Four times a year, publicly traded companies report their earnings and sales figures for the prior quarter. We are just getting underway in Canada with some big names reporting 2nd Quarter results in recent days, including MTY Food Group (MTY), Shaw Communications (SJR.B), Suncor (SU), Loblaws (L) and the two railways, CP and CNR.

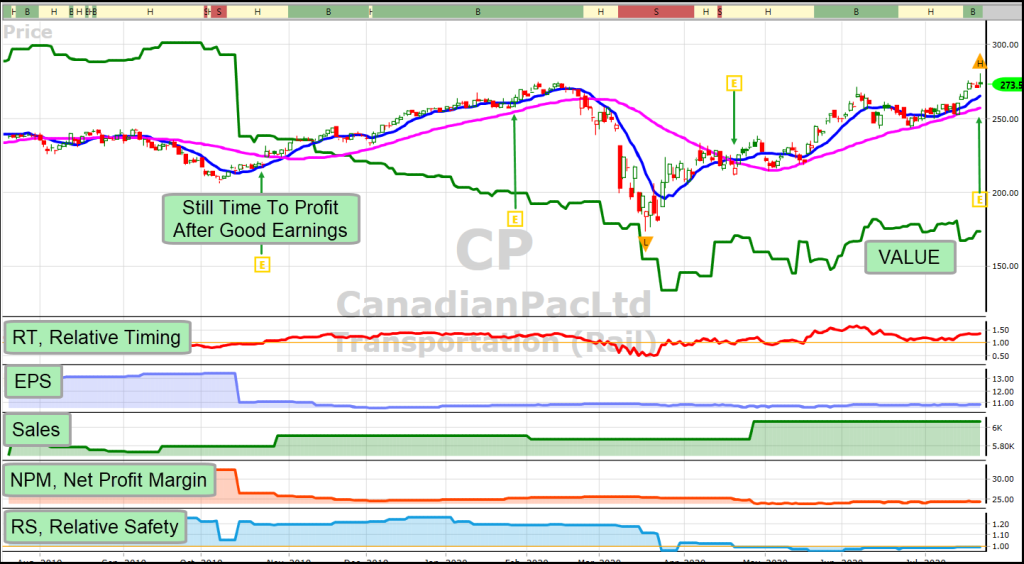

The latest numbers can pleasantly surprise analysts and investors, or bitterly disappoint. As a result, you will see a lot of breakouts after an earnings “surprise” and several breakdowns when companies “miss” their earnings. The difficulty is you never know for sure which way the chips will fall. So, in most cases, it is best not to buy just before earnings and, you may wish to consider selling a stock you own, especially if it is behaving badly. “Behaving badly” refers to a stock that has falling Price, EPS, Value, Sales, Relative Safety (RS), or NPM (Net Profit Margin). It is an extreme warning if more than one or two of the above metrics is trending lower.

LOOK FOR OPPORTUNITIES

Since we know that every earnings season brings opportunities, the question becomes, how best to find them and take advantage? The safest play is to wait for the company to announce the numbers, deliver their guidance, and then see how the market reacts. If the stock breaks out on heavy volume, there will be time to get in and go along for the ride. If it gaps down and continues to sell off on heavy volume, you will be glad you did not try to guess and jump in too early.

Whether you might be a buyer or a seller, VectorVest gives you a massive advantage in market analysis, stock analysis, and knowing in advance the earnings dates for stocks you own and stocks you might like to own.

KNOW YOUR EARNINGS DATES

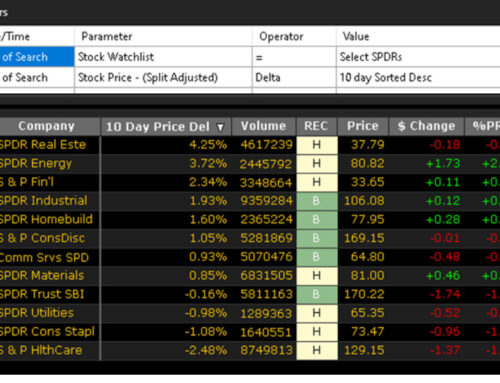

Before you buy a stock, you need to know if its Earnings Release Date is coming soon. You can avoid risk by waiting to purchase until after earnings, as mentioned above. If you wish to be more aggressive with money you can afford to lose, you can do some additional research and at least put probabilities on your side when buying a stock just before earnings. With VectorVest, you can get the earnings dates in three simple ways:

- Add the Earnings Dates to the stock viewer in your Portfolio Manager. This can be a Portfolio of stocks you own or a Portfolio that holds a WatchList of stocks you are studying for possible buying opportunities.

- Use UniSearch to find all upcoming earnings within a specified date range, less than 30 days out, for example.

- Go to the Events Viewer to see which stocks are reporting on certain days. You can filter on stocks that you are interested in. Change the calendar to add more days and then scroll down to see what is coming.

Watch this video, “Solving the Earnings Puzzle” for more tips and techniques for earnings season. Please provide any comments on this content or your suggestions on future content. Your feedback is always welcome!

Here are a few comments that people have have already been posted or sent to me by email:

Sincere appreciation for your video on Earnings, which, as usual, is first-rate. I spend a fair amount of time researching opportunities with an emphasis on capital appreciation, which has served me well…. The tools / ideas which you have provided in the video offers such time saving data to enhance and streamline my financial goals. I find your delivery to be authentic, well informed and demonstrates that you care for our success. – Marty E.

Stan what a fabulous video. After all these years I keep getting surprised about the power of Vectorvest. Thank you so much. – Elmer T.

I have been trading weekly options on stocks with current earnings and have been spending a lot of time on sorting my selections. Your presentation today is going to save me hours of my time. – Gordon C.

Leave A Comment