Before you start trading you need an edge in the markets. If you don’t have an edge, you will likely lose in the long run. What is an edge? Simply put, an edge is a system of discovering buying opportunities and selling in a way that delivers a positive expectancy. In other words, if you keep trading the same way over and over, you may not win every time, but you will come out ahead in profits over the long run.

VectorVest’s edge is trend following. It’s a methodology our Founder and Chairman, Dr. Bart DiLiddo, and his instructors have taught for more than 25 years. It began when Dr. DiLiddo found his edge some 30+ years ago after reading a book called, “Follow the Leaders,” written by Mr. Richard Blackman. Dr. DiLiddo has said, “This book changed the way I selected stocks and managed my portfolio. On January 14, 2000, I wrote an essay on my awakening and called it ‘Revelation.’ If there ever was an essay you should read, Revelation is it.”

Mr. Blackman believed in buying rising stocks in rising industries in rising markets. He advocated buying stocks that were breaking out to new highs. Dr. DiLiddo wrote, “I couldn’t believe what he was saying because it was totally opposite to what I was doing. But when I thought about it and when I tried it, I became a believer.”

THE PRIMARY WAVE.

VectorVest’s method of trend following begins with market direction. Dr. DiLiddo’s early studies showed the week-to-week movement of the Price of the broad market, represented by the VectorVest Composite, was significant. When Price is higher than it was one week ago, the Primary Wave is Up and vice versa. It is a fast, yet reliable indicator of a short-term trend that has the potential to develop into a long-term trend.

THE TWO-WEEK RULE.

VectorVest discovered a slower, but more reliable signal of market direction is obtained by analyzing the two-week movements of the Price of VectorVest Composite. When Price goes up week-over-week for two consecutive weeks, it gives a preliminary signal of a sustainable uptrend and vice versa. When the trend is confirmed with a Confirmed call, subscribers are encouraged to get in early and follow the trend until it ends. Good advice. In Canada, we’ve had just six C/Up calls and six C/Dn calls in the last five years. The longest uptrend lasted more than 12 months from September 11, 2013 to September 19, 2014, giving trend followers ample opportunity to make substantial gains.

RISING STOCKS.

The 3 main principles of trend following in stocks may surprise you.

- Buy high, sell higher.

- Trends in motion tend to stay in motion, so just follow Price.

- Don’t set firm profit targets, let your winners run.

The basic mindset or methodology behind a trend following system is that we’re going to enter a position that is already persistently rising, such as a VectorVest Buy-rated stock and we’re going to stay in that stock as long as Price continues to move higher instead of exiting prematurely. We will set a sensible stop that allows the stock room to follow the overall trend but doesn’t allow a substantial loss or give back too much profit if the trend breaks down.

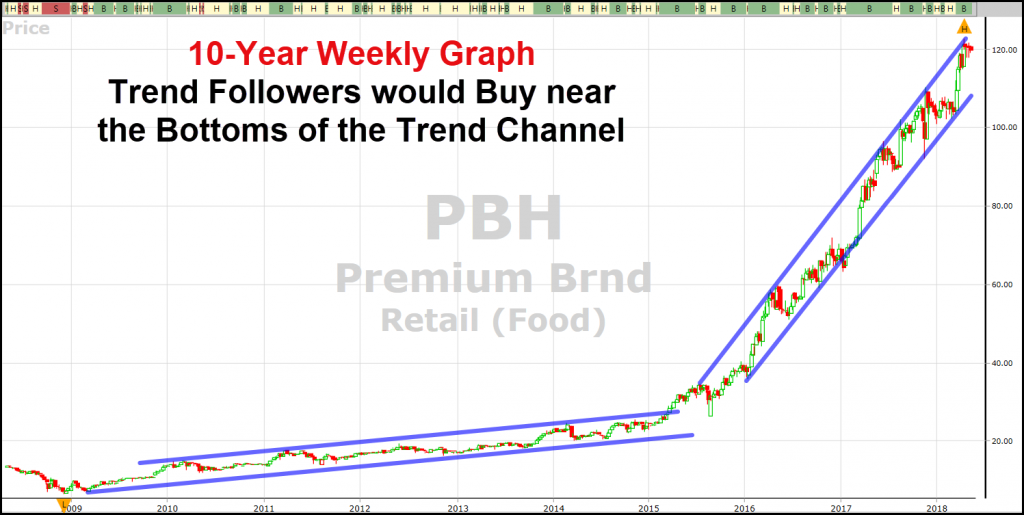

As an example, study a 10-year weekly graph of Premium Brands, PBH. From the time the stock first began to receive persistent VectorVest Buy signals in April 2009, the stock has continued in a steady uptrend, rising in price from around $9.00 to almost $120.00. Trend followers would have seen many entry points along the way, while others worried the stock is too high already, it can’t go much higher. There are just two Sell signals on the graph, both in 2010 and both lasting just one week.

Now look at the 10-year weekly graphs of Valeant Pharmaceuticals, VRX and Autocanada, ACQ. Trend followers would have made substantial profits buying shares on the way up and they would have given all or nearly all of it back if they didn’t adhere to sensible sell rules or short the stocks on the way down.

The message is clear, what is high can go higher and what is low can go lower. And this is what trend following is all about. We FOLLOW THE TREND!

FREE WEBINAR EVENT: You’re invited to join us this Saturday, May 12 at 11:00 AM Eastern for our monthly VectorVest International Online User Group Forum. We’ll take at look at how global markets are trading YTD around the VectorVest world.

We will also have two keynote presentations:

- Top Trading Systems of Past Forums, and

- Understanding the Wicked Wedge and Other Wedges.

Click here to attend live or get the recording for this free 90-minute event:

http://news.vectorvest.com/CA_VectorVestForum_051218_registrationR.html

Leave A Comment