It seems like a long time ago since May 13th when VectorVest signaled a Confirmed Down Call, C/Dn, it’s slowest, most conservative market timing signal. To trigger the signal, price of the VectorVest composite index, the VVC/CA, had moved lower for two consecutive 5-day periods, price of the VVC/CA had crossed below its 65-day Moving Average, and the Market Timing Index, MTI, had fallen below 1.0.

The C/Dn is a strong warning to play good defense by strictly adhering to your Stop-Loss rules and slowing down or even stop buying stocks. While the market didn’t exactly crater during the next four months, it went down and up in fits and starts, frustrating investors and making it difficult to make money and grow their portfolios.

Now finally we have a Confirmed Up Call, C/Up as of Tuesday, September 16th. So, what should investors be doing?

If you’ve been reading my weekly essays, you know that I believe a Confirmed Call means it’s time to get fully invested as early as possible, buying only on days when the market rising. There’s no guarantee, of course, but history shows that most often the easy money comes in the days and weeks immediately after the C/Up. Several of my essays the last few weeks provided ideas and guidance on how to weather the C/Dn storm and get ready for the next C/Up Call. Now it’s here.

On May 31st I wrote that investors should have their WatchLists ready or whatever methods they use that leads to a buying decision. On June 7th I wrote about why “it pays to be ready” and have their shopping list ready for when their personal ‘go time’ market timing signals comes. On June 14th I wrote an essay titled, “About the Confirmed Calls”, providing a table to show how Buy-rated stocks from a simple search had performed YTD to June 11th starting from the fastest timing signal to the slowest, the Confirmed Call. The January 15th C/Up Call did very well thank-you, up 24.67%.

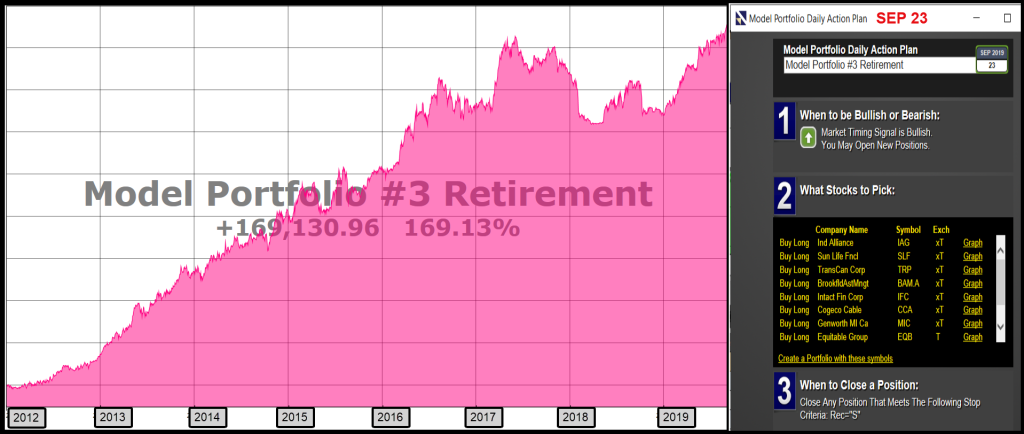

Lastly, last Friday, September 13th, I wrote, “When the Confirmed Up Call comes, as it surely will, we should be prepared to get fully invested as early as possible.” I explained how simply following the Model Portfolio of your choice can make you a more successful investor. Interestingly, Model Portfolio #3 uses the C/Up Call signal for buying, but it only had room for two new stocks the day after Tuesday’s C/Up because eight of the stocks it bought during the last C/Up are still in the portfolio and performing well. Model Portfolio #4 also uses the C/Up Call and it had no room to add stocks because all 10 stocks purchased after the 1/15/19 C/Up are still going strong in the portfolio. Is there a message here?

Does this mean you can’t turn to Portfolio #3 and #4 for new stock ideas? Far from it. You have two choices. You can analyze and graph the current holdings and cherry-pick the best stocks, or you can turn to the Action Plans where a new list of stocks will be displayed under the heading, “What Stocks to Pick”.

Another choice is to create a WatchList of all the current holdings from your favourite Model Portfolios and then cherry-pick from there. That’s what we did during Tuesday’s Q&A webinar. We wound up with 26 stocks which we sorted by RT*CI before analyzing them in stock viewer and graphs. We used 1-year and 6-month daily graphs as well as 5-year weekly graphs.

Finally, if you’re focused on retirement stocks, you can turn to our Master Retirement WatchList under the Special WatchLists folder for some great stock ideas. The WatchList is updated every Monday night with stocks from eight of our best Conservative, Retirement and Prudent searches.

Whatever method you choose, now that the Confirmed Call is here, IT’S TIME TO ACT.

Leave A Comment