A “pinball” market like the one we’ve been in since the May 13th Confirmed Down Call can be frustrating. Up a few days, then down a few days. A difficult time to make money. That said, whether we want to go bottom fishing or restock our long-term portfolios, we need to be ready to buy when green lights start to appear more consistently in the Color Guard. When the Confirmed Up Call does come, as it finally did on Tuesday, September 17, we should be prepared to get fully invested as early as possible, buying stocks on days when the market is rising.

One thing is certain, especially in markets like this, investors who are following a tested and successful rules-based plan will have better returns and less stress over the long-term. That’s why when a new subscriber asked me recently, “Is there one trading system you would suggest that would be a good starting point for the Canadian market?”, I was quick to point him in the direction of our Model Portfolios.

Created a few years ago as an educational service, our subscribers have discovered the Model Portfolios provide a powerful, rules-based stock selection and portfolio management tool. They are perfect for both the seasoned investor and people who are just getting started.

The Model Portfolios can make you a more successful investor in several ways:

REMOVE THE EMOTION

Each of our five model portfolios has an Action Plan that tells you exactly when to buy, the best stocks to buy, and – importantly – when you should sell.

PINPOINT THE RIGHT STOCKS

Once you choose which Model Portfolio is right for your personal style and goals, allow the Action Plan to find the stocks that meet your customized criteria.

DISCOVER HIDDEN GEMS

Our Model Portfolios scan the entire Canadian market looking for specific criteria to present you with opportunities that other investors are missing.

MINIMIZE RISK

Clear, specific rules guide you when to buy and when to sell, before a stock falls below an acceptable level, potentially leading to a devastating loss.

SAVE TIME

Investors today are drowning in data. Our Model Portfolios make it quick and easy to get your hands-on reliable information and drown out the noise. By following a proven system with a step-by-step Action Plan, you can manage your portfolio in just minutes a day.

MARKET-BEATING RETURNS

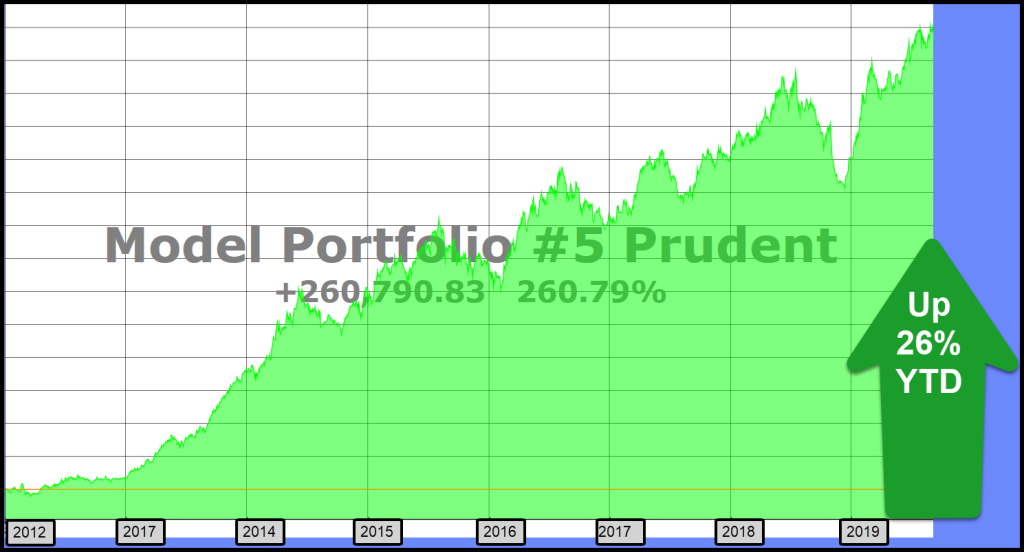

Our Model Portfolios can help you beat the market year-in and year out. Our flagship Prudent Portfolio has delivered an annualized rate of return, ARR, of more than 36% since inception January 2012. As of Friday, September 6th, it was up more than 26% YTD despite a difficult market. Our Retirement Portfolio, focused on stocks with steady dividend growth, is up 18% YTD, not including the dividends. Both these portfolios have averaged around just one trade per month.

Our two Conservative Model Portfolios are both up more than 25% ARR with our lowest drawdowns, less than 15%. And again, that’s not accounting for substantial dividend income. If you are more of a Swing Trader, our Aggressive Portfolio can help you find the right “momentum” stocks and the right time to buy. It has an ARR of more than 29% and, it’s doing it again this year with a 27% gain YTD.

You’ll find the Model Portfolios by clicking on the Portfolios tab. Click on Reports for the transaction log and trading summary. Click on the Details tab for the complete trading system and the Action Plan for daily guidance. I believe our Model Portfolios give investors what they want – BETTER RETURNS AND LESS STRESS.

Leave A Comment