VectorVest Views October 27, 2017

It’s a hard time to be an income investor. A 1-year GIC fetches around 1.95% annual interest. Bond yields are even lower. Inflation, as low as it is, will eat away at those meager returns over time. So, what can we do about it?

Dividends have become hugely popular with seniors seeking income and inflation-beating returns. Analysts report the TSX has averaged about 8.7% over the last five years, including dividends. Blue chips are paying higher yields and raising their dividends each year. Magna International (MG), Canadian National Railway (CNR), Manulife Financial (MFC), Canadian Tire (CTC), Toronto Dominion Bank (TD) and CCL Industries (CCL.A) are examples of companies that have increased their dividends by close to 10% on an annualized basis over the past five years. For seniors seeking income, it’s like getting a pay raise every year.

So how do we find the best dividend payers for income and growth? On September 25, 2017, MoneySense came out with its list of the “Top 100 Dividend Stocks of 2018.” This year, only seven stocks received an “A” Grade and they are all banks and insurance companies. Fifteen others earned a “B,” the rest “C,” “D” and “F.” As I do every year, I ask these questions: “What would VectorVest say about these stocks? Could VectorVest do better?”

MoneySense says it bases its grades “on hard data, starting with dividend yield. Stocks with generous yields get better grades.” They also like stocks that have “boosted their dividends over the last five years” and they “reward stocks that earn more than they pay out in dividends.” Hard to argue with that.

Here is how VectorVest grades its dividend payers. First, you must have good fundamentals. That’s easy with VectorVest. On a scale of 0 to 2.00, where above 1.00 is favourable, we look for high Relative Value, RV, or upside price appreciation potential and high Relative Safety, RS, a measure of consistent and predictable financial performance. We want earnings growth rates, GRT, higher than inflation. Then we look at our Dividend Indicators.

3. Dividend Growth, DG, which reflects the annualized rate of dividend increases.

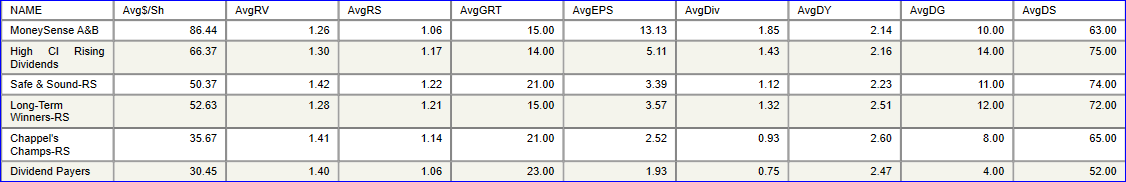

So, could VectorVest do better? To answer this question, I put the 22 “A” and “B” Grade MoneySense stocks into a VectorVest WatchList. They had an average Dividend Yield, DY, of 2.14%, so any WatchList I created with VectorVest had to at least match that. I ran five popular VectorVest searches from the Conservative, Long-Term Winners and Retirement search folders. The only criteria I changed was to add a minimum DY of 1% to help ensure an average of 2.12% or better and ran the searches as of September 26, 2017. If there were more than 22 results, I selected the top 22 found by the search. Here are the results (click to enlarge).

It’s pretty clear that, overall, VectorVest is the answer to the quandary of How To Find The Best Dividend Payers For Income And Growth.

Check out the above searches to find high Relative Safety, RS, stocks with good upside potential. Not a Subscriber? Take a 5-week trial for just $9.95 USD and check out all of our top Conservative, Prudent and Retirement searches. Call 1-888-658-7638.

Leave A Comment