By Don Fanstone, Member Kitchener/Waterloo User Group

Option Blog March 15, 2015:

Delta refers to the option’s rate of change.

To make profitable option trades consistently, buy Deep in the Money Call Options on securities you would consider purchasing.

Options are either:

. Deep in the Money,

. At the Money, or

. Out of the Money.

VectorVest suggests buying Deep in the Money Call Options with a delta of .80 or higher. Essentially, the option will go up in value by $0.80 when the underlying security goes up by $1.00. If you have the VV Options Analyser, this is found with a few clicks of the mouse. If you do not have the analyser, then you need to buy a Call Option that is 10 to 20% below the price of the underlying security.

On a $50 security, buy a Deep in the Money Call Option priced at a $45 Strike Price or $40.00 Strike Price.

You will only find Call Options with a delta of .80 or greater by buying Deep in the Money Call Options.

If a stock were trading at $50, and you purchased a “cheaper” Out of the Money $55.00 Call option, for a (approximate) price of $3.50; the underlying security would need to get to get to a value above $58.50 before realizing a profit. ($55 Strike plus $3.50 Option Premium). This is the primary reason many call option buyers lose money. It’s also the reason that those who Sell Call Options make money.

Option Trades since March 8th.

No trades in the past week.

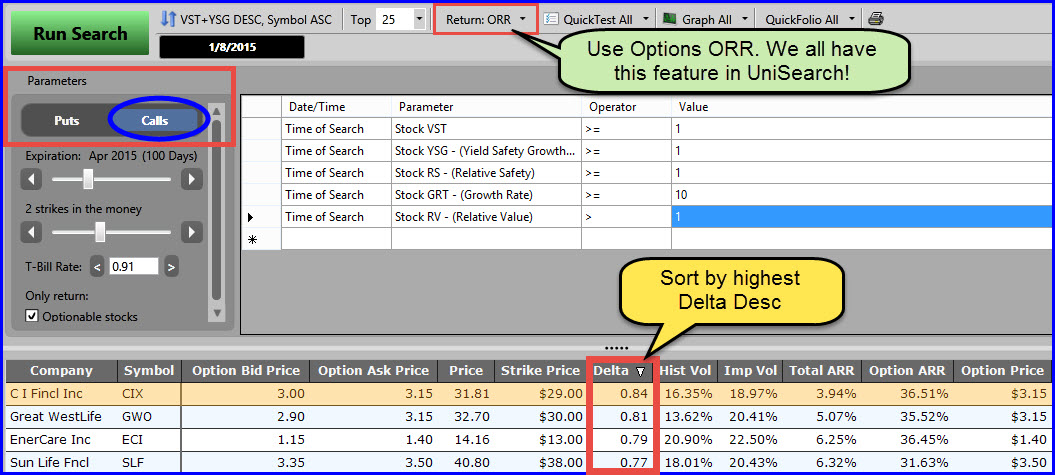

*Note: The search below is for illustration purposes only to show the functionality for options in UniSearch. 1. Instead of Return: Stocks, change to Return: ORR (Options Rate of Return). 2. You can manually change the Parameters at left. Be sure to click on Calls if you’re considering a long call or a covered call. 3. Change the Expiration date and change the Strike Price. 4. 2 strikes in the money as shown is generally Deep In the Money. Finally, 5. you can change the sort to Delta Descending if you wish to see the highest Deltas come to the top.

I encourage all to read Lee Lowell’s book “Get Rich with Options”, go to VV University and watch the Video on Options, and read Dr. DiLiddo’s article in the Views Manager under Special Reports, and attend the VV Options Course.

Understand Options Before you begin to trade, there is much to learn.

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

Hi Don,

Hi Don,

Thank you for sharing so valuable information about Options and I must say you are a kind person. You are the person who encouraged me to trade Options. Recently I did well in few attempts in long Call, Deep in the Money.

Thanks,

Shoaib

Thanks for the illustration Don! I also trade options using an 80 delta or higher (also looking for decent open interest). I was not aware that Vectorvest offered this screen to all members. I will check it out!

Thanks Again & I appreciate your option ideas!

Reg

Hi Reg:

VectorVest never ceases to amaze one with the information available.

I have not put the emphasis on open interest as there is a market maker for option trades. On the Canadian side, I either take the Bid or the Offer depending if I am selling or buying. Putting in a bid between these two results in missing the trade that day.

On the US side, most option trades on the popular stocks have been sufficient.

Don

Hi Don,

You’re commentaries are very helpful to me. Thanks

May I ask, when you buy a call for example, do you exit with a ‘specific’ profit percentage and loss percentage?

Gerry

Hi Gerry:

Gerry, I do have a trading plan that works best when I follow it. Mainly, looking for good stocks, HI RS and

HI CI, price > 30 DMA, and DPO positive.

Regards profits, usually anything over 25% has me watching it closely.

Today, DOL jumped up on earnings and I sold before the stock hit it’s high. I was up 68% and lessons have taught me to take the profit that’s in hand. Leaving money on the table is acceptable.

To answer your question, I do not have a specific profit or loss target, although to be successful, one needs to cut losses before you run out of money to invest.

Don