What an exciting day VectorVest investors had yesterday during VectorVest’s monthly International Online User Group Forum Saturday, Nov. 4! Keynote speaker Susan HayesCullerton of Ireland, an economist and Managing Director of VectorVest Europe, took us on a fascinating and educational tour of seven countries that comprise the largest markets in Europe.

What you will hear is Susan giving us the vital history and the backdrop of what is truly going on inside Europe’s growing economy. Following that, Susan delivers on three ways investors can invest successfully in Europe, a region she described as the world’s largest exporter, the largest importer, the largest population and now the wealthiest developed region in the world. What is happening in Europe is something all serious investors need to pay close attention to.

“Europe has its challenges, but as a place of business, it’s open, it is progressive, and there is a lot of entrepreneurial support,” Susan told attendees.

Europe is an outstanding market to be investing right now. And, to make it easier, Susan offered a surprise bonus gift to registered attendees which is a link to free access to VectorVest Europe for 30 days. Here is the link: www.vectorvest.com/TryEU. No credit card necessary, the trial will simply expire after 30 days. If you wish to continue after the trial, please contact VectorVest Support to make arrangements. Hurry, this offer expires at midnight, Tuesday, November 6th.

How to invest in Europe’s robust regional economy? First, Susan showed how we can quickly find 35 New York traded ETFs that invest in European countries. She then explained the differences between two of the most popular ETFs, EZU and IEUR. In terms of individual countries, Germany, EWGS, and Poland, EPOL, lead the pack with 49% and 47% returns YTD.

In VectorVest Canada, we have VEF, XIN, ZDM, RID, XEF, ZEA, ZWE, ZEQ, XMI among others.

The second way to invest in Europe, Susan said, is in the individual stocks themselves, something that requires finding a broker who will give you access. She showed how she uses VectorVest market timing and stock analysis to trade successfully. Once you have your free access to VectorVest Europe, you can read her essay about one of her favourite strategies in the November 3rd VectorVest Views.

And finally, the third way to invest, and this is Susan’s specialty, is to use Options, specifically, selling Options.

Here is just a sampling of the many positive comments attendees chatted in about Susan’s presentation:

“Fantastic presentation and an eye-opener to another market! Thanks.” – Salim D.

“Great presentation and timely with the breakout on the FTSE this year to all-time new highs.” – Petra H.

“Wow! Tremendous, informative insight.“ – James P.

“What a joy to listen to Susan. Please bring her back again for an update with all that is happening in the UK and EU.“ – Warren G.

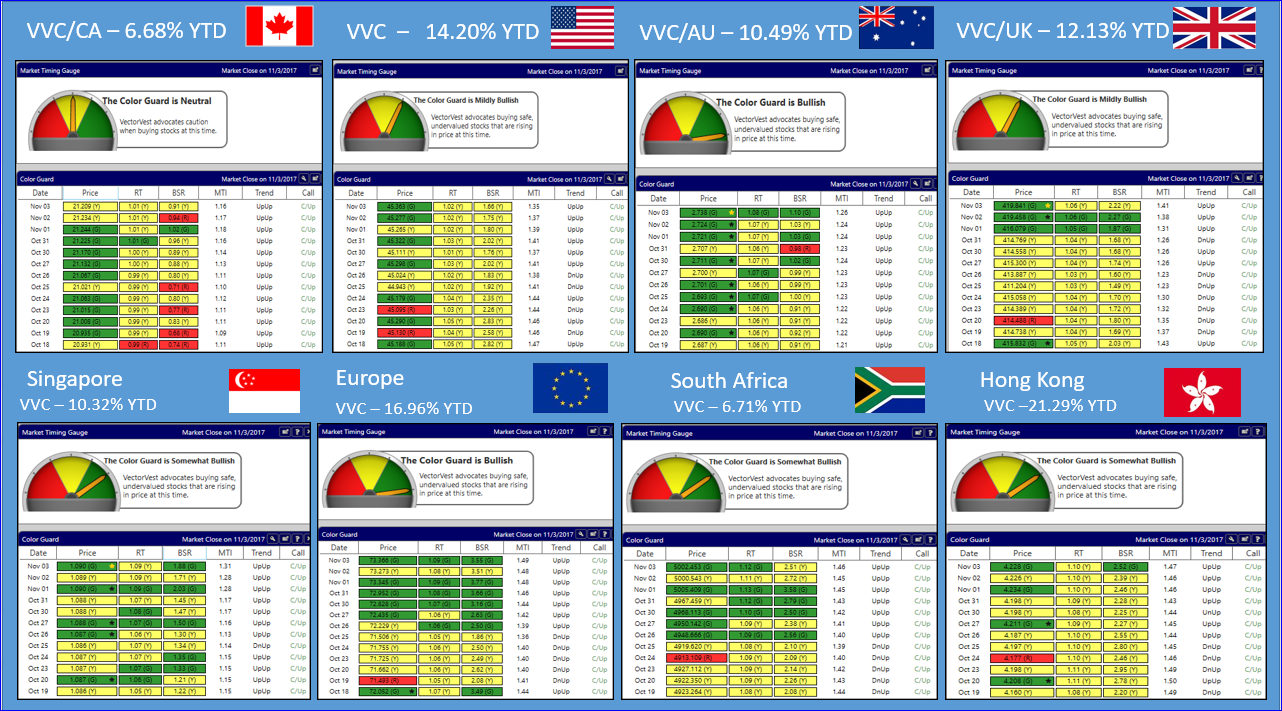

OUR MONTHLY GLOBAL MARKET REVIEW. Finally, as part of our regular monthly agenda, Stan Heller, VectorVest Canada Consultant, gave a market review. Below is a graphic showing VectorVest guidance in the Color Guard reports for all eight VectorVest countries.

How Well Are The Canada and US VectorVest Model Portfolios Performing? Please watch Friday’s Special Presentation video and then join me Tuesday at 12:30 am Eastern for our weekly Special Presentation Q&A webinar. We’ll review the markets, look at individual stocks and answer your questions about the Model Portfolios. Please click the link to register: REGISTER NOW!

How Well Are The Canada and US VectorVest Model Portfolios Performing? Please watch Friday’s Special Presentation video and then join me Tuesday at 12:30 am Eastern for our weekly Special Presentation Q&A webinar. We’ll review the markets, look at individual stocks and answer your questions about the Model Portfolios. Please click the link to register: REGISTER NOW!

Not a VectorVest subscriber? Take a 5-week trial for just $9.95 USD and learn how to make money with VectorVest. Call 1-888-658-7638 to arrange your trial. No need to take any action should you wish not to continue, the trial will just expire. Contact VectorVest if you do wish to continue for exact pricing.

DISCLAIMER: The information contained in this Blog is for educational and information purposes only. Example trades and strategies must not be considered as recommendations. You should always do your own analysis and invest based on your own risk tolerance, investment style, goals and time horizon. There are risks involved in investing and only you know your financial situation, risk tolerance, financial goals and time horizon.

To View previous Online Forum video replays, click on the recording links below:

November 4, 2017 – Three Ways To Invest In Europe’s Strong Markets by Susan Hayes, Cullerton.

Leave A Comment