So much for the Santa Claus rally. Yes, we did have a couple of huge up days near the end of the month, most notably a 385-point gain December 27th, and still our Canadian market is on track for its worst December since 2008. By far. At the close Friday, December 28th, the TSX Composite was down 6.42% in December compared to a negative 3.05% in 2008. The Grinch has been even nastier South of the border where the US market is having its worst December since 1931, the depths of the Great Depression.

No matter which way the stock market goes in 2019, investors can expect it to be another stomach-turning ride. Our Founder, Dr. Bart DiLiddo, put his finger on “persistent pessimism” as the major reason for the decline.

So, what should traders and investors be doing? More than ever we need to be prepared to ride the waves. That is, take advantage of the bounces that will surely come, and be quick to play good defense when the trend turns bearish. Considering the rough markets we’ve endured, the next few paragraphs are intended as reminders on how to survive and thrive in down markets.

CAPITAL PRESERVATION IS YOUR FIRST PRIORITY

That means playing good defense by having protective Stops for every position you own and tightening Stops when market conditions are not improving. In last week’s essay I wrote that playing good defense means “actually selling when your stops are hit”. I thought it was a superfluous and possibly irritating comment to some, but it turns out it resonated with quite a few investors. I received comments such as, “You are bang on.” and “Selling when I know I should is my biggest problem”.

PROTECT AND MAKE MONEY WITH OPTIONS

Sell covered calls, buy protective puts and combine them to create a collar. You can make good money buying puts long when the market is falling. For example, a member of the OptionsPro Ultimate Retirement Solution Facebook Group posted on Friday, December 21st, “Ron Wheeler, (Senior Options Pro Instructor) – Your day trading session more than paid for the VV annual cost today. $6,820 in half a day! Thank you!” Learning options the right way from Ron and the VectorVest team may be the best decision you make in 2019.

HEDGE WITH INVERSE ETFs

An inverse or “contra” ETF provides the same benefits as shorting, yet it trades like a stock, doesn’t require margin, and exposes an investor only to the difference between the purchase price and the price when you sell. They can be traded in tax-protected accounts such as RRSP’s.

Before you invest in inverse ETFs, here are three rules to take note of:

- Know what you are buying. Understand the index or underlying equities represented by the ETF.

- Know the direction of your trade. Don’t buy the Bull ETF when you mean to buy the Bear.

- Determine if you want non-leveraged ETFs or leveraged. The greater the leverage, the greater the potential hedge, but, also the more volatility and risk you are exposed to.

If ever you are uncertain, run the Full Stock Analysis Report and check the Business Description.

VectorVest 7 conveniently identifies inverse ETFs in the Viewers tab/WatchLists. They are categorized in Canada by Non-Leveraged ETFs – Inverse, and Leveraged ETFs – Inverse. We do not have 3x leveraged ETFs, only 2x. In the US database you will see the WatchLists categorized by Non-Leveraged ETFs – Contra, and 2x Leveraged ETFs – Contra, and 3x Leveraged ETFs – Contra.

HOW TO TRADE THEM

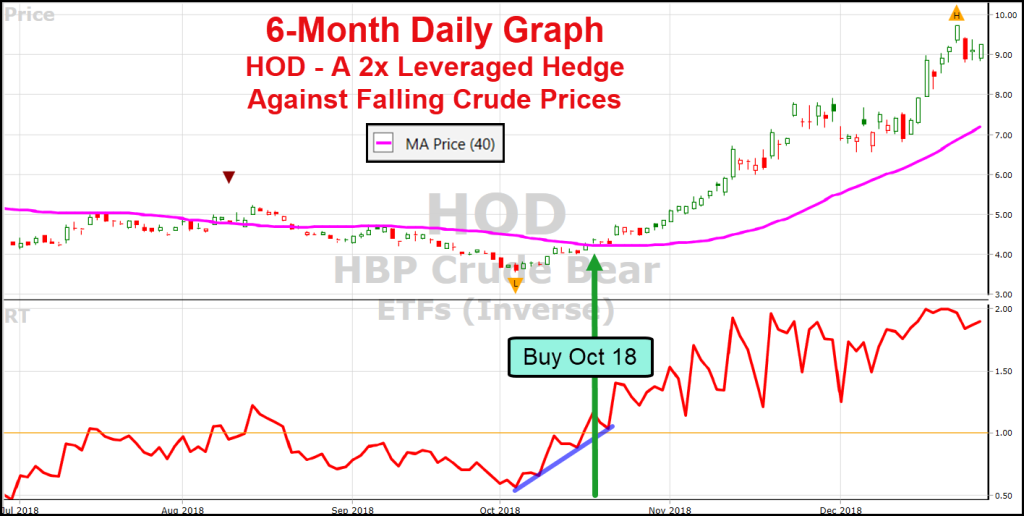

I haven’t found anything that works better for ETFs in both CA and US than VectorVest’s default layout with price, a 40-day SMA and RT, Relative Timing. It’s a good idea to add volume. When RT is rising and above 1.0, and price is above the 40-MA, it’s a good time to buy. The earlier in the set-up the better. Look at HOD, the 2x inverse of crude. The ideal set-up came on October 18th. Price ran from $4.38 to $9.33, a 122% gain. HFD, a 2x inverse on Financials closed above its 40-SMA on October 1st with an RT of 1.01. Price was $4.83. It closed at $6.45 on December 24th, a 33% gain. You get the picture. Several US contras have performed amazingly well, as you would expect, however, if you don’t want to trade in USD currency to hedge the US market, consider HSD, a 2x Bear on the S&P 500 or HQD, 2x Bear on the Nasdaq.

Graph the Leveraged and Non-Leveraged ETFs for yourself and run some QuickTests. Maybe you’ll like a better set-up. In any case, if you don’t know options, you don’t short, and you hold positions you just don’t want to sell, the best way to protect your holdings, or just flat-out make money, is to HEDGE WITH INVERSE ETFs.

Leave A Comment