At its core, VectorVest is a trend-following system.

We see it in our Market Timing signals. The Primary Wave, our fastest timer, requires a five-day price trend to trigger a new alert, and the Confirmed Call, our slowest, requires a two-week trend.

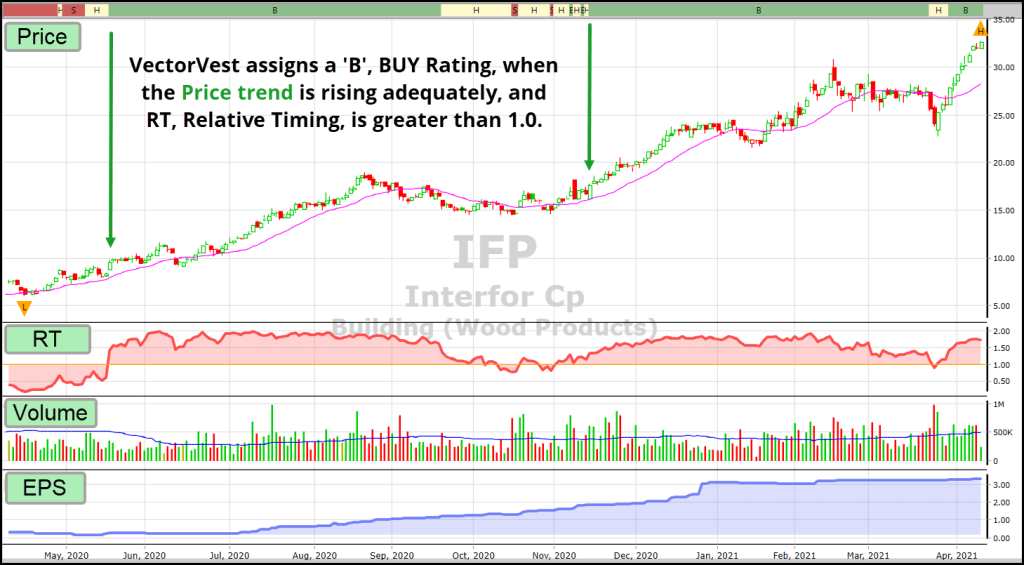

We see it also in our stock analysis. A stock cannot earn a BUY rating unless price is in a rising trend. Relative Timing, RT, a smart indicator that analyzes price trend, magnitude, and dynamics, must be greater than 1.00 on a 0.00-2.00 scale.

Here is an important principle often missed by even the most experienced traders and investors. It has to do with market behaviour and probability. There is a 70% probability, according to at least one authority, of a trend continuing until it eventually loses momentum. That said, the longer the trend is in motion, the more likely it is to lose steam as fewer new buyers jump in and current shareowners take profits.

A sideways trend is not dynamic. It can continue for days, weeks and even months before breaking out one way or the other. A sloping uptrend, on the other hand, is dynamic. It shows activity with investors and institutions interested in buying the stock, pushing the price trend upward. Trading volume increases.

As swing traders, these are the stocks we should want to own. The earlier in a new trend, the better, or buy on the dips. Here is another crucial point, discovered or at least articulated the best by Daryl Guppy, an Australian financial writer and author. “Traders are always first to lead the change in trend. The Investor takes more time to recognize the change in trend, but eventually follows the lead set by the traders.”

This observation led Guppy to create an indicator he called the “Guppy Multiple Moving Average” or “GMMA.” When traders and investors agree, and you marry the GMMA with VectorVest’s Market Timing and a Moving Average of our superb Relative Timing indicator, you can create a rules-based Tactical Trading Strategy Using The GMMA. This is one of my favourite strategies. The trading rules are simple, visual and effective. I am excited to have the opportunity to share it with you next Friday, April 16th, at 1:00 pm.

We will literally be TIPPING THE PROBABILITY OF TREND IN OUR DIRECTION.

The Financial Freedom Summit

My presentation is part of VectorVest’s Financial Freedom Summit taking place April 16th and 17th. It’s FREE, and you will have the opportunity to hear from top-rated speakers from around the world as they share with you their own favourite strategies for building wealth. The entire event will be Live Streamed, so you can watch it all from the comfort of your own home.

Register now to reserve your spot. Did I mention it was FREE? You will receive updates on the Summit and be entered for a chance to win great prizes. To view the complete agenda and to register, please click here.

Leave A Comment