Mike Simonato, Ontario. Presenter: “Investing for the Long Term”, presented to the Feb. 6, 2021 International Online Forum, you can watch by CLICKING HERE.

The following is for informational purposes only and should not be considered Investment advice. This is What I’ll be doing/ considering but what works for me may not work for you.

My Trading Thesis is I want Safe No Worry Stocks that give me enough Capital Appreciation that I don’t have to worry about money in my retirement. Dividends will play a part in Retirement as well.

I look for stocks that will outperform no matter what happens. Here is what I have held and what I will be adding and why.

I have Owned Amazon, Apple and Shopify for a while now (Quite a while for Amazon and Apple)

For me, adds are Online Shopping. The Big 3 are Etsy, Shopify and EBay Note I have no interest in Ebay as it doesn’t fit my thesis. This Black Friday is not seeing the usual crowds in stores. More and more people are skipping the insanity and shopping online. Businesses are seeing a huge surge in their online networks and are realizing that’s the place to be. USA saw over 4 million quit their jobs per month this year with many in Canada and USA saying they are going to start their own business. Again, Etsy and Shopify are where you want to be. If this new South African variant leads to more lockdowns, these 2 names will continue to outperform.

Bob Turnbull ETFs. This strategy can be traded in Canada and, or USA. I’m not going to go into detail as Bob will be sharing an update next Saturday, December 4 at 11 am Eastern. Go to YOUTUBE Vector Vest International Forum:

International VectorVest User Group Forum – December 2021 | VectorVest – YouTube

This is a Must Watch!

Banks These can give some capital Appreciation while paying a nice dividend In Canada the only ones I consider are NA, RY and TD. In the USA look at FBNC

Ones to consider. These are ones I come across in day-to-day living that I either see or observe . I have attached a list but here is again my thesis. I see and hear things every day and I think of how can I trade this. WARNING: The following may disturb some and make me look like a heartless jerk but I assure you nothing could be further from the truth: Let’s start in a safe zone:

- There is an insane amount of home renos going on where I work The Trade: HD – Home Depot

- Peoples lifestyle are becoming less and less healthy, leading to a surge in Diabetes The Trade Dexcom DXCM

- People love their pets and will do anything for them and many aquired pets during Covid. With Climate change (especially the west coast) this has led to serious health issues in farm livestock and peoples pets (cats and dogs) have required Vet services The Trade IDXX

- As more and more people enter the realm of the self-employed, they need financial services The Trade INTU

- Now for the Creepy one. With Covid unfortunately many have lost their lives. In the USA well over 1 million have died and in Ontario we will hit the 10,000 mark by early next week at the latest. If this newest variant takes hold, it can become catastrophic. The trade: Funeral Homes In Canada, PLC . USA look at SCI There are 2 others to consider as well.

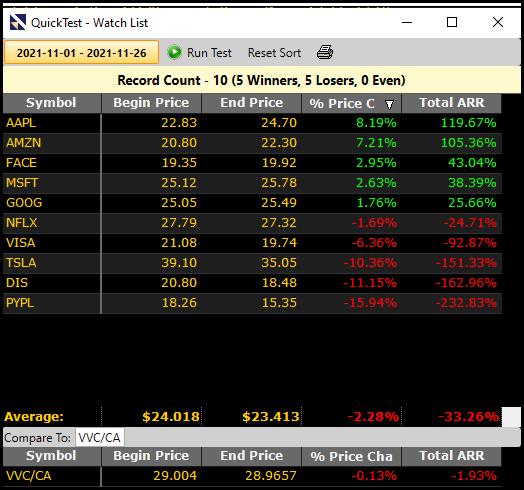

NOTE I have included the Canadian CDRs Note how Amazon and Apple have outperformed. Yesterday Stan had another outstanding Webinar with the reps from CIBC They will be adding 10 more CDRs in Dec and another 5 in Jan (Subject to change) Something to strongly consider.

Next week I’ll dive into online payment systems

As always nothing more than my 2 cents and I hope It’s of value and interest

Leave A Comment