Written by: Mike Simonato, Ontario

Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

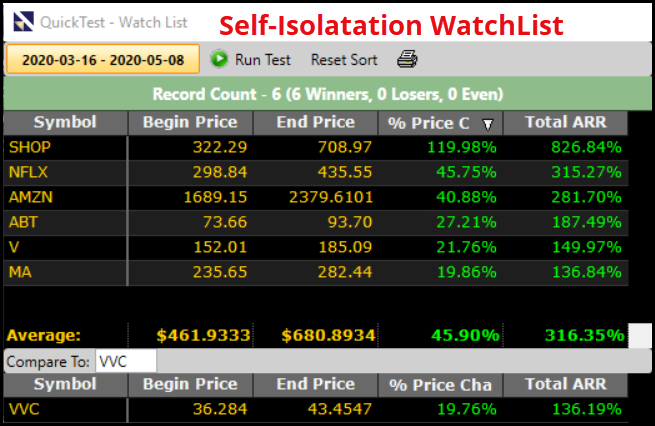

First let me say at the outset Vector Vest gives us what we need to make money in the market. Recently we had BSR of .01 and MTI’s in the 20’s How much more of a sign do we need that this is an outstanding buying opportunity. The Reality is however we’re all scared and in cash. When you look at the attachments it didn’t matter really where you put money odds are you’d be up. ie Look at the World ETF’s. YTD there is only 1 positive and that’s QQQ, however if you look from Mar 16 to May 8 both pages show 100% winners, same with Stan’s ETF’s, the self Isolation Portfolio, Retirement portfolio etc.

To be 100% safe however ALWAYS Trade the Chart. We all have our favourite setups so trade what works for you but in such oversold conditions it’s easier to make money than at the top.

Next Week we could get C/UP in USA and Canada and the guidance is to get in early.

In the world we find ourselves in however it is important to be aware of things that could affect the market. It’s also key to pay attention to Stan’s views on when to exit a trade.

The Street (Most based on facts but some is my 2 cents)

BUSINESS: The Financial post article I shared there will be a number of business bankruptcies. The number will be determined by how much longer there are restrictions/ closures as well as sectors. ie Restaurants will be worse off than the Trades.

PERSONAL: Personal debt is at an all time high in the USA ($14.3 Trillion) and of course Canadian consumers were deep in debt before this even started.

GOVERNMENTS: USA went from $2.6 Trillion in debt to $6.3 Trillion in debt and growing CANADA went from $22 Billion in debt to over $300 Billion in debt and growing

EFFECTS: TD Pre announced that it set aside $1.1 Billion for bad loans in this latest quarter alone. As the Financial Post article stated we won’t know the total damage until everything reopens. One thing we do know is that the lawyers will be very busy with bankruptcies and business restructuring. They will also be very busy dealing with Personal Bankruptcies. Another consequence of those who didn’t pay rents or other bills on time Credit Scores could take a big hit thus affecting many things for years to come.

REAL ESTATE: Already I’m seeing many forced to sell due to various circumstances. With the above (Bankruptcies) and other various circumstances if there is a glut of properties on the market suddenly it could force prices down.

INCENTIVES: As I showed in another articles businesses will want to get business back as quick as possible and sectors such as auto’s may offer amazing deals to get you through the door.

INEQUALITY: As the jobs numbers showed life isn’t always fair. The hourly wage numbers showed the higher paid people aren’t as affected by this current situation as the lower paid workers. Possible result: Where I work, Collingwood/ Blue Mountain the locals hate the Toronto People because of them the cost of living is so high that the locals can’t afford to live in their own town. Result may homes get egged, rocks thrown trough windows and Greed Kills spray painted on peoples properties. This will become worse because many companies will use this opportunity to not higher everyone back. Well run companies are using this to stream line their businesses. (Media reported there will be a record number of Wrongful Dismissal Lawsuits in the future).

Things I’m seeing. Many are very happy working from home. Both the companies and individuals are seeing the benefits. From money saved by working at home, no fighting Toronto Traffic, Can work (from Home) anywhere. (Most came up to Collingwood). For those who phoned in March the person I told you about has been informed that she will be working from home indefinitely and possibly permanently. The Downside to this is the Trades I told you about aren’t all going through which is a big deal so still bugs need to be worked through.

One Example of how this may shake out look at the Cruise Industry:

NORWEIGAN Cruise Lines Likely Bankrupt

ROYAL CARIBBEAN: Getting lean and more efficient “Furloughed” 26% of stay to get in good financial position to survive Plan on back up and running at some point in 2021

CELEBRITY CRUSIES Plan on being up and running very soon

Shows how the smart and efficiently run companies can likely come out ahead while being safe at the same time.

This week it showed an airplane packed with people shoulder to shoulder.

GOV’T STRATEGY: Many are in what they call Recessionary Conditions and others are close. Debt levels at all levels are at a point where it could take decades to recover.

The prospect of record numbers of bankruptcies both personal and business is a very real concern. So even though there are still reasonably large numbers of cases and deaths they have decided to risk the virus getting a lot worse and or a serious second wave and rush opening things back up.

They are trying to do it in a way to keep things safe and reduce the prospects of the virus getting worse but what I seen yesterday was people thinking because things are opening back up they don’t have to practice social distancing anymore.

If this strategy works we can dig ourselves out of this reasonably quickly however if it doesn’t work we could be facing a Depression the likes of which the world has never seen.

For me I’m trying to position myself to be able to weather whatever storm happens.

Stay safe everyone and as always nothing more than my 2 cents and I hope it’s of value and interest

Leave A Comment