Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

Before I place any Trade I do 2 things:

- Consider what the Street is telling me

- Consider what the Color Guard, the MTI Graph, and the Stock Graph is Telling me (Most Important)

What the Street is telling me (Wall Street and very high level industry execs)

- USA will be completely shut down until a vaccine is found (Likely a Nov occurance)

- There will be a big Stock Market Crash (Likely Oct)

- There will be a second wave of the virus leading to a worldwide shutdown. (Even countries who had it under control and reopened are seeing numbers rise again)

- Bankruptcies both Business and Personal will soar

- Canada The Rent and Mortgage Deferral program ends and a shockingly large number have not been paying their mortgages so when the bill comes due there could be a lot of evictions and Mortgage Defaults

- Big and Smart Money people have gone to cash and are raising capital in anticipation of what’s to come

- Silver will be the place to be (Far outperform Gold)

I could go on and on but by now you should get the picture

ME: While I do recognize that everyone telling me the above is a lot smarter and better informed than me it means nothing until it happens. Many lost out this spring because the ones “In the Know” said there would be a double bottom or another pullback worse than the first both of which never happened. That’s why I always look at the graph as well. That is why all through the spring I said the graph is telling me the Bull is still running and until the graph says otherwise I’ll continue to ride this puppy.

MY Thought Process:

I went to cash Fri Aug 28 except for Apple and Amazon.

Silver I have a large amount of the highest quality and rarest Gold and Silver (85% Silver) I did a series of tests to determine the best Gold and Silver plays in both Socks and ETFs.

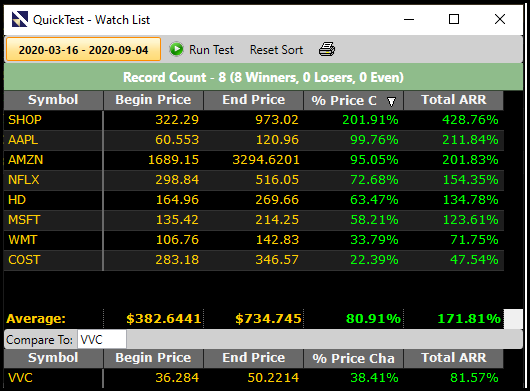

The Industry started a downtrend at the start of Aug so I tested from Mar 16 to Aug 4 to see who and what performed best through the nice run and then did a 2nd test from Aug 4 to Sept 4 to see how everyone performs during a weak period. This tells me the strongest overall Stocks/ ETFs. (See Attachments)

Currently the Gold/ Silver Industry Graph is respecting a support level which next week the 79 SMA will also be at giving even more strength to support. Since the downturn there have been 2 touches (Came close to a 3rd on Fri). For me I like to see 3 and then watch very close for a breakout (Trend Change) on Strong Volume. ONLY when the Trend Changes will I place a Trade. I never buy anything in a downtrend. I am very cautious with my Retirement Money.

I also Create/ Refine my Shopping List:

USA Long Term Portfolio:

3 Stocks I wouldn’t buy until after a lockdown ends are Home Depot, Wal Mart and Costco. Although 2 will remain open as essential sales will suffer to a degree.

Revised Self Isolation Portfolio: While this performed very well with the surge is Business Bankruptcies Mastercard and Visa will suffer and were temporarily removed. Long Term they will do well with the switch to online shopping however I won’t buy until the time is right (The graph will tell me when)

CONCLUSION:

There may well be an unprecedented number of bankruptcies in the future. For me, that means I do not buy any of the following unless big enough ie Wal Mart.

Retail, Restaurants, Airlines, Cruise Lines, Hotels.

NEVER Bet more than I can afford to lose. Even though I can have several $100,000 Portfolios with $10,000 positions, I will NEVER put more than $5,000 on an Initial Trade. Reason: If it goes to zero, while I will need a hug, I know I’ll be ok and my retirement isn’t ruined.

NOTE: In the event of a crash, Bob Turnbull’s Brilliant Bull Strategy is a must (VectorVest International Online Forum – January 2020 CLICK HERE TO VIEW RECORDING. Just look at the year he’s already had. Well Done

As always nothing more than my 2 cents and I hope it’s of value and interest.

Leave A Comment