Ebay Inc. (EBAY) is up more than 8% so far Wednesday morning after delivering impressive Q4 earnings alongside optimistic guidance for the current quarter.

The online marketplace grew revenue to $2.56 billion from $2.51 billion this time last year, narrowly outperforming the FactSet consensus of $2.51 billion.

This was coupled with a net income of $728 million compared to $671 million last year. On a per-share basis, eBay delivered earnings of $1.07, beating the $1.03 analysts were calling for according to FactSet.

The company was happy with this performance, stating that there are still concerns with the economy, but e-commerce shoppers have remained steadfast in their purchasing habits. There is also growing competition in China and here at home in the face of Amazon, Walmart, and others.

While Q4 can be chalked up as a win, eBay is still working its way through a tumultuous period. Just a few weeks back the company announced its intentions to cut 1,000 jobs, or 9% of its workforce. Even as the top and bottom lines have grown, it feels as if expenses are growing at a faster pace than the business.

Ebay also announced that it would be increasing its dividend by 2 cents while repurchasing up to $2 billion in company stock back.

Looking ahead to the current quarter, eBay is forecasting sales in the range of $2.5 billion to $2.54 billion. Analysts are expecting $2.53 billion, so it will be interesting to see if the company is able to beat the consensus in Q1.

The stock has now climbed more than 10% through the first two months of the year, and 17% in the past 3 months. It’s hard to ignore the pace EBAY has been on, but is there still room to buy this stock?

We’ve taken a look through the VectorVest stock software and found 3 compelling reasons to consider buying EBAY today.

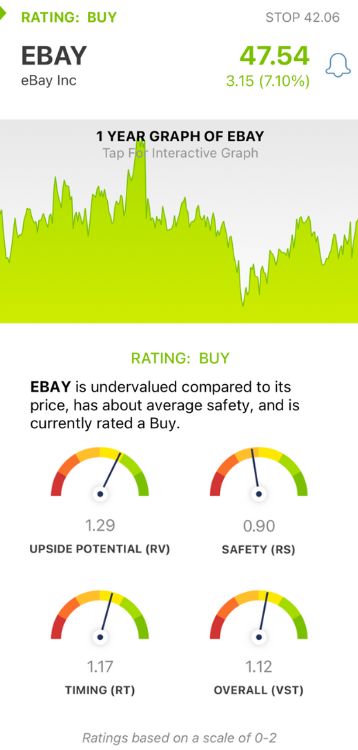

EBAY Has Very Good Upside Potential, Fair Safety, and Good Timing

VectorVest is a proprietary stock rating system that saves you time and stress while empowering you to win more trades. You’re given all the insights you need in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets even better, though. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for EBAY:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. EBAY has a very good RV rating of 1.29 right now.

- Fair Safety: The RS rating is a risk indicator calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. EBAY is a fairly safe stock with an RS rating just below the average at 0.90.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.17 is good and reflects EBAY’s performance in both the short and long term.

The overall VST rating of 1.12 is good for EBAY, and it’s enough to earn the stock a BUY recommendation. Don’t miss out on this opportunity - get a free stock analysis at VectorVest today and capitalize with confidence!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. EBAY is climbing higher after delivering impressive Q4 earnings alongside upbeat guidance for Q1, despite economic challenges and steep competition. The stock has very good upside potential, fair safety, and good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment