Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

First the Street. Business is still strong and still 50-60% paying cash. Still the big shock this year. I’ve been paying between 89 and 91 cents a litre for gas this year so fuel costs are a fraction of what I’m used to so profit margins are up.

Now for the Markets:

USA MTI 1.62 BSR 220 (Falling) MTI and RT have gone sideways the last 8 days

DOW JONES: False Breakout above 27,044.42 (3 Touches last 8 days) Watch 200 and 20 SMA for support RT Rolling over

NASDAQ: 2 touches @ 10,839.93 Fell below the 20 but rose to close just below the 20 SMA Possible channel between 10,161.58 and 10,839.93

S&P 500: Broke below support @ 3234.01 RT rolling over. See if it can hold the 20 SMA. Could be a bull flag

MKT TIMING: MTI, RT and BSR fairly flat lately. Possible false breakout above 48.61 or could be a Bull Flag. Watch to hold 20 SMA

READ Strategy

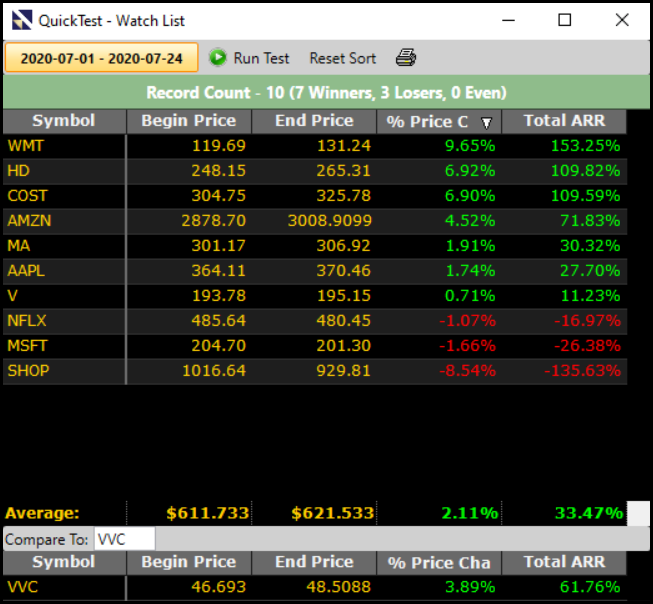

A Warning (Red Flag for me) In July AMZN up 4.52% SHOP (-8.54%) To me this is another form of Bearish Divergence

My PICKS for the YEAR. WMT, HD, AMZN and COST continue to do well in a challenging mkt. SHOP has dragged the basket down.

CANADA MTI 1.48 (Same as 10 days ago) BSR 1.61 RT slightly above 10 days ago

PTSE: Broke out but then pulled back to the 200 SMA See if it will act as support. RT falling steadily. Light Volume

VENTURE: Channel last 11 days. 2 touches at top. Tried to break down but came right back up into the channel Still strong volume

MKT TIMING: Price rolling over. Closed just below the 8 EMA. MTI, BSR and RT all falling RT in a wedge and MTI in a channel

READ VIEWS (One to Print out – Stan does it again), Strategy, and Climate. (Both USA and CDN Earnings Indicators continue to fall further into Bear Mkt Territory)

MODEL PORTFOLIOS 1,2 & 5 continue to look good

GOLD/ SILVER Month of JULY – PAAS still #1 but ELD and TGZ catching up. This past week Gold had a good week and silver fell. Still a very good basket to own or at least strongly consider ETF’s. Dr David Paul, VectorVest’s UK Managing Director, and many others feel that Gold and Silver are setting up for a strong Bull Run. (Dr Paul expecting a pullback before the next big leg up)

As always nothing more than my 2 cents and I hope it’s of value and interest.

Leave A Comment