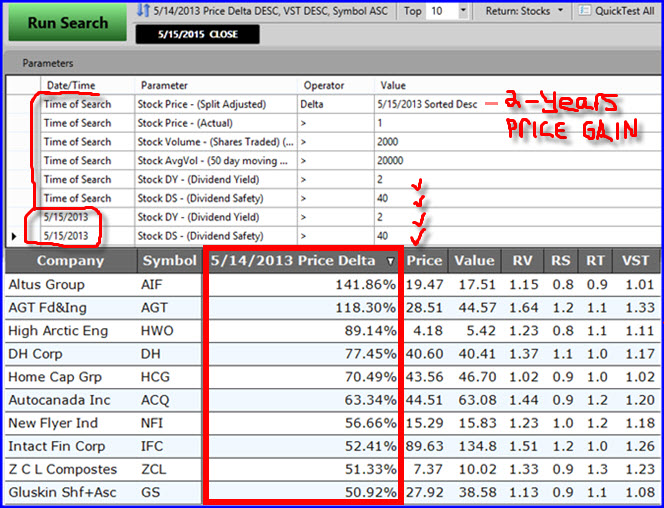

Using Delta To Find Top Dividend Stocks. We use the Delta operator in a VectorVest search anytime we want to see a percent change in any Value over a specific time period. In the example below run Friday, May 15, it’s interesting to see which dividend paying stocks have the highest percent price gains during the last two years, so we Sort the list by Delta Descending. As you can see from the search criteria, I only looked for stocks that paid a dividend yield greater than 2% two years ago and the current yield is still above 2%. I also looked for a minimum Dividend Safety of 40 on our scale of 0-99.

Altus Group (AIF) in the Real Estate Management industry group tops the list with a 141% gain, but a quick look at its graph shows it hasn’t done very well this past year. The stock has been volatile and trending lower overall. EPS has also been falling. AGT Food & Ingredients (AGT) is second on the list with a 118% price gain. Its chart looks better and EPS has been rising, but it’s been range-bound the last year between $24 and $30. A good one perhaps for your WatchList to consider when it finally breaks out in a more consistent and smooth uptrend.

New Flyer Industries (NFI) in the Auto & Truck Mfg Industry has arguably the best looking 2-year weekly graph, and it has managed a 56% 2-year gain. NFI shows EPS rising all the way to the right edge of the graph. Price has been fairly smooth from bottom left to top right. Worth noting that price is up the last two weeks on unusually high volume. The company has kept its dividend yield above 4% with timely dividend increases, and it pays a monthly dividend. Intact Financial (IFC) also has a great-looking 2-year graph although price has pulled back the last four weeks on lower volume.

MONDAY’s WEBCAST: Join me Monday, May 18 at 12:30 p.m. EDT for our regular weekly SOTW Q&A webcast. Yes, it’s Victoria Day and yes, the Canadian market will be closed. Oops! However, we’ll use the time to answer your questions about Friday’s Special Presentation about Option trades, as well as your general questions about the market and the VectorVest software. We’ll also look at some trade ideas for the coming week. Remember to register even if you can’t attend the live event. You will receive an email with a link to the recording to watch at your leisure over the course of next week. Here is the link to register: http://news.vectorvest.com/CA_SOTW_QA_051815_registration.html

Finally, I’ll also be presenting a special webinar on technical analysis Tuesday, May 19 at 4:30 EDT. For this presentation we’ll show how you can use MACD, Stochastics and Support & Resistance to improve your entry points whether you’re a short term trader or long term investor. This is a special partnership webinar between VectorVest and Questrade, so we’re always able to make some attractive special offers. Click here to register for this event: http://news.vectorvest.com/CA_3TechniquesQuestrade_051915_registration.html

Ist the Delta search only available in Pro-trader? If so it should be mentioned right off. Thanks Stan!

Hi Mike, ProTrader is not required to run Delta searches. It’s a pretty cool tool that we all have in our toolbox. If you need any assistance setting up your first Delta searches, please don’t hesitate to contact Support at 1-888-658-7638. A representative can walk you through the steps while you are at your computer. Thanks Mike.