By Don Fanstone, Member of Kitchener/Waterloo User Group

January 23, 2015

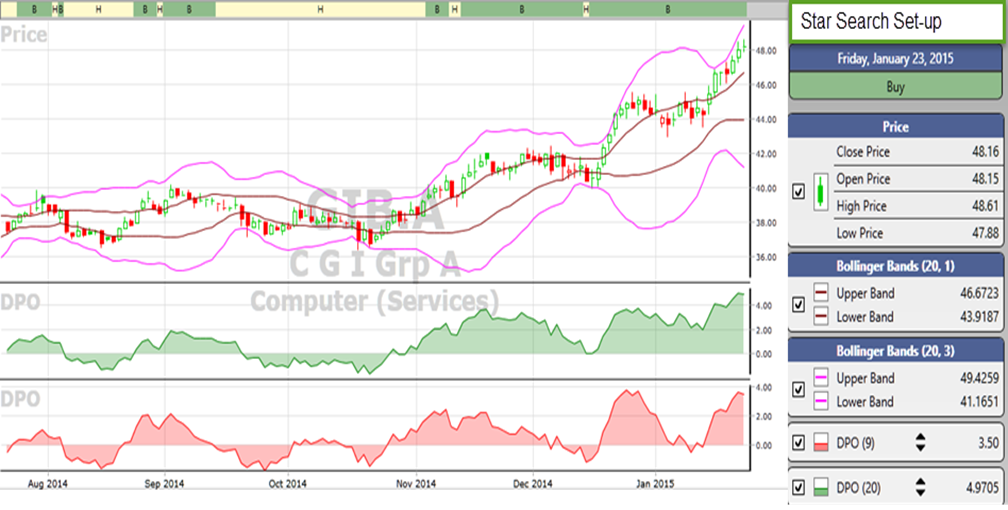

Sometimes I am too hasty in protecting profits. Taking the profits in GIB.A wasn’t all bad, but had I followed the Star Search Graph and had a little more faith in the graph, I would have held on. Experience is a great teacher, but sometimes one becomes over cautious.

Sometimes I am too hasty in protecting profits. Taking the profits in GIB.A wasn’t all bad, but had I followed the Star Search Graph and had a little more faith in the graph, I would have held on. Experience is a great teacher, but sometimes one becomes over cautious.

CGI Group (GIB.A). CGI Group will report earnings on Jan. 28. I re-entered the market today and purchased 5 August 40 Calls at $10.00 each. This is a half position of that normally taken. With the profits in hand from the first trade, there is good coverage on the downside. If the earnings report is favourable, it may lead to adding to the holding. The stock is at $48.45, indicating a premium of $1.55. (Strike Price + Premium Paid – Stock Price).

Royal Bank (RY). Royal announced a takeover of an American Bank yesterday and the stock fell $1.90 to $74.71. Royal is one of the top banks and this price provides an attractive entry point, the downside is limited in my opinion. I purchased 10 July 64 Call Options at $12.45. The stock today is at $75.85 indicating a premium of $.60. This is a very low premium and an easy way to control or participate in the likely rise in price of 1000 shares.

Canadian National Railway (CNR). CNR reports on Tuesday Jan. 27th. Yesterday, CP reported strong earnings, as did Union Pacific in the USA. CNR has moved up exceptionally strong, the June 66’s moving from a purchase price of $13.60 to a current price of $19.40. CNR is off $1.46 today, however will hold for the earnings report on Tuesday. It is expected that earnings will be very good, there is a possibility of a dividend increase and a favourable outlook. At this stage, with a 42% gain in hand, whether to hold or sell is an individual choice.

Enbridge: (ENB). Holding July 52’s purchased Dec. 24 at $7.80, currently worth $10.10. All of the Pipelines are good candidates for higher values.

Companies to Watch:

Home Capital (HCG). Buy July 36’s. I do not own this company at this time. I have owned it previously and it is now coming off of a low. Very attractive in my opinion.

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

Hi Don,

Thanks for your contribution! Do you predominately trade Options? After becoming knowledgeable in Options, do you find it to be less risky than Buying positions long or shorting?

Jake

Jake:

Yes: I primarily trade options. I do hold several stocks that do not have options, but for all intents and purposes, I trade options. There have been many lessons along the way, the most costly is not cutting losses quickly enough. Alternately, on the winners the leverage is excellent. There is more risk in trading options as you are in a loss position the moment you purchase a Call Option, and if the stock price starts to retreat, it’s necessary to make a decision to cut your losses quickly. Buying Call Options coming off of a low is most attractive, that being in the current situation. I do a great deal of fundamental research to the extent possible and use VV to determine entry and exit points.

Hope this helps.

Don

Don,

How do you use the Star Search Graph?

Alternatively, can you ‘point’ me to a URL that describes the setup & use of this Graph?

Thanks, Stephen

Stephen:

Go to Strategy of the Week and look for Star Search, dated 04/07/2914, this will give you the background. You can use this graph in daily or weekly mode. Look for stock prices continuing to rise in the upper channel.

Don

Thanks.