Canadian investors love their bank stocks, and why not? They are outstanding businesses and essential cogs in the Canadian economy. But how do you decide which ones to buy and when to buy them?

If you have room in your portfolio for just one bank, and assuming you are looking for a longer-term hold, you must ask yourself, “Which is the best one for me to invest in today?” Let’s look at the big seven banks: BMO, Bank of Montreal; BNS, Bank of Nova Scotia; CM, Canadian Imperial; CWB, Canadian Western; NA, National Bank; RY, Royal Bank; and TD, Toronto Dominion.

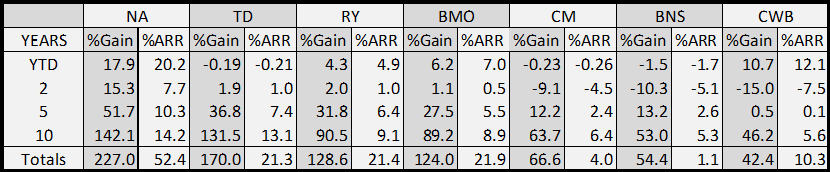

We will use VectorVest of course to study performance and important earnings and dividend metrics to help us decide. First, we will look at price performance over 10 years, 5 years, 2 years and YTD to December 20th. VectorVest’s Quicktest feature makes the comparison quick and easy. The gains do not include dividends.

Alright, that was fairly revealing already. National Bank was the clear winner in every timeframe. TD, considered by many analysts as Canada’s top bank, came in second, but not that close overall. Also revealing is all the banks except NA have underperformed the TSX Composite over the last two years to December 20th, the TSX showing a gain of 5.93% or 2.97% ARR.

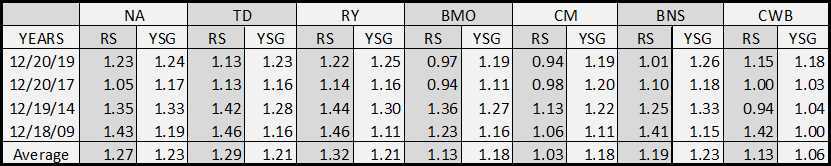

Next, Dividend Yield, DY, Dividend Safety, DS, and Dividend Growth, DG, are three big reasons why Canadians love their bank stocks, so let’s look at those metrics at our study dates. In VectorVest, we can compare each indicator on by itself, and also by a composite of DY, DS and DG called YSG, a master indicator which stands for Yield, Safety and Growth. For this study I also compared Relative Safety, RS a measure of Safety based on consistency and predictability of earnings. Stocks that have high RS scores typically have high DS and DG scores because they have the revenue, sales, net income and cash flows to sustain and grow their dividends.

First thing to note is the average results by the YSG are all Good on a scale of 0-2 except for CWB at 1.06 which is only Fair. The average RS scores are all very good or good although BMO, CM and BNS are showing some weakness currently.

VectorVest allows you to study, rank and compare other useful indicators such as Comfort Index, CI, Earnings Per Share, Earning Growth Rate, Sales and Sales Growth for example.

THE WINNER

For me, National Bank is the clear winner. I give heavy weighting to the consistency of price performance in the 10-year, 5-year and 2-year tests and also the fact that NA currently has the highest ranking when sorted by RS, RT, CI, VST, CI or DS. Current Dividend Yield is important, but not nearly as important as Dividend Safety and Dividend Growth. Although NA’s current DY is below other banks due to its strong price performance, its DG is well above inflation, year in and year out. The banks to avoid for now are quite evident by the numbers: CWB, BNS and CM.

I own NA having purchased shares in early September and adding more in November. It was an easy choice having gone through my analysis, RANKING THE TOP CANADIAN BANKS FOR 2020.

Leave A Comment