Gold and oil prices lifted the TSX to a 40 point gain today. US stocks fell on weaker than expected economic data, however, the DJI gained back more than 100 points from the day’s low, closing down 77 points.

Gold and oil prices lifted the TSX to a 40 point gain today. US stocks fell on weaker than expected economic data, however, the DJI gained back more than 100 points from the day’s low, closing down 77 points.

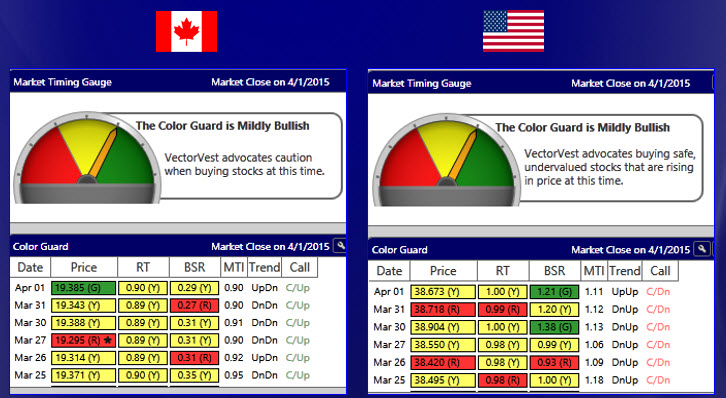

Notice from the graphic that VectorVest’s Color Guard is Mildly Bearish in both Canada and the US. However, the guidance for tomorrow is quite different. In Canada, the caution light is on when buying stocks long. Guidance on the US side is much less reserved, stating that VectorVest advocates buying safe, undervalued stocks that are rising in price at this time.

Why is the guidance so different, especially since Canada rose today while New York fell? It’s because in Canada we have an UpDn market trend with the short term trend Up and long term trend down.(MTI is less than 1.0) In the US, we have a more bullish UpUp trend. The underlying long term trend is bullish because the MTI is greater than 1.0.

Click here to watch the video recording (sorry, I forgot to push record for the first 10 seconds or so): http://www.screencast.com/t/pL9dsF6Dxd50

Here’s what we cover in the video:

- market timing guidance

- today’s top percent gainers

- today’s top percent losers

- New BUYS

- New SELLS, and

- Top 10 Midas Touch Stocks

We look at several graphs in the video. One stock you might want to put in your WatchList for further study is Spectral Diagnostics (EDT), a Midas Touch stock that is in a steady uptrend after breaking out of a long channel. EDT was up 15% today on higher volume.

PLEASE NOTE: The CA Colour Guard video is intended for educational purposes only. It should not be construed as specific stock recommendation or investment advice. Investors should always do their own research and make buy and sell decisions based on their own criteria, investment style, risk tolerance and financial goals.

Great variety in your presentation! You drill down beyond the front page. I enjoyed your special searches.

Thanks, Jake

Thanks Jake. Happy Easter!