As investors, we tend to spend most of our time looking for reasons to buy a stock and very little time thinking about why we SHOULDN’T take the trade, at least not now. But with so many choices, why settle for a stock that has one or more negative aspects that might cause it to drop instead of going up the way we expect it to?

To improve your win rate, do the opposite of what most investors do. Ask yourself these six questions to determine if there is any reason why you SHOULDN’T take the trade.

- Is this a good time to buy stocks? A stock may look good, but if the Color Guard is showing mostly yellow and red lights, and the Primary Wave is Down, why not wait until the market starts rising again before stepping in? Too often even a good stock will be pulled down by the overall market trend.

- Is there a good set-up? In other words, what is the precise event or trigger that tells you now is the time to make the trade? It could be good earnings or good news. It could be a price breakout or simply steady price and earnings growth on a 1-year graph. A pullback followed by bullish reversal candles or a new Buy-rating from VectorVest might be your trigger. If you don’t see a good trade set-up that has a high probability of success, don’t take the trade.

- Is there enough upside potential compared to the risk? A stock can go up, down or sideways after you buy it. If there isn’t enough upside potential compared to the downside risk, then don’t take the trade. VectorVest suggests looking for opportunities that have a 2:1 or even 3:1 reward to risk potential. That way, you don’t have to be right even half the time and you’ll still make money over time.

- Is the stock too volatile? Volatility creates uncertainty. The easiest trades are when price is moving steadily higher or breaking out after a quiet period of low volatility. If a stock’s price is bouncing up and down and moving all over the place before breaking out, there’s a greater chance the stock will fall back right after you pull the trigger. You don’t need that uncertainty.

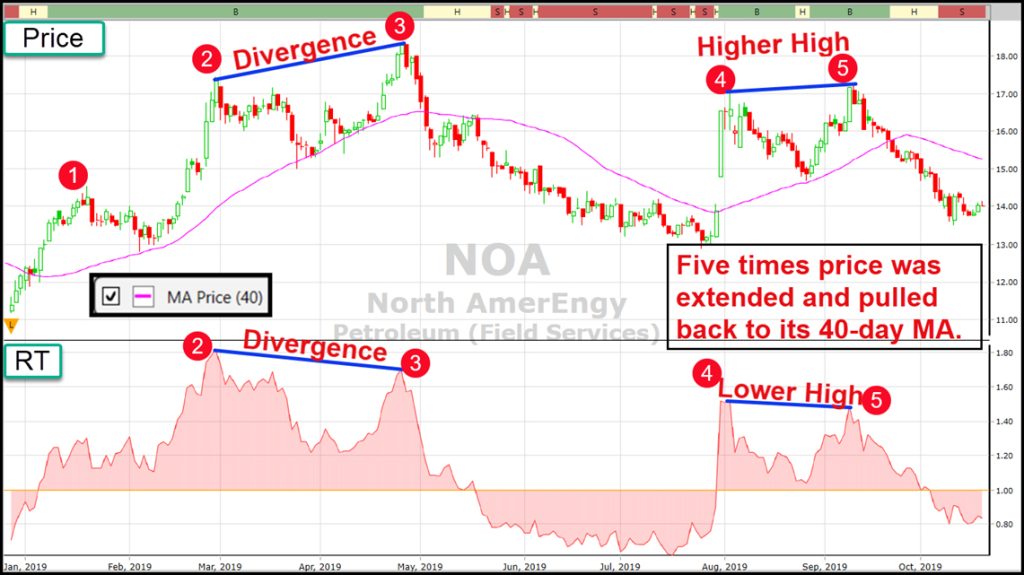

- Is the stock too extended from its 40-day moving average (MA)? The farther a stock pulls away from its mean moving average or a lower trendline, the riskier it becomes. Yes, you could miss out on another solid up day or two, but there is a greater risk the stock is going to come down to its mean average right after you make the purchase.

- Is the stock in a weak Sector or Industry Group? You might like everything about the stock, but if you find it’s the only Buy-rated stock in its sector or the industry group has an RT that is less than 1.0 and falling, this should give you second thoughts. Remember the adage, “a rising tide lifts all ships”? Well, the opposite is also true. Need proof? Consider a few of the more robust sectors this year such Investment Trusts, Utilities, Real Estate, REITs and Transportation. Their RT Rankings have among the leaders through most of 2019 and the average return of the stocks in each group shows double-digit gains. Leading stocks as of October 11th include Boyd Group Income Fund, BYD.U – up 61.5% YTD; Algonquin Power, AQN – up 33.5%; Brookfield Asset Management, BAM.A – up 34.9%; Dream Industrial REIT, DIR.U – up 41.9%; and Air Canada, AC – up 76.4%. If your stock is in a weak sector or industry group, you might do better to skip it in favour of a strong stock in a strong group.

To recap, instead of only looking for reasons to Buy a stock, you might find more winners and suffer fewer losers when you start asking yourself, WHY SHOULDN’T I TAKE THIS TRADE?

Leave A Comment