Hats off to Mr. Todd Shaffer, VectorVest Manager of Research. Todd does an amazing amount of research to develop time-tested, proven trading systems for VectorVest’s Model Portfolios. He tries to show a variety of investment styles, timing systems, and Stop-Sell criteria. I know firsthand the amount of time and creativity that went into creating Canada’s five Model Portfolios for 2017.

I’ve started a review of the Model Portfolios to prepare for my January 6th presentation to the VectorVest International Online User Group Forum. I’ll review the performance of VectorVest’s Model Portfolios in Canada, the U.S. and our other VectorVest countries. We’ll introduce any line-up changes for 2018, and finally, we’ll show at least three ways subscribers can follow along and trade the Model Portfolios or just the stocks.

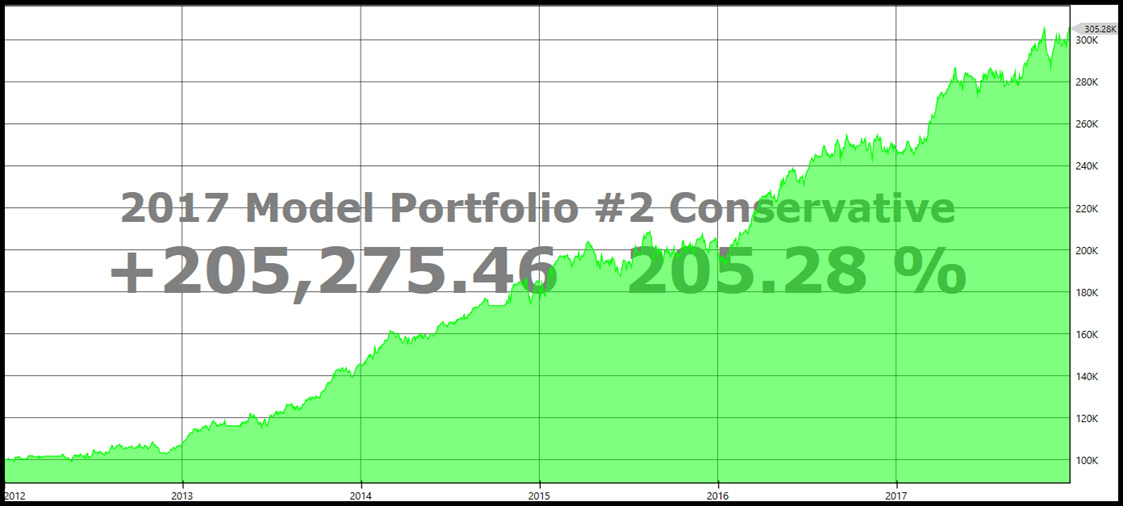

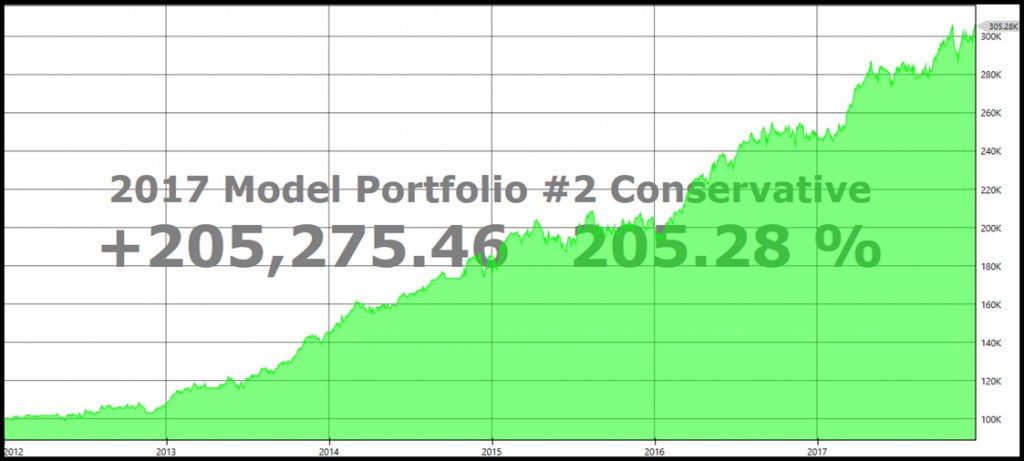

So, what have I found so far? Well, the top performing Canadian Model Portfolio in 2017 is #2 Conservative. It has taken the portfolio to a value of $303,283 on Tuesday, December 19th from a starting point of $248,905 on December 30, 2016. The trading system uses the Pale Blue Chips – RS search. It buys long using the Green Light Buyer Market Timing System, uses Sell criteria of either a 50% Gain or 20% Loss and goes to cash on a Confirmed Down Call. Four of its best performers in 2017 are Savaria (SIS), up 44.03%; Teck Resources, (TECK.B) 28.51%; Industrial Alliance (IAG) 18.05%; and Magna International, (MG), 18.03%; all current holdings.

Portfolio #3 Retirement is focused on dividend growth stocks from the High CI Rising Dividends Search. It buys only on Confirmed Up Calls and sells on VectorVest’s SELL recommendation. Its 2017 winners include current holdings Maple Leaf Foods (MFI), up 23.17% and Magna (MG) 17.96%. That conservative approach, buying high RS (Relative Safety) and high CI (Comfort Index) stocks that are growing their dividends faster than inflation, led to four triple digit winners in the portfolio’s trade history including Premium Brands (PBH), purchased on May 01, 2015 and finally sold this year on November 14th for a gain of 189.83%. As with all the model portfolios, dividends are not counted in the gains.

Portfolio #4 Conservative finds stocks from the Steady Eddies search. It too uses the Stop SELL Recommendation and buys only on Confirmed Calls. Our Founder Dr. Bart DiLiddo wrote in Chapter 10 of “Stocks, Strategies & Common Sense,” that you can expect low turnover when you buy high RS stocks. That’s certainly been the case here. Only 39 trades; that’s just one trade about every two months. Dollarama is the largest gainer among current holdings, up 92.71% since being added on March 02, 2016. It also has four triple digit winners in its trade history, including Alimentation CchB (ATD.B) which racked up an amazing 428.85% gain from January 05, 2012 to February 09, 2016.

