Yesterday, the Centers for Medicare & Medicaid Services (CMS) shared their plans for federal payments to Medicare Advantage plans, and Humana (HUM) has taken a hit on the news. The stock is down 15% so far Tuesday morning.

CMS first disclosed these plans back in January. At the time, Humana warned that should the outlined proposal pass, it would affect profits as medical costs continue to soar.

The plan entails an average payment increase of 3.7%, which could work out to more than $16 billion from 2024 to 2025. The goal of this increase, at least according to the agency’s own administrator Chiquita Brooks-LaSure, is to keep payments accurate and up to date, ensuring the stability of Medicare Advantage.

This payment revision is a 0.16% decrease year over year and left a sour taste in the mouth of investors and health insurers alike. This is only the second time in the last 10 years in which Medical Advantage rates have not increased from their initial proposal.

Humana’s CFO said that the company would fail to reach the upper-end target of its $6 to $10 earnings per share range for 2025 without a dramatic uptick in payment rates.

While other healthcare companies were affected by the news too – CVS, UNH, and CNC – Humana took the brunt of the bad news. The company is already struggling with sky-high medical costs, and without supplemental income to offset those costs, the provider is in for a bumpy road ahead.

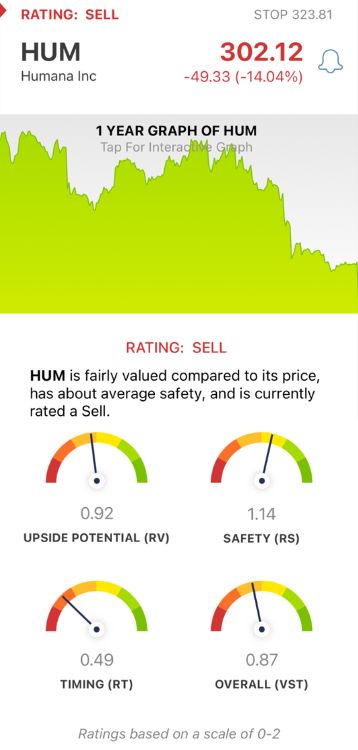

HUM is now down more than 34% in the past 3 months, and today’s news cycle certainly isn’t going to help the issue. That being said, is it time for you to sell this stock? We’ve taken a look at this situation through the VectorVest stock forecasting software and see reasons to consider it…

Despite Fair Upside Potential and Good Safety, HUM Has Very Poor Timing Holding it Back

VectorVest is a proprietary stock rating system designed to save you time and stress while helping you win more trades. You’re given all the insights you need to make calculated, confident decisions in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets even easier, though, as you’re offered a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for HUM:

- Fair Upside Potential: The RS rating compares a stock’s long-term price appreciation potential (projected 3 years out), AAA corporate bond rates, and risk. It offers far better insight than the standard comparison of price to value alone. As for HUM, the RV rating of 0.92 is fair. The stock is fairly valued right now, with a current value of $312.

- Good Safety: The RS rating is a risk indicator. It’s computed through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. HUM has a good RS rating of 1.14 right now.

- Very Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. This is the biggest issue for HUM right now - a very poor RT rating of 0.49 reflects the downward pressure pushing the stock lower and lower.

The overall VST rating of 0.87 is a ways below the average but deemed fair nonetheless. That being said, the stock is currently rated a SELL - learn more about this situation and make your next move with clarity through a free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. HUM is trading 14% lower Tuesday morning after the CMS announced their rate plan, which will throw a wrench in the healthcare company’s profits. The stock has fair upside potential and good safety, but very poor timing is weighing it down.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment