Is it time to buy gold yet? A lot of people are asking the question. Here’s what we know.

In last night’s US Daily Color Guard Report (Monday, Nov 17), Steve Chappell astutely pointed out that the HUI Gold Bugs Index had reached a 6-year bottom. He cautioned the gold “bears” that it might be time to protect profits. He didn’t say it, but logically, it follows that it might also be time to consider cautiously stepping back into gold stocks. At least have your WatchList ready and keep an eye on it. Remember, the HUI rose 200% or 72% annualized from that bottom around November 10, 2008 to the top around August 29, 2011.

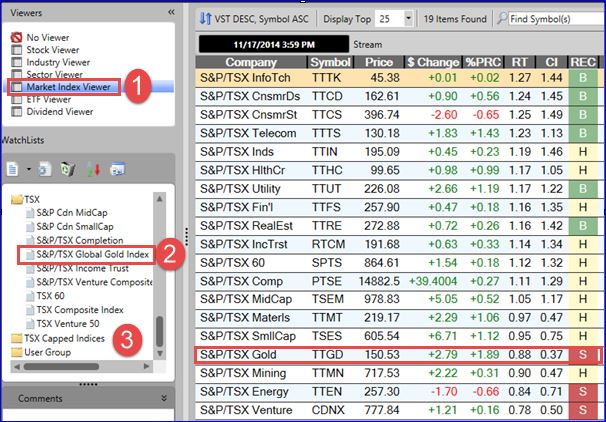

In Canada, TTGD, the S&P/TSX global gold index, is just starting to rise off of a six-year low. The index includes 31 Canadian stocks and 9 international stocks selected by the TMX Group as a benchmark for quality gold miners. You’ll find TTGD in the Market Index Viewer. ![]() Then you’ll find the 31 Toronto exchange stocks in the WatchList folder labelled, TSX – subfolder S&P/TSX Global Gold Index.

Then you’ll find the 31 Toronto exchange stocks in the WatchList folder labelled, TSX – subfolder S&P/TSX Global Gold Index. ![]() Note: The stocks for most other Indices are found in the WatchList folder labelled TSX Capped Indices.

Note: The stocks for most other Indices are found in the WatchList folder labelled TSX Capped Indices.![]()

As a VectorVest subscriber, we also have the advantage of being able to graph the gold/silver industry group. VectorVest takes the average price and average values of all of our indicators, and allows us to plot them on a regular graph. Talk about being able to spot and participate in a trend! What I like to see is the RT rising and the average price crossing above the 40-SMA. That’s exactly where we are as of today! From there, I cherry pick from the Gold Digger UniSearch (Special Searches Folder). Just look at the results from the last two “trend up” signals.

Will it always work out this way? There’s no guarantee. But look at a longer graph and identify previous opportunities. Run your own Quicktests starting with one week, then two, then three and so on as your end dates. Most often when the industry price trend is rising above the 40-SMA, you have at least a one or two week window to make significant gains.

YOUR COMMENTS PLEASE: Are you buying gold yet? What stocks are in your WatchList?

Stan Heller

Consultant, VectorVest Canada

Nov 18, 2014

Saw the same indicators today and picked up a couple choice names……hopefully not a dead cat bounce!

Fantastic! Thanks for sharing Shayne.

I picked up $AUY at $3.50 per share on November 5th. I chose this day for a number of reasons:

1) Huge selling pressure since recent high on Aug 12th at $9.04 That was a 258% drop in almost 3 months. The drops in the five days prior were enormous.

2) Huge funds out there had to have the gold stocks OUT of their funds for year end Oct 31st.

3) Huge selling of gold in the last week of Oct (JUST A TON OF VOLUME). The volume in the final five days prior to my purchase was a signal.

4) I switched my chart on $AUY to look it on a monthly view. When you see it this way, it was a double bottom!

5) It was oversold (viewable via bollinger bands as well as stochastics)

6) Due for some sort of bounce. Whenever a stock gets THAT far away from the 20 SMA, it always has to get back to it.

Anyways, YES it’s time for GOLD. When all of the sellers are gone, there is only one direction. UP.

Look at the weekly time frame on $AUY now. You see the last two candles (assuming this week closes up) have higher lows and higher highs. Good start to an up trend.

$GOLD is now over both it’s 20 and 50 SMA. It has the 100/200 SMA’s in it’s sights too…. I’ll take some profit soon….but not yet.

Good Trading Everyone!

David Hiebert

Great insights into your analysis approach and strategy David. Thanks for sharing.

While I am not usually a gold bug, I have learned over the past few months that when the mining sector is moving you really must get on the roller-coaster…..but when? Steve’s comments on the HUI and Stan’s suggestion to watch the Industry SMA(40) price are great times to start bottom-fishing. For my shorter term swing trades, I like to watch the 8 day EMA cross-overs to start building out an initial watchlist, then buy on confirmation of the trend

I have been wading into a few gold stocks using the Gold-digger search which often generates strong back-test results at the first sign of a turn-around. I like to run Gold-digger in the “Options Return” format and have added several names to my watchlist presenting “cheap” option buys based on low implied volatility compared to the historical volatility.

So far I have completed 5 trades using DITM calls on EDR, TRI, ANV, SSO and NGD with 100% success rate. The advantage of options trading is that you can wade in slowly to the mining sector with minimal capital at risk, while still exposing yourself to significant potential price moves using high Delta DITM calls.

