By Don Fanstone, Member, Kitchener/Waterloo User Group

VectorVest advises buying undervalued High VST stocks in a rising market.

USA: Col. Grd Neutral: MTI .79 Up/Dn, C/Dn, Buy with Caution in a Rising Mkt.

CAN: Col. Grd Neutral: MTI .71 Up/Dn, C/Dn Buy with Caution in a Rising Mkt.

While both markets are sporting a Primary “Up” Wave, there needs to be further evidence of a sustained rally. Look for a DEW signal.

With earnings season under way, in the US you can buy insurance if you’re holding options through an earnings report, buy a weekly PUT to protect yourself on the downside.

Great West Life (GWO) ($37.04 close on Friday and a 3.5% Dividend), will report EPS on Wednesday August 5th. The stock has been trading in a channel, roughly between $36 and $37.50 since March 24th.

GWO is the Top rated Insurance Co. in the Insurance group. It sports ratings of RV 1.48, RS 1.46, RT 1.14, VST 1.35, and CI 1.37 with a VectorVest HOLD rating.

A Conservative Dividend Investor would Buy the stock and collect the dividend.

A Prudent Investor wanting to own the stock, would sell “At the Money” Puts now, collect the income, and if “Put To” buy the stock, sell covered calls, and collect the dividend.

An Aggressive investor would sell “At the Money” Puts now and use the income to buy at the “At the Money” Call Options now. If “Put to”, then likely sell the stock.

A Speculator would buy relatively inexpensive slightly “In the Money” Call options on Tuesday Aug. 4th, with a one month expiry hoping that a positive EPS report and/or a dividend increase would provide a quick gain.

An August 36 Call Option can be bought for $1.31. The stock would have to rise from $37.04 to $37.31 (Strike Price plus Option Premium) or $.27 to break even. One Call Option can be purchased for $131.00, 10 Calls for $1310.00 which will control 1000 shares.

As reported last week, Linamar (LNR) had fallen from a high of $88.73 to $76.66 and was a potential buy. Earnings will be reported approximately Aug. 7th. Linamar was oversold and popped up $6.00 a share on July 25th. Sometimes caution can cause one to miss an opportunity and sometimes to save you from disaster.

Sells for the Week of July 27th:

Thompson Reuters. (TRI) 10 Jan. 44 Calls at $8.50 40% Gain

Hudson’s Bay Co. (HBC) Sold 5 Oct 23 Calls, Broke Even

CGI (GIB.A) Sold 7 Aug. 46’s Loss on weak EPS report (Held too long)

Buys for the Week of July 27th:

Added 4 Starbucks (SBUX) Jan. 50’s

Potential Call Option Buys, Delta .80, Jakes Patent Winners:

Valeant (VRX) $335.32 January 280

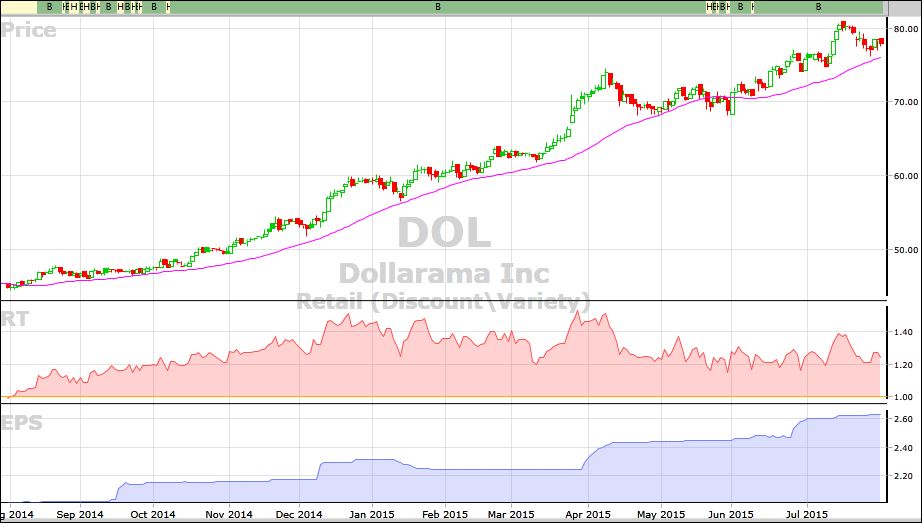

Dollarama (DOL) $77.85 January 70

Metro (MRU) $35.59 December 32

Loblaw (L) $71.32 January 64

Ritchie Bros (RBA) 35.38 January 30

Can. Tire (CTC.A) $130.39 December 120

Grt. West Life (GWO) $37.04 January 32

Linamar (LNR) $$79.81 January 70

Agrium (AGU) $133.80 January 115

Emera (EMA) $43.62 January 38

Celestica (CLS) $17.52 January 15

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

Exceptional post. Thank you for sharing your considerable knowledge and even going as far as showing how each type of investor would handle the same situation. Again thx for all you do.

A great post Don. It was certainly a surprise to see so many Potential Call Option Buys from the JPW search. It would be interesting to track them to see what the results would be if one had made the purchases. I have got to get back to my options training course before I can participate.

Thanks, Jake

U continue to Amaze! Great post and wrap up, sorry I missed the presentation.