This Thursday trading session could end up being a landmark day for Viasat (VSAT), and not in a good way. The stock is currently on a trajectory for its worst performance in the company’s history – down more than 30%. How’d we get here, though?

The company released a statement regarding a malfunctioning communications satellite while deploying its reflector. While the initial Space-X Falcon Heavy rocket launch on April 30th was successful, CEO Mark Dankberg said that this will materially impact performance.

Further to that point, Dankberg went on to admit that the recent developments are a massive disappointment. He also emphasized that existing customers will not be affected by the incident as there are 12 other satellites in service right now.

That being said, this is still cause for concern. Viasat has yet to assign blame for the malfunction but has admitted they are working alongside the manufacturer to rectify the issue. We know it’s not Boeing, which has contributed to the rumor that the reflector came from Northrop Grumman.

Regardless of who is at fault for this mishap, the implications are grave. This was just the first of a trio of satellites designed to encompass the broadband business for Viasat. As a result of this, the company may have no choice but to reallocate one of the next satellites in line to replace this one.

On the financial side of things, Viasat could end up making a $420 million claim – an unprecedented event in the space insurance sector.

All of this said, one analyst at Wiliam Blair, Louie DiPalma, says the market has dramatically overreacted to this news. The sell-off we’ve witnessed this morning is driven purely by emotion, not logic.

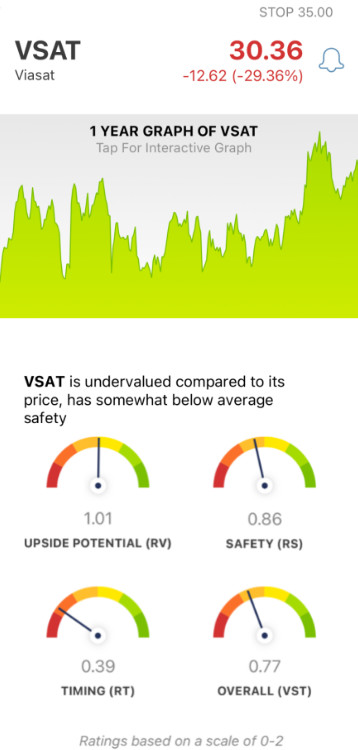

But the truth is, we’ve dug deeper into VSAT using the VectorVest stock analyzing software and found real cause for concern…

While VSAT Still Has Fair Upside Potential and Safety, the Stock’s Timing is Very Poor

The VectorVest system helps you simplify your trading strategy and empower you to win more trades with less work. It’s all possible through a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it.

The system is made up of 3 ratings - relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00, with 1.00 being the average.

And, based on the overall VST rating for a given stock, the system offers a clear buy, sell, or hold recommendation - at any given time. As far as VSAT is concerned, here’s what we found:

- Fair Upside Potential: The RV rating offers a comparison between a stock’s long-term price appreciation potential (based on a 3-year projection) and AAA corporate bond rates & risk. As for VSAT, the stock’s RV rating of 1.01 is fair - just above the average. But the real kicker is that the stock is currently undervalued after today’s fallout - with a value of $43/share.

- Fair Safety: In terms of risk, VSAT is considered a fairly safe stock with an RS rating of 0.86 - despite being way below the average. This rating is derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Poor Timing: The biggest issue for VSAT is the strong negative price trend that took over the stock this morning. Down nearly 36% at one point, the timing is very poor - and the RT rating of 0.39 reflects that. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.77 is poor for VSAT - but does that mean it’s time for you to cut losses on this stock? Or, is now a good time to buy at a great value? Don’t play the guessing game or let emotion cloud your judgment.

Get a clear buy, sell, or hold recommendation and execute your next move with complete confidence and clarity. A free stock analysis is just a few clicks away at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for VSAT, the stock does have fair upside potential and safety. But, while it’s fair to say that the stock tanking is the result of market sentiment and can be considered an overreaction, the fact of the matter is that this stock has very poor timing right now - regardless of what’s caused the fallout.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment