Submitted by: Don Fanstone, Ontario

Have been following the new Hot Stocks search, Cherry Picking folder, with initial success, thanks to VectorVest.

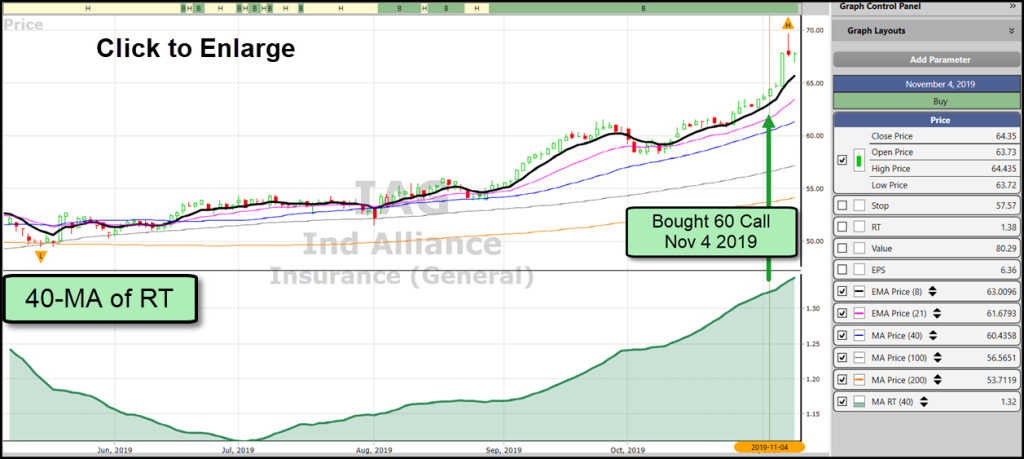

IAG is in the Insurance Industry and the insurance industry has been leading the RT rankings of late. I was a little slow off the mark after doing a trade analysis, but then, the hot stocks search has only been in use for a week, but can be used to look back at previous calendar dates.

I bought March 60 Calls on Nov. 4th as a result of the search for $4.50 and sold them on Nov. 7th for $8.30 based on a Red candle and what appeared to be an overbought condition. As it turned out, at the end of the day, IAG was not on the HOT STOCKS for Nov. 7th nor the 8th.

Hot Stocks are not a Buy and Hold trade. TRADING IDEA: Hold the option as long as the Security remains on the Hot Stock List and Price is above the 8-day EMA.

I normally BUY options with 6 months to maturity and a delta of .80 or better to give the stock price time to work. With HOT STOCKS, I am now evaluating shorter time frames and at the money call options.

I don’t win on every option trade, but the key is to cut losses when the stock price goes below the 8-DEMA.

Candidates for Nov. 11th, Hot Stocks with a new Buy Rating. CAE and OTEX.

Have not included RNW as this is a steady, slow growth, long term performer.

CAE March 30’s at $4.85 (purchased on Nov. 8 at $4.40)

OTEX April 50’s at $5.75

Be sure the market and the stock are rising before initiating the trade.

A good paper trade for anyone interested in following this search.

Mission and Risk Disclaimer. Content posted on this blog is intended solely to educate and empower investors to make better investment decisions using VectorVest. It is not intended and should not be considered in any way as investment advice. There is financial risk involved with any investment. You should always do your own research before making any investment decision.

Leave A Comment