By all accounts people who attended Saturday’s International Online User Group Forum or viewed the recording came away with more than a few valuable takeaways. I love the participation and insights we get, not only from our guest presenters, but also the attendees from around the VectorVest world.

George Clark, Pensacola, Florida User Group Leader, delivered an enlightening presentation on how to research and build a robust competition portfolio. It will be a great help to everyone as they prepare to enter the upcoming VectorVest All-Subscriber Competition. It looks like Pensacola will be the clear winner in our User Group Leader Portfolio Competition when it closes today. Congratulations George!

Since my focus is mainly long-term investing, I wanted to expand on one of the major themes from the Forum that quite a few people commented on. That is, their appreciation for the “back to the basics” approach highlighted by our review of the hidden wisdom in Dr. DiLiddo’s little green book of Stocks, “Strategies and Common Sense.” What follows is some of the best guidance for retirement accounts taken from the little green book, Dr. DiLiddo’s essays, the Guide to Worry Free Investing (Views Tab Special Reports), and my own experiences.

Here goes.

- It takes time to build your retirement nest egg. Try to ignore the short-term gyrations and allow the power of compounding to let your money work for you. VectorVest will alert you in good time of any special bearish situations like we saw in 2008.

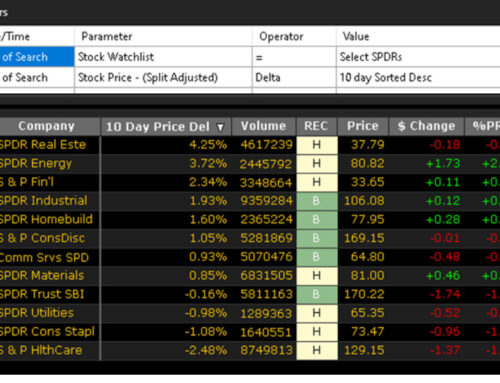

- Buy great businesses. The best way to minimize risk is to buy high Relative Safety (RS) stocks. Avoid the “hot stock tip” and cyclical industries such as mining and petroleum.

- Favour undervalued stocks. VectorVest provides two types of valuation. Value is an estimate of what the company is worth today, and Relative Value is what VectorVest expects the company to be worth one to three years out. Often the best companies are expensive for a reason, because they are great companies, and they are widely held by individuals and institutions. Don’t ignore valuation, but don’t let it scare you away from truly great companies that offer exceptional long-term capital appreciation potential. Shopify, SHOP and Amazon, AMZN, are two examples.

- Favour long-term dividend payers, but not at the exclusion of those safe, high growth companies mentioned above that do not yet pay a dividend. Dividend payers deliver a cheque straight to your bank account on a monthly or quarterly basis. Even if your stock does drop from time to time, the dividends keep coming and compounding which can still mean an overall gain on your investment.

- Diversify in what you buy and when you buy. Aim for a portfolio of 10 to 20 stocks. It’s a number that will smooth out the inevitable blips, and it will be easy to manage using VectorVest WatchLists and Portfolio Manager. Do not put more than 10% of your funds into any single stock and do not plunge into the market all at once. Instead, buy one to three stocks on days when the market is rising. Do not own more than two stocks in the same industry.

- Diversify globally. Set up a US dollar account and trade the US market. It’s worth any currency risk. Let’s face it, the US market provides more selection and world-class companies. Always check with your tax advisor, but generally you can avoid withholding tax by holding your US dividend payers in registered accounts, but not your TFSA or RESP.

- Use market timing. VectorVest has historical benchmarks to determine when the market is near a bottom or near a top. Buy more often when the market is near a bottom and rising. Stop buying and become more defensive when the market is near a top and falling or starting to flatten out.

- Favour buying stocks that have smooth, steady and rising price and EPS patterns. Start with a 2-year weekly graph or longer to smooth out price and determine the longer-term trend.

- Use Stop-Sell Prices. By following the above basic principles, you can set wide Stop-Prices that allow compounding over time while still protecting against a big loss that can mortally wound your portfolio.

- Don’t panic. When your stock gaps down because of one bad earnings report or other bad news, chances are the bad news is priced-in and most of the damage is done. Let the dust settle and assess things after the market closes when you can be less emotional. Don’t ignore your Stop-Sell rules, but take some time to determine if the selling was an overreaction and buyers are ready to step back in.

More often than not, we get our best results when we remember to get BACK TO THE BASICS.

Thanks for awesome article