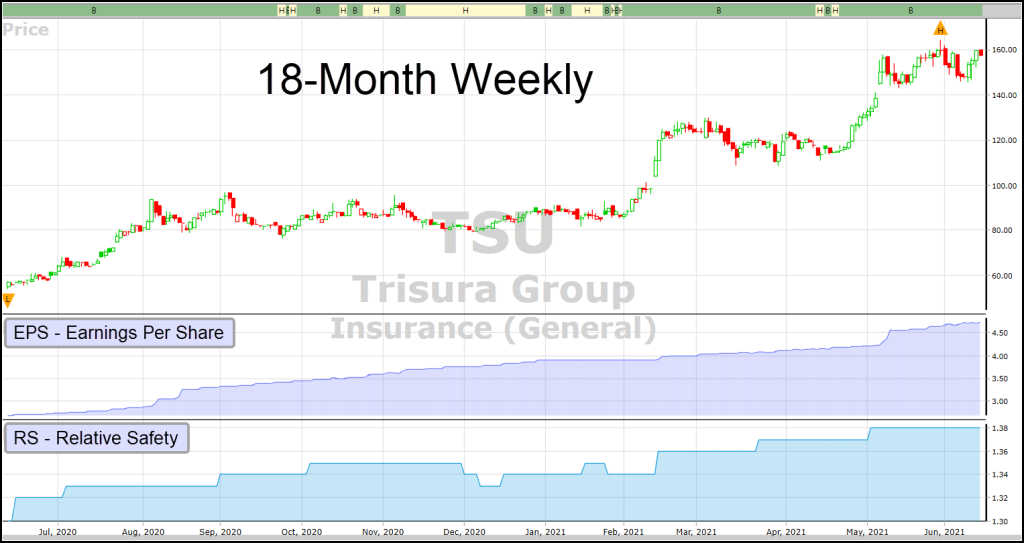

It is one reason conservative and prudent investors should favour high RS, Relative Safety stocks. Additionally, VectorVest allows subscribers to graph a one-year forecast of earnings per share for every stock. Stocks that have earnings rising from bottom left to top right have the highest probability of price appreciation over time.

Dr. DiLiddo concludes his shredding of Myth #2 by writing, “If you bought 10 stocks, and limited your loss on any single stock to 10% by using Stop-Sell orders, your total portfolio risk is only 10%. Your risk on any single stock is only 1% of your total portfolio. How many investments can you think of that have the upside potential of stocks with such limited risk exposure?”

Now you know the truth about STOCK MARKET MYTH #2.

Leave A Comment