Besides the Gold-digger search, I am entering trades with the following set-up:

1. Price closing trading above EMA(8) with a green-candle

2. ADX(14,14,5) setting showing a Di-/Di+ cross-over ideally, or at least strongly converging

3. Stochastics %K greater than %D, and crossing above 20% in the past 3 days

4. Exit trades on either a 50% price gain, or a bearish closing candle….some trades hit the max gain in 2 days!

As always, run your own back-tests and make sure you understand your trading plan before playing with real-money. For beginner option traders, the options analyzer is a great tool to “paper-trade” options while you go up the learning curve. Every month the Red Deer, Alberta Users Group focuses on options training and how to use the powerful VectorVest search and charting tools to lead you to better investing success.

Thanks to Stan, Cathy and Angel for running a great intermediate options course that certainly got me going in the right direction! Highly recommended!!

May the trend be with you….

This is tremendous information. Thank you Michael. The “thoughts” we’ve had already about this article shows the potential of our BLOG to help each other become better investors. Let’s keep it going!

It looks like once again the gold-bugs were only able to enjoy a brief wild ride! I enjoyed a nice short-term profitable ride but with the commodity weakness I bailed out of my option positions on the first red candles as planned which has worked out well as the gold sector index has been weak ever since. I am now right out of the gold sector until another day when the twinkle of the gold catches my eye again!

Gold, Crude and all other commodities will likely continue to struggle with the ever strengthening US dollar….be smart, be lucky and may the trend be with you!

I don’t understand gold as an investment and have never profited from buying it. I understand commodities but other than some minor industrial uses and the major consumer, India, buying gold in the late summer to fall of each year to make, I do not understand what would drive the price of gold up in late November. While the Americans were printing money as fast as they could (on Canadian paper) for the last 3 years, the result was that their currency went up and the price of gold did not profit from any movement of the market to seek safety in gold. I wish someone could explain why gold would move up at this time. Before I invest in something, I like to understand the logic behind the business.

Wonderful perspective to add to the discussion Dave. Thank you. VectorVest provides us with some exclusive tools to analyze and follow the trends, but there’s always risk from outside forces. That includes supply and demand, especially with a commodity such as gold. Thanks again.

I would think that the hoarding of Gold by Russia, China and India would put pressure on the price of Gold. Someone also mentioned that Malaysia is accumulating Gold. The question remains, is there enough gold production to fill the demand? I kind of believe the chance for gold to bounce is pretty good. No guarantee as always!

I have been watching gold ETF HEP – made quite a turn around last few days and it may to time to buy. Also pays a nice dividend. Any other comments out there on HEP? Thanx Bill

ADX and MACD are positive. 12% annual div yield and a monthly payer. In the past, has followed the industry trend quite closely.

I am not convinced. I think many people will be selling gold stocks in the next few weeks for capital loss purposes, thus gold shares may be poised to fall further.

I bought a couple of Leveraged Gold ETFs in the past 2 days based on their rising ADX, RT & OBV – You have Buy and Sell pretty quickly with these volatile instruments but especially in this wavering market – If you buy in the morning, you may need to sell before the close to lock in your nice gains and then start over the next day – if conditions permit – because they can rise and fall 10 to 20 % over the course of a day or two – They are great when they work out and not so much when they don’t

Disappointing we didn’t get follow-through today. Price fell back below the 40-DMA on the gold/silver industry graph. I agree those leveraged ETFs can move quickly, but so can the individual stocks. More for the aggressive trader or at least that small part of one’s portfolio. Hopefully we’re getting close to seeing a sustainable trend, but likely more volatility ahead. A few commentators today talked about the potential impact of the Swiss vote next week and Russia’s hoarding, but no consensus.

agreed and thanks Stan – we’ll see what tomorrow brings

Hi,

One of my key observations in the metals market has been that Silver must be rising by twice the percentage that Gold is rising in both the futures and spot price for at least 3 days to see any sustained follow through . I do buy some small positions in miners on these short term pops with tight stops and will only add if the Gold/Silver ratio is correct.

Petra

I would like to thank you for the efforts you have put in writing this blog. I am hoping the same high-grade web site post from you in the upcoming as well. Actually your creative writing skills has inspired me to get my own web site now. Actually the blogging is spreading its wings quickly. Your write up is a good example of it.

Thank you for your kind words Agustin. I’m delighted you’ve been inspired to start your own blog. Wishing you every success.

You share interesting things here. I think that your website can go viral easily, but you must give

it initial boost and i know how to do it, just search in google – mundillo traffic increase

Hi Jacques, thanks for your comments. I will check out the website, but right now I’m relying on our subscribers to spread the word through sharing by email, facebook, twitter and other social media.

I simply want to say I am just beginner to weblog and truly enjoyed you’re blog site. Very likely I’m planning to bookmark your site . You really have remarkable articles and reviews. Thanks a lot for sharing your blog.

Thank you very much. As you can tell, all the participants on this blog including me are dedicated to learning everything we can to become better and more successful with our investing. Hope to see you back here often.

Excellent weblog right here! Additionally your web site so much up fast! What host are you using? Can I am getting your affiliate link on your host? I wish my web site loaded up as fast as yours lol

Thanks for your comments. The site is developed in-house by VectorVest.

I’ve been surfing online more than three hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. In my view, if all site owners and bloggers made good content as you did, the net will be a lot more useful than ever before.

Hi my family member! I want to say that this article is awesome, great written and come with approximately all significant infos. I would like to see more posts like this .

I haven¡¦t checked in here for some time as I thought it was getting boring, but the last few posts are good quality so I guess I¡¦ll add you back to my everyday bloglist. You deserve it my friend 🙂

Thanks for your kind comments.

Thank you for your kind comments. Yes, we did have some website hosting issues the last couple of days. I have been assured that all is good now. Thanks again and come back to our blog often.

Wonderful to get such positive feedback. Thank you.

Thank you. Please visit out Blog as often as you like.