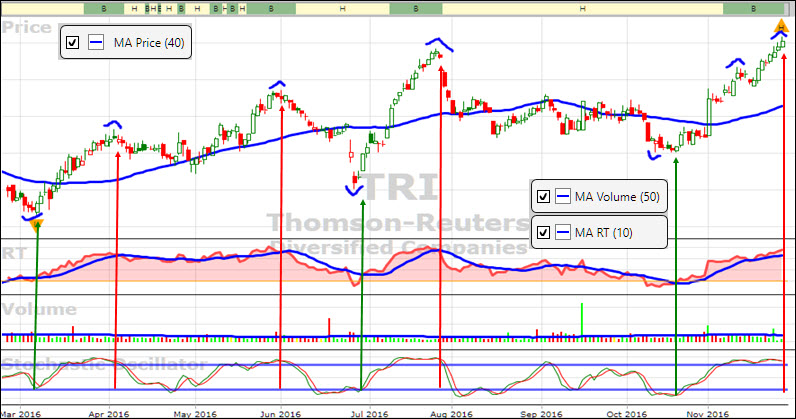

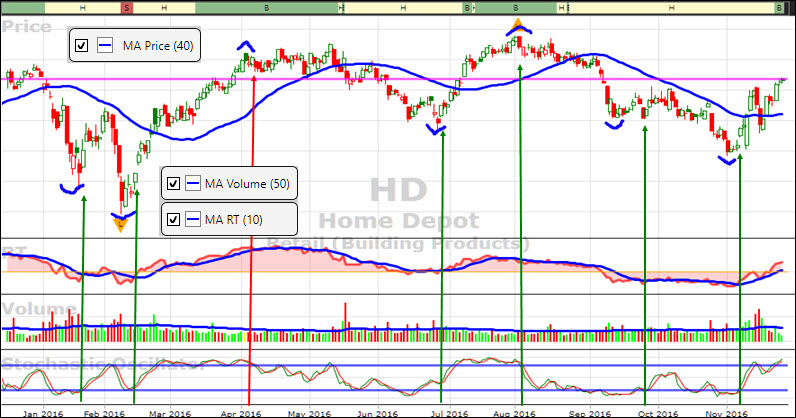

VectorVest teaches us that when price has pulled sharply away from its 40-day Simple Moving Average, it’s more likely to pull back closer to the 40-MA before resuming its upward trend. The theory behind this relatively consistent move is called, Reversion to the Mean. In other words, it’s more risky and you are likely to pay too much if you decide to jump in and buy after price is extended from its 40-MA. There’s no formula to determine this price action, but it’s visual. Knowledge comes with studying graphs and tracking personal experience.

This is especially true if price has gone up parabolic, something we have seen recently in the marijuana stocks like Canopy Growth (CGC) in Canada and the shippers such as Dryships (DRYS) in the U.S.

Similarly, it may be a short term buying opportunity when price becomes extended below its 40-MA (please see charts below).

With the beneficial perspective of hindsight, I have put together a short video showing how you can avoid control your emotions and avoid chasing a stock that might be closer to a pullback or even a crash than a continuing rally. CLICK HERE TO WATCH THE VIDEO.

Join us next week for two free webinars. On Tuesday, Nov. 29 at 12:30 Eastern / 9:30 Pacific we’ll host our regular weekly Special Presentation SOTW Q&A. Let’s find a few good trade candidates together using the Industry Rotation techniques explained in Friday Special Presentation Video. Click here to register for the Q&A.

Finally, I am very excited about Saturday’s monthly International Online Forum, Dec. 3 at 11:00 am. Eastern / 8:00 am Pacific. Our keynote presentation will be delivered by Mike Simonato on the topic, My Three Friends: Value, Price and Earnings. A successful VectorVest investor from Ontario, Mike previously delivered last December a valuable Forum presentation on how he uses WatchList average values and the WatchList graph to manage his long-term portfolio with less trading activity, less stress and less time. My Three Friends completes the picture. Click HERE to Register for the International Online Forum.

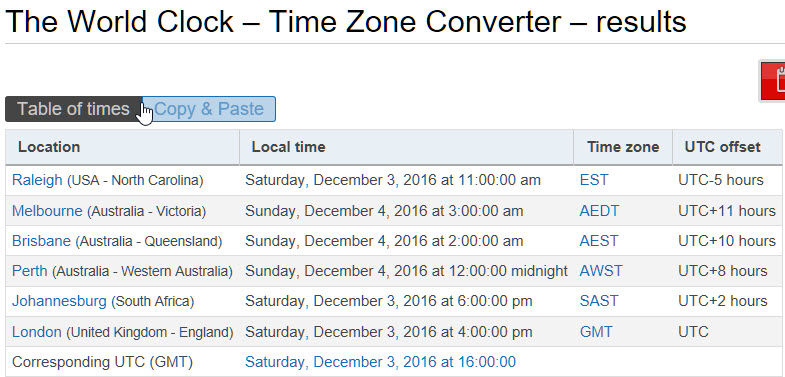

If you are tuning in from outside North America, please consult a Time Zone Converter website for the time in your locale. Listed at right are a few examples:

If you are tuning in from outside North America, please consult a Time Zone Converter website for the time in your locale. Listed at right are a few examples:

Finally, below are a couple of examples showing where price has pulled away and become extended from the 40-MA.

Posted by Stan Heller, Consultant, VectorVest Canada

DISCLAIMER: The information contained in this Blog is for education and information purposes only. Example trades must not be considered as recommendations. You should always do your own analysis and invest based on your own risk tolerance, investment style, goals and time horizon. There are risks involved in investing and only you know your financial situation, risk tolerance, financial goals and time horizon.

Reviewing your short video reminded me to take action on my KBE etfs that had become very extended. Because of my schedule, I am never available for your live events but watch all recordings. I thank you for all you do to make us better investors.

Thank you very much Gleason. Delighted to be of help.