Plug Power Inc. (PLUG) has been steadily climbing over the last month – when it first caught our attention. And it appears that the stock just got another good gust of wind in its sails, as shares are climbing 3% higher so far in Wednesday’s trading session.

This time, it’s the news of a deal in Australia that has the market excited. Plug Power specializes in the design, development, and manufacturing of hydrogen and fuel cell systems. In other words, the company provides alternative energy sources. And Plug’s been selected to provide two 5-megawatt proton exchange membrane (PEM) electrolyzers for projects in Australia.

These machines use electricity to break down a standard water molecule into hydrogen and oxygen and will play a key role in bolstering the infrastructure of green hydrogen projects in Tasmania. These Tasmanian plants are responsible for decarbonizing road transport and natural gas sectors throughout the Australian state.

Plug’s CEO Andy Marsh said he’s pleased to partner with Countrywide Hydrogen, the organization in Tasmania, to support its ambitious green hydrogen projects. And, he’s got to be delighted by the way his company’s stock has trended so far this year.

Just last month, we told you to keep an eye on Plug Power as we wrote about its trajectory toward hitting 2030 targets. At the time, PLUG sat at right around $10/share. And since then, the stock is up nearly 25% – sitting at $11.52 today.

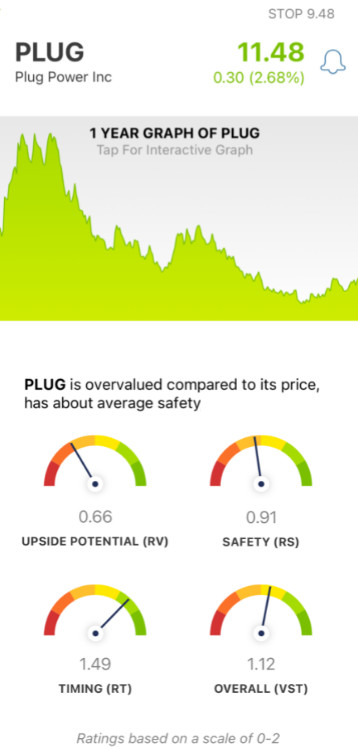

That being said, will this trend continue? Is the timing right to add PLUG to your portfolio? We’ve taken an updated look at this stock through the VectorVest stock analyzer to find out how things have changed since we last assessed PLUG. And, things have certainly shifted. You’re going to want to see these 3 things below…

PLUG Still Has Poor Upside Potential and Fair Safety, But the Timing is Excellent Now

The VectorVest system helps you simplify your approach to trading by boiling down all the insights you need into 3 ratings. This saves you time and stress while helping you win more trades.

The ratings are relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on an easy-to-understand scale of 0.00-2.00, with 1.00 being the average. And interpretation gets even easier. The system offers a clear buy, sell, or hold recommendation based on these ratings for any given stock, at any given time. As for PLUG, here’s the update you’re looking for:

- Poor Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (forecasted 3 years out) and AAA corporate bond rates & risk. And right now, PLUG has an RV rating of 0.66 – which is poor. This is a slight step backward from mid-June when the stock was rated at 0.70.

- Fair Safety: In terms of risk, PLUG appears to have gotten safer since we last talked about it. Previously, it had an RS rating of 0.89. But today, the RS rating sits at 0.91. This is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: Where things really get interesting is in terms of the stock’s price trend – which has gotten substantially stronger in the past month. PLUG had a very good RT rating of 1.27 in June – but today, the RT rating of 1.49 is excellent. The rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating has improved from around this time last month – to a solid 1.12, which is considered good. Previously, our stance on this stock was to hold off on buying or selling it. Has that changed with today’s news and the shifts we’ve seen in this stock over the past month, though?

A clear buy, sell, or hold recommendation based on today’s information and real-time data is a few clicks away at VectorVest. Get a free stock analysis today and find out what your next move with PLUG should be!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PLUG has made great strides over the past few months, and has landed a solid deal in Australia – which will only strengthen its price trend. While this stock still has poor upside potential, its safety has improved slightly – and its timing is excellent now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment