AudioCodes (AUDC) once reached a recent high on the stock market of $41/share in 2020. Today, the stock sits at under $10/share. What was once a billion-dollar company is now a troubled company facing declining revenue and internal turmoil – and the 55% decline in the past year reflects that.

The company has been around since 1993, but got its big break during the pandemic. AudioCodes provided firms with communications solutions as the world moved to the work-from-home model. But as the pandemic is becoming a distant memory of the past, demand has dwindled. While some companies still work from home, many have returned to the office.

It’s not just issues with individuals returning to their previous working environment, either. There has been an uptick in competition, as cloud-based solutions have all but eliminated the need for AudioCodes’ products.

As a result, revenues have declined dramatically. In fact, the company recently updated its 2023 revenue guidance to between $240 million and $250 million – a 16% decrease from its original forecast for the year. This also happens to be a 12% drop from 2022. It’s not just revenue that is tanking either, but profitability.

Shabtai Adlersberg, the founder (and current CEO), tried to make an exit during the highs of the pandemic. But, he faced a myriad of challenges in getting the company sold. Now, he’s had to watch in despair as his company’s valuation has tanked – and he’s seemingly missed his window.

But as an investor in this company, you may be wondering if it’s now time for you to get out of this stock. Or, maybe you’re seeing the dramatic fall off and wondering if this stock has good value at its low point today. We’ve taken a look at AUDC through the VectorVest stock analyzing software and have 3 things we want to show you…

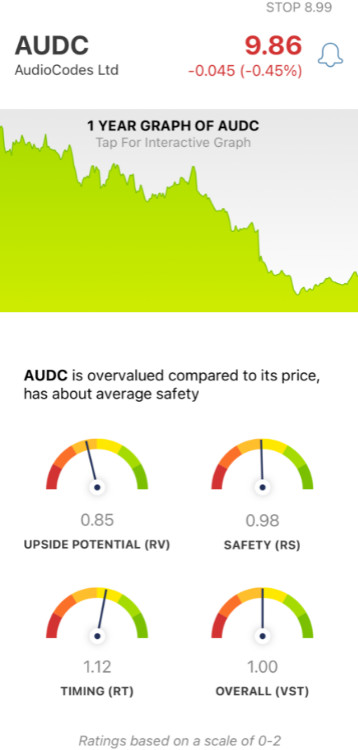

Despite Good Timing and Fair Safety, AUDC Has Poor Upside Potential

The VectorVest system helps you eliminate emotion and guesswork from your investing strategy by giving you clear, actionable insights in 3 simpler ratings. Simply put, it empowers you to win more trades with less work.

It’s all possible through the proprietary stock rating system - which is comprised of relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on a scale of 0.00-2.00, with 1.00 being the average.

And, based on the overall VST rating, you’re given a clear buy, sell, or hold recommendation - for any given stock, at any given time. As for AUDC, here’s the current situation:

- Very Poor Upside Potential: The RV rating draws a comparison between a stock’s long-term price appreciation potential (forecasted 3 years out) and AAA corporate bond rates & risk. And right now, the stock has a poor RV rating of 0.85. Further to this point, the stock is overvalued - with a current value of just $8.36.

- Fair Safety: In terms of risk, AUDC is a fairly safe stock. It has an RS rating of 0.98, which is just below the average. This is calculated through a thorough analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Good Timing: The one thing this stock has going for it is good timing, as it climbed more than 3% in the past week. As such, it has an RT rating of 1.12. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year to paint the full picture.

In the end, the overall VST rating of 1.00 is considered fair - but what does it mean for you as an investor? Should you buy, sell, or hold AUDC? Make your next move with complete confidence after getting a free stock analysis at VectorVest. A clear recommendation is just a click away!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While AUDC has good timing and fair safety (albeit below the average), the poor upside potential is currently holding it back.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment