Early news reports indicate that Greece has voted convincingly to reject austerity measures. Already the ‘fear mongering’ headlines are starting to appear. ‘Chaos’ is the word of the day. No one knows for sure how the markets will react, but taking cautionary steps is never a bad thing. (Remind me to give you a little quiz and story about this in our weekly SOTW webinar tomorrow. It delivers emphatically and undeniably the importance and preference of having a defensive mindset.)

Early news reports indicate that Greece has voted convincingly to reject austerity measures. Already the ‘fear mongering’ headlines are starting to appear. ‘Chaos’ is the word of the day. No one knows for sure how the markets will react, but taking cautionary steps is never a bad thing. (Remind me to give you a little quiz and story about this in our weekly SOTW webinar tomorrow. It delivers emphatically and undeniably the importance and preference of having a defensive mindset.)

What to do now? Watch closely the futures tonight and especially tomorrow morning. Your broker site, BNN; www.bloomberg.com and www.finviz.com are all good choices. A defensive mindset is the direction VectorVest guidance has been taking us the last several weeks. Consider these excerpts below from Dr. DiLiddo’s guidance in the U.S. Strategy section of the Views.

June 19 (one day after the C/Up Call in the US market) – “While this implies that the support level is stronger than the resistance level, I believe that the case for caution is stronger than the case for aggression.”

June 26 – “It’s hard to make real money in this kind of market, so be patient. A tradable trend will develop sooner or later.”

July 2 – (U.S. gets a C/Dn Call) “Although I don’t believe that Greece’s problems will affect the U.S. very much, they are causing considerable uncertainty and volatility in the financial markets. It’s time to be defensive and protect profits.”

In Canada, the words, ‘remain on the sidelines’ has been almost daily guidance to Prudent Investors in the Strategy section under the Views tab, even before our Confirmed Down (C/Dn) Call on May 12.

Finally, be sure to read Dr. DiLiddo’s essay from Thursday, July 2 in the Overview section of the Views titled, GREECE’s EURO DRAMA. He is suggesting that stock prices have ‘overreacted to Greece’s Euro Drama’. He says what’s more important is what’s been going on in China, what the Fed is likely to do with interest rates and the upcoming earnings season.

So, bottom line, it’s still a good idea to use caution. Things are likely to be especially volatile early this week as the market sorts things out. But no need to overreact. Consider using any defensive measures that you’re comfortable with: Buy puts, buy contra ETFs, or simply sell some shares to reduce risk and raise cash for the next potentially sustainable rally. VectorVest will let us know when the time comes.

Remember, judging from MTI levels both here and U.S., we’re nearing what has historically been a market bottom. However, we still have a way to go to the 0.60 historical bottom, so the prudent thing to do if you haven’t already started, is to raise cash by taking some profits and as always, selling your losers as soon as they hit your stops. You may consider tightening your stops if you haven’t already done so. And of course, don’t buy stocks until we get the signal from VectorVest that it’s okay to buy stocks. I have to say, it was tremendously gratifying to hear from so many of you during last Monday’s webcast that you’ve already been acting on VectorVest’s defensive guidance and you’re ready for what comes next.

Whew! So, with that out of the way, and speaking of preparing ourselves for the next rally, wasn’t that a terrific Special Presentation Friday night by Jim Penna, our Manager of Retirement Services? If you missed it, please go to the Views tab in your VectorVest Canada product, scroll down to the Strategy section, and click on the link for the Special Presentation. Then join me tomorrow, Monday, July 6 at 12:30 ET. where we’ll analyze in Realtime the market’s reaction to the Greek crisis and answer your questions about Friday’s Special Presentation.

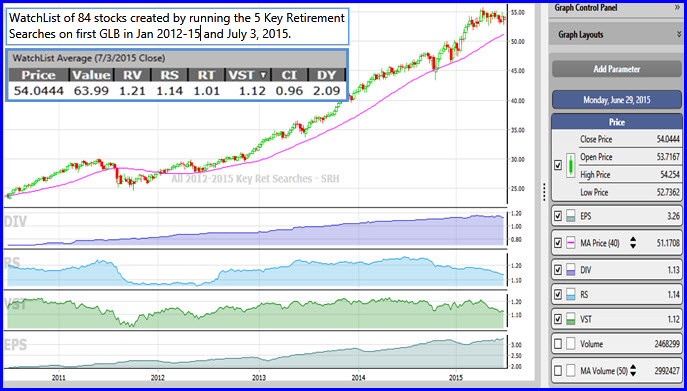

Webinar for you re: Special Presentation: 5 TOP Retirement Strategies. I loved this strategy! For anyone preparing for retirement or already retired, this is a ‘must-see’ video. Watch Jim’s presentation and the video below, then join me Monday, July 6 at 12:30 ET for our regular SOTW Q&A webinar. I’m sure you’ll love the graphs of the Canadian stocks we can find using a Jim’s concept of Top 5 Retirement Searches. (Just look at the equity curve of 84 stocks I found employing Jim’s strategy in Canada from January 2012 to July 2015. We’ll answer your questions about Jim’s presentation and show you how his methodology can be applied effectively for our Canadian market. Click here to register for our webinar: https://attendee.gotowebinar.com/rt/4093035754967328770

Finally, please take the time to watch the following short video to learn the 7 keys to managing risk. It’s presented by Angel Clark, VectorVest’s Creative Marketing Director, and it could not be more timely. It’s short, interestingly presented and packed with wisdom.

Click here to watch: WATCH VIDEO

Not currently using VectorVest? At the end of the Managing Risk video, there is a special offer to subscribe to our Realtime service for 30 days for just $29.95 USD. Take it. It’s worth the trial subscription price just to be able to watch the 5 TOP Retirement Strategies presentation. But while you’re at it, be sure to check out VectorVest’s 5 Successful Investing videos on the Welcome tab. And compare VectorVest’s top-rated retirement stocks with the stocks you own. Your satisfaction is guaranteed or ask for a full refund.

Not currently using VectorVest? At the end of the Managing Risk video, there is a special offer to subscribe to our Realtime service for 30 days for just $29.95 USD. Take it. It’s worth the trial subscription price just to be able to watch the 5 TOP Retirement Strategies presentation. But while you’re at it, be sure to check out VectorVest’s 5 Successful Investing videos on the Welcome tab. And compare VectorVest’s top-rated retirement stocks with the stocks you own. Your satisfaction is guaranteed or ask for a full refund.

Submitted by Stan Heller, Consultant, VectorVest Canada

Email: [email protected]

DISCLAIMER: The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. There are risks involved in investing and only you know your financial situation, risk tolerance, financial goals and time horizon.

Leave A Comment