Tom Van Noyen of Belgium wowed attendees Saturday, November 2 at our International Online User Group Forum with his common sense approach to investing in high Relative Safety (RS) stocks. With that important measure of safety and risk management baked in, he is confident enough in his favourite US strategy to let his positions run with a wide Stop-Price, a 25% trailing stop. He only buys when the market is in an uptrend, evidenced by a Confirmed Up Call. During Confirmed Down Calls he just manages the stocks that he already owns, selling if they hit the Stop-Price. His approach delivers safety and performance, with price and dividends compounding substantially over time.

His favourite U.S. search is one that we all have access to: WFIC-BLR-Long found in the Searches – WFI Challenge folder. What’s uncommon and notable about the search is that it looks for stocks priced greater than $100 and the 50-day Average Volume is greater than 1,000,000. You read that right – one million shares. These are well established, high quality stocks being accumulated and held by large institutions. The US has enough of these companies, 164 currently, to make this strategy work. For an extra measure of safety, the sort is RS DESC, bringing stocks with the most consistent and predictable earnings to the top of the list.

We can’t duplicate the WFIC-BLR search precisely in Canada. We literally have just three stocks priced over $100 with that kind of volume – Royal Bank, RY, Canadian National Railway, CNR, and CIBC, CM. However, we do have three outstanding Model Portfolios that fit the bill for Tom’s priorities for safety and risk management. The portfolios continue to perform extremely well and specifically require a high RS number in their search criteria. Model Portfolio #2 Conservative uses the RS DESC Sort; Model Portfolio #4 Conservative stipulates RS>=1.25; and Model Portfolio #5 Prudent requires RS>1.0.

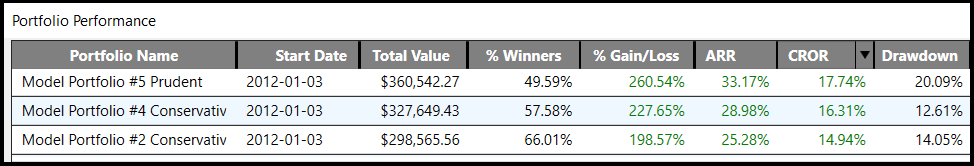

How about performance? From January 3, 2012 to November 8, 2019, Model Portfolio #5 Prudent has turned $100,000 into $360,542; Model Portfolio #4 Conservative turned $100,000 into $327,649, and Model Portfolio #2 Conservative has grown $100,000 into $298,56.

The table below has all the numbers:

Note: The returns do not include dividend payments which would be substantial over seven years. The Maximum Drawdowns at 20% or less are reasonable over such a long period that includes market corrections in 2015 and 2018.

These three model portfolios embody the principles of safety and risk management that Mr. Van Noyen was teaching last Saturday. You’ll find the Model Portfolios by clicking on the Portfolios tab. Click on the Portfolio of your choice. Click on Reports for the Transaction Log and trading Summary. Click on the Details tab for the complete trading system and the Action Plan for daily guidance. Why not follow along and trade our Model Portfolios? I believe they deliver what most investors are looking for – SAFETY AND PERFORMANCE.

PS: You can watch the November 2nd International Online User Group Forum replay of Mr. Van Noyen’s presentation on our VectorVest YouTube Channel, please click here.

See for yourself the true power of VectorVest

Leave A Comment