Portfolio #5 Prudent uses the Safe and Sound search. It displays a couple of distinctive features: the RT Kicker Combo Market Timing System and VST < 1.20 for the Stop. Best performer among current holdings is Premium Brands (PBH) with a gain of 168.57%, purchased way back on December 29, 2015. BRP Inc (DOO) was added on May 30, 2017 and has a nice 49.83% gain. This portfolio also has four other triple digit winners in its trade history: Alimentation CchB (ATD.B) at 430.87%; Autocanada (ACQ), 367.97%; Gildan (GIL) 103.75%; and Dollarama (DOL) 102.28%.

Portfolio #1 Aggressive has been the laggard this year, although its six-year performance is still an impressive 183.81% G/L. It buys long using Ballistic New Highs – RS and sells short using IG Plungers/CA. It uses VectorVest’s second fastest signal, the Green Light Buyer. It returned to YTD profitability lately with current holdings DOO, DOL, MG and PBH all posting double-digit gains since being purchased on June 02, 2017.

Which portfolio will find the next big winner? If you have some time this weekend, I urge you to study the graphs of stocks in the Model Portfolio’s current holdings and Trade History (Click on Reports). Use a Weekly graph with just price, the 40-MA, RT and EPS. Throw on the 8-EMA for good measure if you wish. When were the stocks bought? What direction and slope were the moving averages? Was EPS rising? When did the SELL recommendations appear?

I hope I have piqued your interest. If so, check the Views tab and register today for the Saturday, January 6th International Online Forum. You can be sure we will study and analyze many more GREAT STOCKS THAT KEEP SHOWING UP IN OUR MODEL PORTFOLIOS.

INTERNATIONAL ONLINE USER GROUP FORUM

SATURDAY, JANUARY 6th 11:00 AM EASTERN / 08:00 PACIFIC

How To Trade VectorVest’s Model Portfolios, presented by Stan Heller, Consultant for VectorVest Canada

Stan- on yesterdays International webinar – reference was made to the US Prudent Performers portfolio you are running- is there a past presentation on this strategy you are using and the search?

thx

-kim mcmorries

Hi Kim, This is a portfolio that our Cobourg User Group Leader has been running with his group. It’s not an automated trading plan, but rather a cherry picking type of portfolio, so not really anything we can share unfortunately. Thanks for following up.