Last Friday’s “Special Presentation” about Bottom Fishing was helpful to prepare traders and investors for the next market bottom. It may come sooner than later if the market continues its overall downtrend.

Generally, when VectorVest instructors teach strategies for Bottom Fishing, we focus on the searches in the Bottom Fishing folder. Many of these strategies are proven to deliver explosive results more often when the market is rallying from a deep bottom. However, it may be useful for the long-term investor to know that market bottoms are also one of the best and safest opportunities to rebuild their retirement portfolios. You can even apply bottom fishing techniques by purchasing good quality, high RV, RS stocks that have been beaten down in price evidenced by low RT.

Consider, for example, the recent market bottom on 12/24/18 that led to an explosive rally before losing momentum in early May. I will concede that that the top Bottom Fishing Searches returning 10 stocks all delivered an average gain of more than 25% from 12/27/18 to 5/1/19. Jailbreak/CA, “the mother of all Bottom Fishing searches” according to our Founder, Dr. Bart DiLiddo, gained a whopping 47.33%. However, most of these searches return lower priced stocks and few dividend payers. Most would not be suitable for your retirement account.

UniSearch and WatchLists

So, let’s look at how we could have used UniSearch and VectorVest’s WatchLists to find more robust stocks at bargain prices; stocks that we could potentially add to our retirement accounts and hold for the longer term.

First, the searches. One that’s a pre-built, VectorVest bottom fishing search is VST+YSG Bottom Fishers. It’s even in the Retirement folder. The sort is RT ASC. In the same test period as above, the strategy gained a very nice 14.50% average gain or 42.36% ARR with 9 winners and 1 loser. The average dividend yield, DY, was 2.07% and dividend safety, DS, 72. Top performers were well-known companies like Canadian Pacific, CP, TFI International, TFII, and Parkland Fuel, PKI.

In the Trends – Bottom Fishing folder, the searches Rising CI Stealth Stocks/CA and RT Reversal are excellent choices. In the timeframe above, Rising CI Stealth Stocks/CA, which uses a VST/CI sort, had 8 winners, 2 losers with an average gain of 9.16% or 26.77% ARR led by Badger Daylight, BAD 45.23% and Alimentn CchB, ATD.B 16.63%.

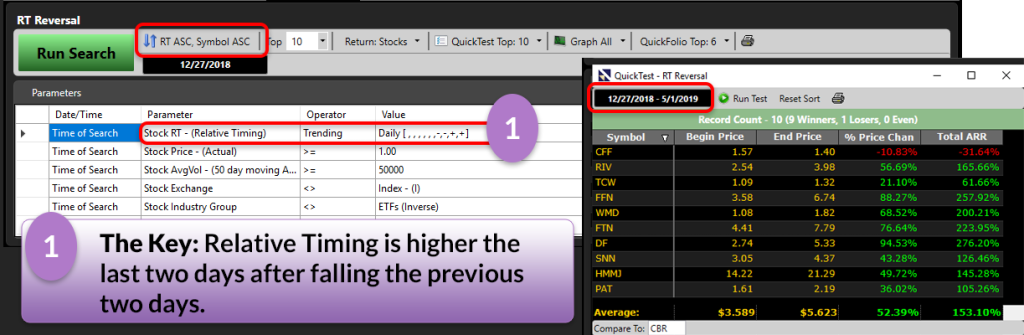

The RT Reversal search returned 10 winners with an average gain of 21.22% or 61.99% ARR. The biggest winner, TransAlta Renew, RNW, I’m certain would not have been at the top of any “buy” list for most investors, or on any list for that matter, but it was the top performer in this strategy, gaining 37.05% while offering a 9.29% dividend yield. Constellation Software and Boyd Group Income Fund weren’t far behind at 36.55% and 35.99% respectively. Just an idea, change the sort to RT ASC from VST DESC and the average gain jumps to 52.39% with nine winners led by DF, 94.53%; FFN, 88.27% and FTN, 76.64%. That’s the magic of RT.

As for WatchLists, a technique for finding the best candidates at market bottoms is to look for stocks that have low RT scores but acceptable to high RV scores. You can change the WatchList sort to RV/RT or RT ASC, common sorts to find beaten down stocks for Bottom Fishing. So, let’s go to the Special WatchLists folder on 12/27/18 and run our Quicktests again to 5/1/19.

Starting with DRIPS and using the RT ASC sort, you get 9 winners, 1 even for an average gain of 21.89% or 63.96% ARR. The Monthly Dividend Payers WatchList using RT ASC gained 26.04%. The Master Retirement WatchLists using the RV/RT sort delivered a 23.76% gain, all winners, quite a bit better than the RT ASC sort which “only” managed a 15.20% average gain with 9 winners, 1 loser. Interestingly, the WOW Dividends WatchList had a slightly better gain using the RT ASC sort than the RV/RT, 18.74% to 16.33%, but the win-rate wasn’t as good, 7 and 3 for RT ASC compared to 10 and 0 for RV/RT. Finally, the WOW Value and Growth WatchList delivered a 28.84% average gain using the RT ASC sort, led by marijuana plays OGI, 142%, and HMMJ 49.72%.

So, there you have it, you can absolutely find opportunities to rebuild Your retirement account when the market hits bottom.

Leave A Comment