Timing the Market vs Time in the Market: Is One Better Than the Other?

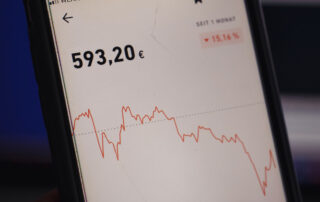

Timing the market vs time in the market - a subtle variance in phrasing, but a dramatic difference in investment strategy. While these two principles may sound similar, they speak to opposite ends of the spectrum in terms of how you should invest your capital. Those who advocate for market timing believe in investing more [...]