As expected, the Bank of Canada on September 4th held the overnight interest rate at 1.75 percent. It was the first time in eight weeks that Governor Stephen Poloz delivered any policy announcement or comments about the economy — a long stretch considering the volatile and uncertain global economic conditions.

Business leaders, taxpayers, consumers and investors have had a few things on their minds. Concerns like the impact on Canada of the US-China trade wars, for example, and lack of any progress toward ratifying the United States-Mexico-Canada trade agreement.

The good news is Canada’s economy beat expectations in the second quarter with its strongest quarterly stretch of growth in two years according to Statistics Canada. However, Governor Poloz pointed to growing headwinds and said he would be open to lowering interest rates in October, lifting market sentiment for the day at least. If it continues, perhaps we can finally break out of this persistently narrow trading channel we’ve been in since the May 13th Confirmed Down Call. That said, if Canada is unable to sustain its surprising second quarter growth, the most likely scenario according to Poloz, investors will expect a rate decrease. Anything less would be would have a bearish impact on the market.

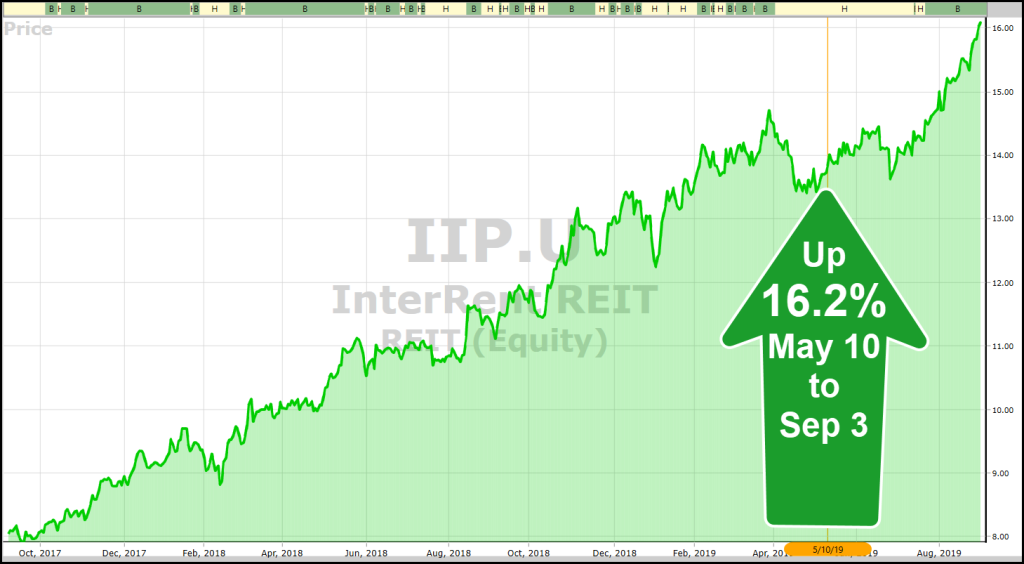

In the meantime, have you noticed? With interest rates continuing at historically low levels, investors are persistently seeking yield, even if it means adding measured amounts of risk in stocks, for example. Sectors comprised mainly dividend paying companies have been at or near the top of our RT Sector Ranking since the beginning of the January rally and some even before that. As of Tuesday, the REIT sector is ranked #1. It’s never left the top 10 since May 10th. Constituents include well-known names such as Canadian Apartments, CAR.U; Granite Real Estate, GRT.U and InterRent, IIP.U. A Quicktest of the top five stocks ranked by Dividend Safety (DS) on May 10th to Septembers 3rd shows an average gain of 9.78%. The average DY or Dividend Yield is 3.5% – and they all pay monthly. By comparison, the TSX gained just 0.62% during the same period.

The second ranked sector is ETFs. As a group they boast an average DY of 2.27%. Third is Utilities, boasting an average DY of 4.39%. Utilities have gone pretty much straight up since December 27th. Its RT Ranking has never fallen above 8. A few of the best performers are well-known names such as Fortis, FTS – up 25.4%; Emera, EMA – 36.0%; and Algonquin Power, AQN – 28.2%.

I urge you to regularly open the Sector Viewer and study the Sector leaders in Canada. It’s the best way to discover which sectors and stocks are performing best. Currently, in this low interest rate environment, DIVIDEND PAYERS ARE IN FAVOUR.

P.S. I hope you’ll join us for our next International Online User Group Forum Saturday, September 14th at 11:00 am Eastern Time. In addition to our regular update of VectorVest markets around the world, we’ll provide a comprehensive review and study the lessons of the August User Group Hot Stock Picking Contest. Prepare to look at a lot of graphs and takeaway a ton of trading ideas. Did you know, for example, the most widely selected stock in August was Enphase Energy, ENPH? It was picked by 10 Groups. Canada’s Kirkland Lake, KL was next with nine selections. Which one did better? Spoiler alert. ENPH delivered gained 4.73% while KL delivered a gain of 19.45%. Join us for lots of insights and trading lessons. CLICK HERE TO REGISTER.

Leave A Comment