You’ve no doubt heard the saying, “We have met the enemy and he is us.” It’s our own emotions that are the enemy of every investor.

The emotions of fear and greed are all too familiar to most of us. Most dangerous is greed and the fear of missing out. For example, an investor I know bought Kinder Morgan (KML) at the open Tuesday morning on news that the Canadian government had stepped in to buy KML’s Trans Mountain pipeline. In return, Kinder Morgan will go ahead with its original plan to twin the pipeline this summer. The investor paid top dollar as KML roared out of the gate, opening with a gain of more than 7.00%. Unfortunately, it fell steadily throughout the day and closed with a loss of -2.95% as investors weighed the pros and cons of the decision. Greed without a plan. Perhaps our greatest enemy.

On the other side, fear often causes us to sell too soon, even before our Stop-Price is met if we even have one. Tuesday for example, the brother-in-law called pleased-as-punch to say he sold Premium Brands (PBH), a stock he bought at my suggestion at about $70 when it had a new BUY rating from VectorVest. It had already moved up from $25 in the previous 36 months. PBH opened Tuesday at $116.03 per share but fell below $115.00 per share for a short time. That’s precisely when the brother-in-law sold. It might turn out to be a good move, but I doubt it. There was no plan, only fear. I’m still holding PBH until it hits my Stop which is VectorVest’s SELL recommendation. If I had sold every time PBH had dropped a percent or two or even a little more, I would have sold many times on its way up the chart.

3 Ways to Reduce the Emotional Costs of Investing

Bottom line, if you want to sleep well while investing in stocks, you must have a plan for controlling your emotions and managing risk. VectorVest offers a few simple guidelines.

WRITE IT OUT. You need to have a set of trading rules, written out and preferably set up in Portfolio Manager. Your rules will guide you on When to Buy, What to Buy and When to Sell. Writing them out will cause you to think through the process and follow the rules. Ideally your plan should be based on strategies that you have tested and believe in. The BackTester allows you to run a series of tests over a period of defined market conditions. Portfolio Manager allows you to paper trade going forward to build even more confidence. It will then guide you with alerts before you place your real money trades.

KNOW YOUR TOLERANCE FOR RISK. How much are you willing to lose on any one stock trade? VectorVest recommends not risking any more than 1% to 2% of your total portfolio on a single trade. For example, if you have a $100,000 portfolio, you should set your Stop-Price to ensure you lose no more than $1,000 if 1% is your rule.

BUY HIGH RELATIVE SAFETY STOCKS. The ultimate way to minimize risk is to buy high RS, BUY rated stocks. These stocks are already going up in price and have well established track records of consistent, predictable growth. They do well in good times and they weather the storms in bad better than most. Most pay a dividend to boot. You can combine safety with the power of compounding by buying high RS stocks with Growth Rates greater than the sum of current inflation and interest rates. We call it, “Worry-Free Investing,” WFI. You can read all about it in our guide located in the Views tab under “Special Reports.”

How well does it work? Tom C., one of our regular weekly Q&A attendees, chatted in on Tuesday, May 22nd: “I am keeping it simple with WFI and URS (Ultimate Retirement Seminar) and my entire portfolio is up over 10% since May 4th. I am stunned.”

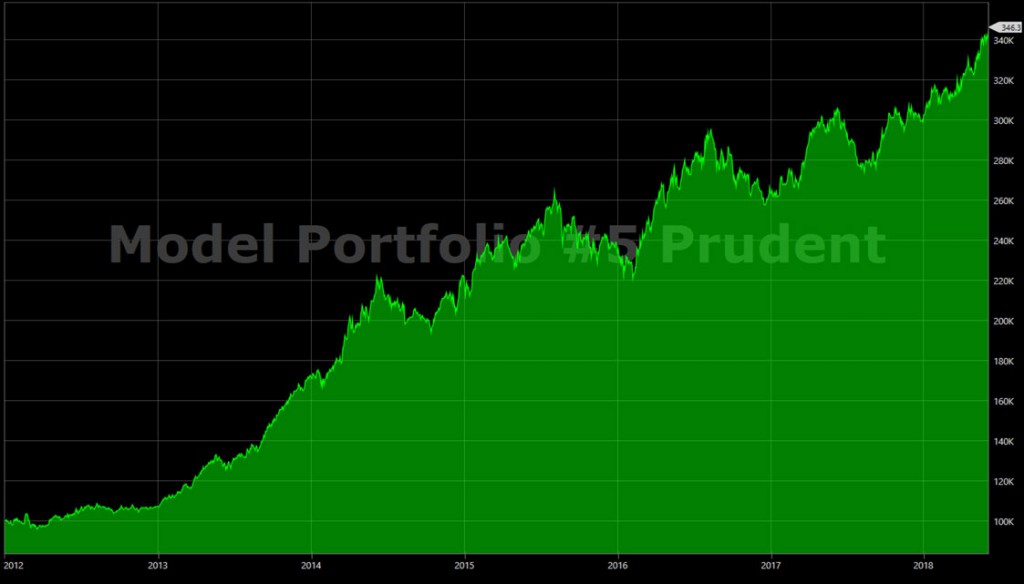

As a further example, VectorVest’s Model Portfolio #5 shown below is a Prudent trading system that focuses on stocks that have above average safety, RS and favourable upside potential, RV. The portfolio has delivered an annualized Rate of Return, ARR of more than 38% over 6.5 years. The return in 2018 is 15.7% YTD as of June 4, 2018. The Daily Action Plan for the portfolio makes it easy for VectorVest subscribers to trade along with the trading system.

At the end of the day, trading stocks is as risky as you choose to make it. A portfolio of high RS stocks and a written plan for When to Buy and When to Sell will help you Invest Safely and Sleep Well.

Leave A Comment