President Trump and President-elect Joe Biden seem to have polar-opposite views on climate change and the importance of solar and green energy. Biden says he favours a transition away from fossil fuel energy over time. Still, analysts say a real shift won’t happen until clean energy costs are cheaper than traditional fuel sources.

Biden has promised more government investment in solar and clean energy, and stocks in that industry space traded higher throughout the presidential campaign. If Biden follows through with more government money and more producers get involved, economies of scale will kick in, and costs will drop. This creates a profitable opportunity for investors who recognize the strongest trends early and get on board with stocks that will benefit the most. VectorVest can help you find them and track them.

Green energy stocks in solar, wind and hydroelectric energy in particular are expected to flourish under a Biden presidency.

Consider TAN, the solar energy index ETF-US. It gained a whopping 194% from the April 6th DEW Up market timing signal to November 6th, one day before Biden was declared president-elect by the major news networks. One of TAN’s largest holdings, ENPH, Enphase Energy, gained 260% during that period.

In Canada, we have fewer green energy stocks, but they have also fared well. In the Energy (Clean) industry group, for example, PYR, Pyrogenesis Ca from April 6th to November 6th went from a 0.43 cent penny stock to $3.80, a 784% gain. Among the more robust players in the Clean Energy space, BLDP, Ballard Power gained 71%, PIF, Polaris Infrastructure gained 29%, and INE, Innergex Renewable Energy also gained 29%.

In Utility (Electric), during the same period as above, NPI, Northland Power gained 53%, BLX, Boralex 51%, and RNW, TransAlta Renewable Energy 18%.

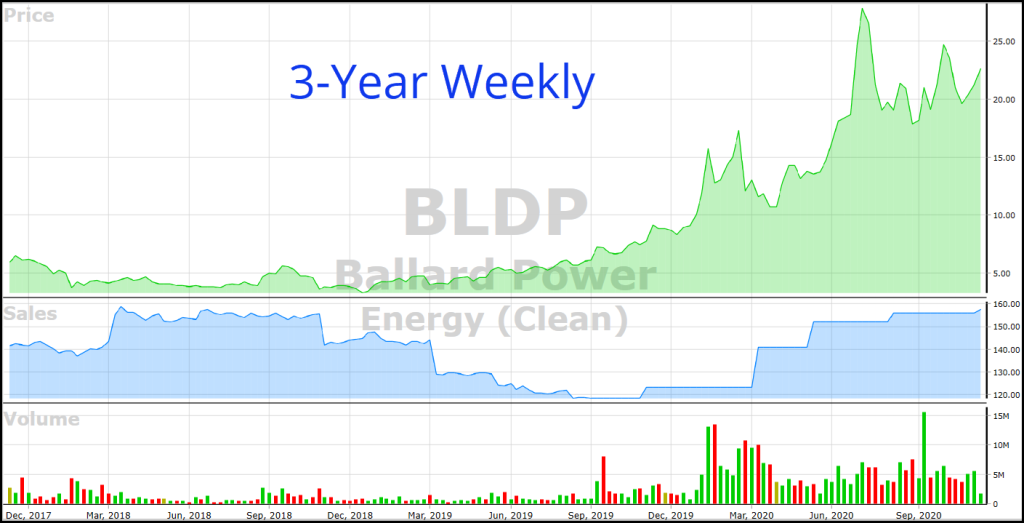

I have created a WatchList of all these stocks and moved them into Portfolio Manager so I can keep an eye on the basket’s equity curve in addition to individual stock price performance. I am most interested in Ballard Power. Why? Well, it made the TSX-30 list this year with its 459% three-year price performance. The stock is off of its July highs but has still managed a year-to-date gain of 119%. It actually receives low scores from VectorVest in the fundamentals of RV and RS, but annual sales are $156(M) and growing at 9% per year. Ballard’s vision is to deliver fuel cell power for a sustainable Earth. Its zero-emission fuel cells enable electrification of mobility in buses, commercial trucks, trains, marine vessels and cars.

Ballard is a company that is well-positions to benefit from the CLEAN ENERGY REVOLUTION.

Leave A Comment